The ISM Non-Manufacturing Index is the second important indicator that investors should pay attention to today ahead of Friday's publication of the NFP report for March. The report will be published at 15:00 (BST).

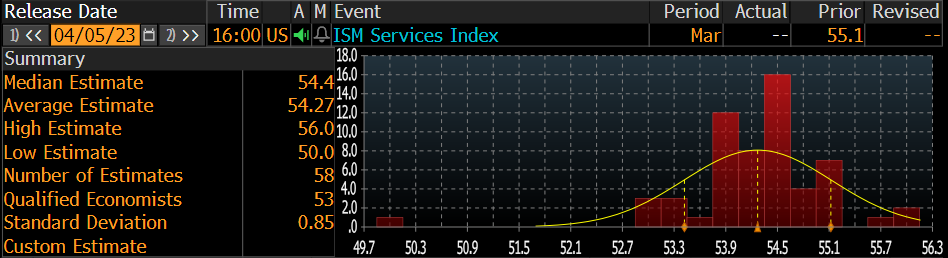

Currently, the average of analysts' estimates indicates a reading of 54.27. Most of the analysts' estimates are quite convergent and are between 53.9 and 55.1. Hence, any reading significantly deviating from these levels could lead to increase in volatility. ISM reading for services higher than expected may appreciate the dollar and lower the chances of sooner FED pivot. On the other hand, the lower-than-expected ISM reading will confirm the weaker condition of the services sector and broader US economy.

It is also worth paying attention to the ISM Non-Manufacturing Employment Index, in the context of Friday's NFP publication.

Expectations of analysts surveyed by Bloomberg, source: Bloomberg

After a weaker ADP reading at 145k against the expected 200k and previously 242k, the dollar depreciates and the EURUSD price increases approaching 1.09600.

EURUSD, source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report