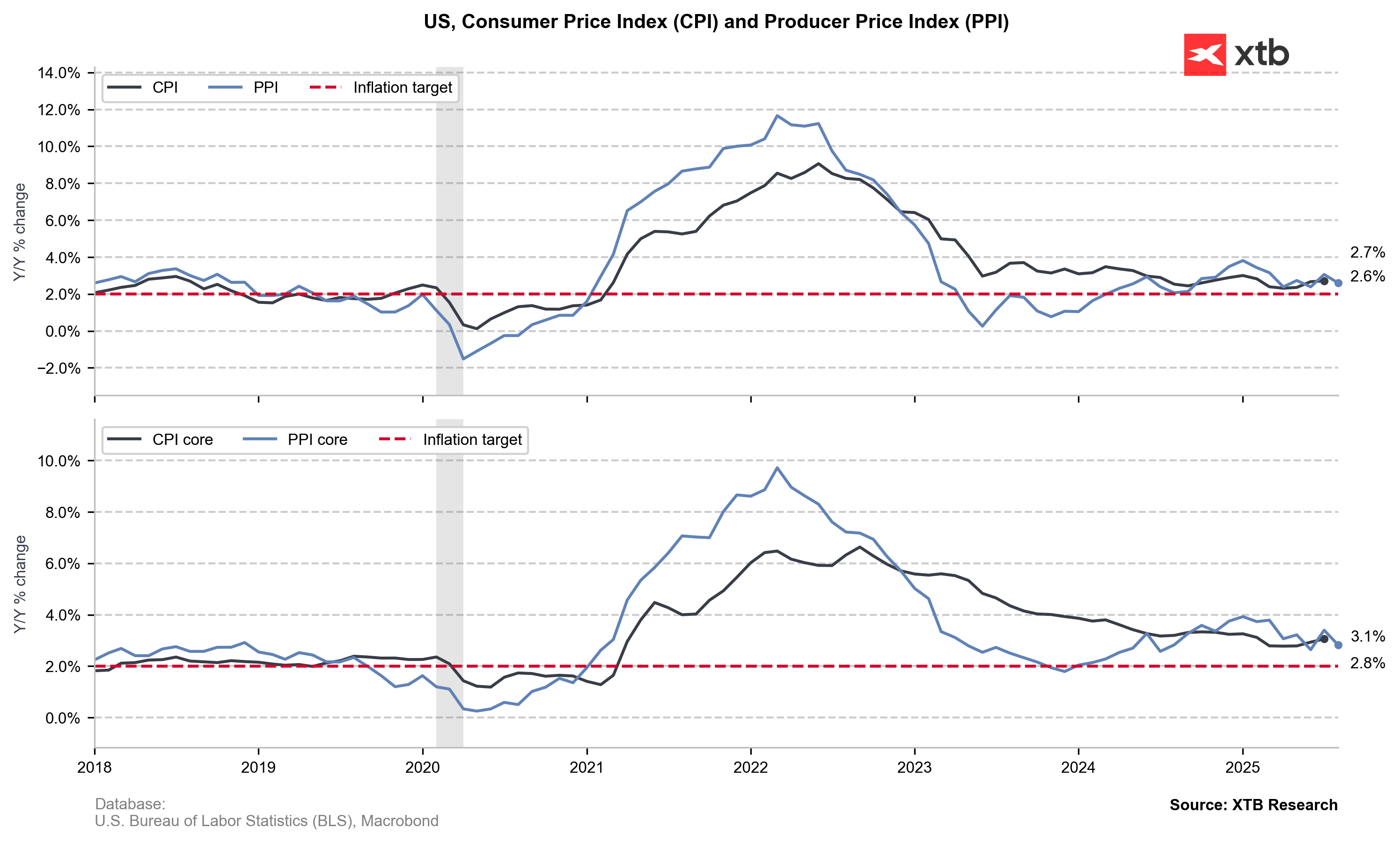

Today's August 2025 CPI figures could prove crucial for shaping market expectations for Fed policy and the future of the EUR/USD pair. While previous consensus pointed to a higher inflation reading, yesterday's PPI surprise suggests a chance of a lower-than-expected figure. Should inflation come in below expectations, it would likely increase the probability of a larger rate cut from the Federal Reserve.

The PPI data may hint at a more benign scenario for CPI inflation, though the correlation is not perfect. PPI inflation has been falling more sharply since the beginning of the year, while CPI has recently rebounded. The recent bounce in PPI also appears to have been a one-off. Source: Bloomberg Finance LP, XTB

The PPI data may hint at a more benign scenario for CPI inflation, though the correlation is not perfect. PPI inflation has been falling more sharply since the beginning of the year, while CPI has recently rebounded. The recent bounce in PPI also appears to have been a one-off. Source: Bloomberg Finance LP, XTBExpectations ahead of the crucial inflation report

Bloomberg Intelligence points to the risk of slightly higher August CPI, which would dampen expectations for a larger Fed cut. Interestingly, Bloomberg Intelligence suggests the primary drivers of inflation will not be tariffs but rather higher pressure in the hospitality sector and rising airfare prices.

