This morning we saw gains on the EURUSD pair, which could be related to the expectation of less global risk after assurances from Chinese authorities of more stimulation of the economy. Besides, BoJ chief Ueda indicated that even though there will probably be an exit from negative interest rates in Japan, policy will remain very loose. In the end, however, the declines on USDJPY were not too large and since the beginning of the European session we have seen a return of demand for the dollar. This goes hand in hand with rising yields.

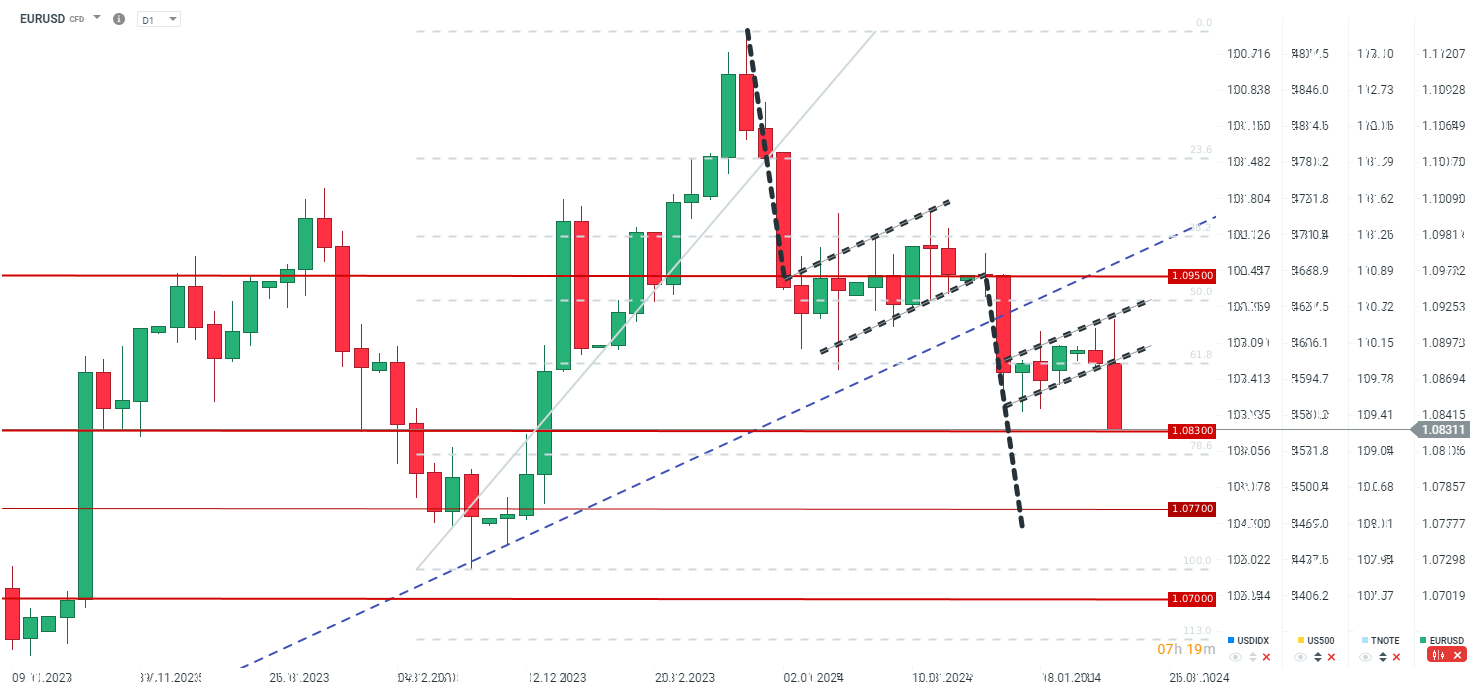

The EURUSD pair is breaking out another inverted flag formation and realizing a range near the 1.0830 level. On the other hand, the pair still has a larger inverted flag formation to realize with a target near 1.0750. EURUSD is down more than 0.5% today and is at its lowest since December 13. This week we will still learn the ECB decision, and although the message is unlikely to be very dovish, the market tends to focus on a more hawkish Fed approach. In addition, we will learn a number of publications from the US like the PMI index, GDP and PCE inflation.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)