-

Bloomberg Intelligence Forecasts:

-

Monthly Core CPI: +0.33% m/m (vs +0.32% in July)

-

Monthly Headline CPI: +0.37% m/m (vs +0.20% in July)

-

Annual Core CPI: 3.1% (unchanged)

-

Annual Headline CPI: up to 3.0% (from 2.7%)

-

-

Market Consensus:

-

Monthly Core CPI: +0.3% m/m

-

Monthly Headline CPI: +0.3% m/m

-

Annual Core CPI: 3.1% y/y (unchanged)

-

Annual Headline CPI: 2.9% y/y (vs 2.7% previously)

-

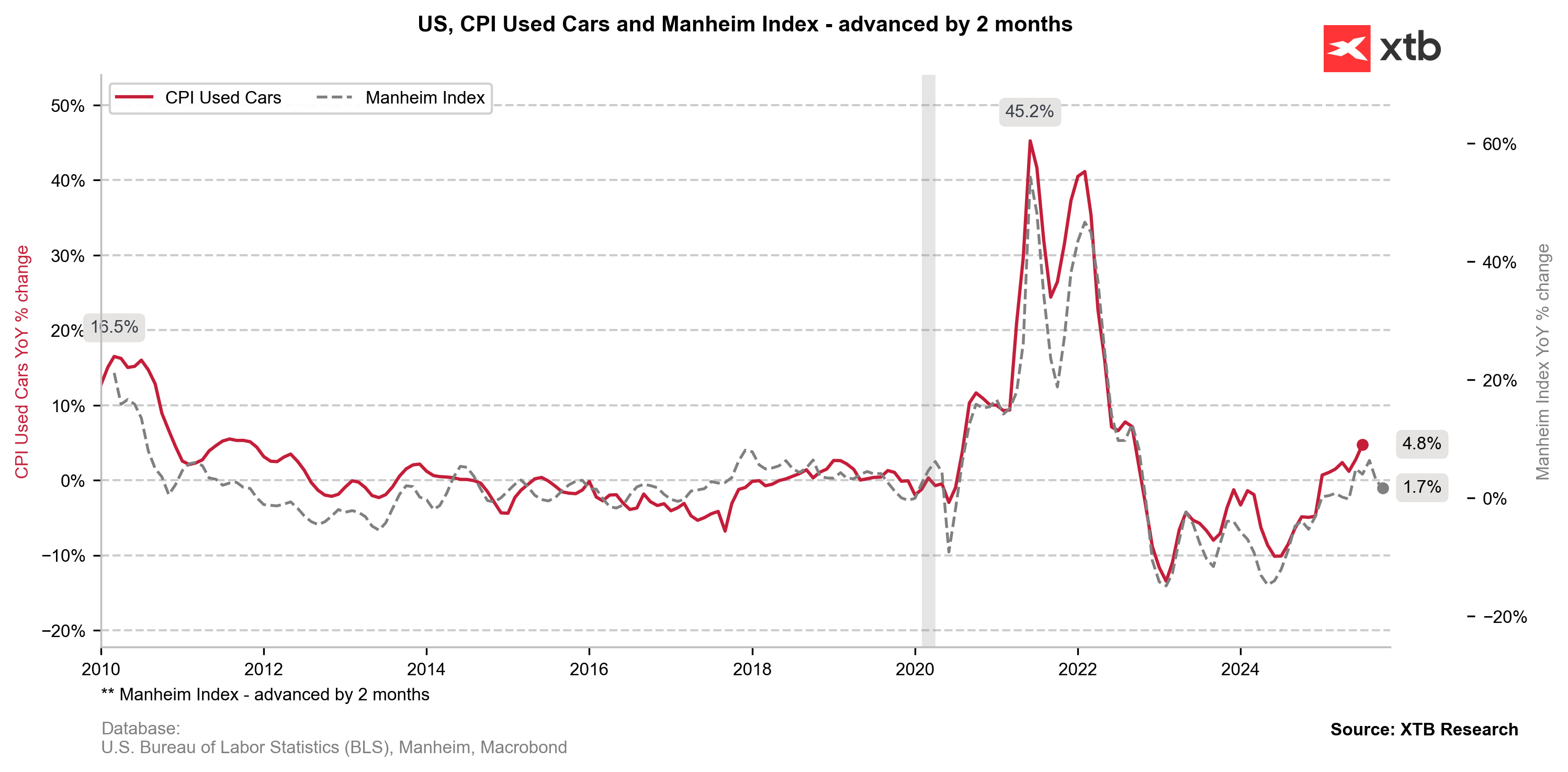

The structure of price growth will be a key aspect of today's data. Contrary to earlier expectations, the main drivers of inflation are not expected to be trade tariffs but rather discretionary services, specifically airfare and hotel accommodation. Bloomberg forecasts a 3% monthly increase in airfare and a 2% rise in lodging costs. This is an economic paradox—rising prices for tourism services do not typically occur in a weakening economy, potentially suggesting that the Fed's concerns about economic health may be overstated. Concurrently, recent data from the Manheim Used Vehicle Value Index suggests a potential slowdown in price appreciation.

The Manheim Index suggests a smaller increase in used car prices. In July, this segment contributed 0.12 percentage points to the annual rate, and used cars also contributed to the monthly inflation rebound. Source: Bloomberg Finance LP, XTB

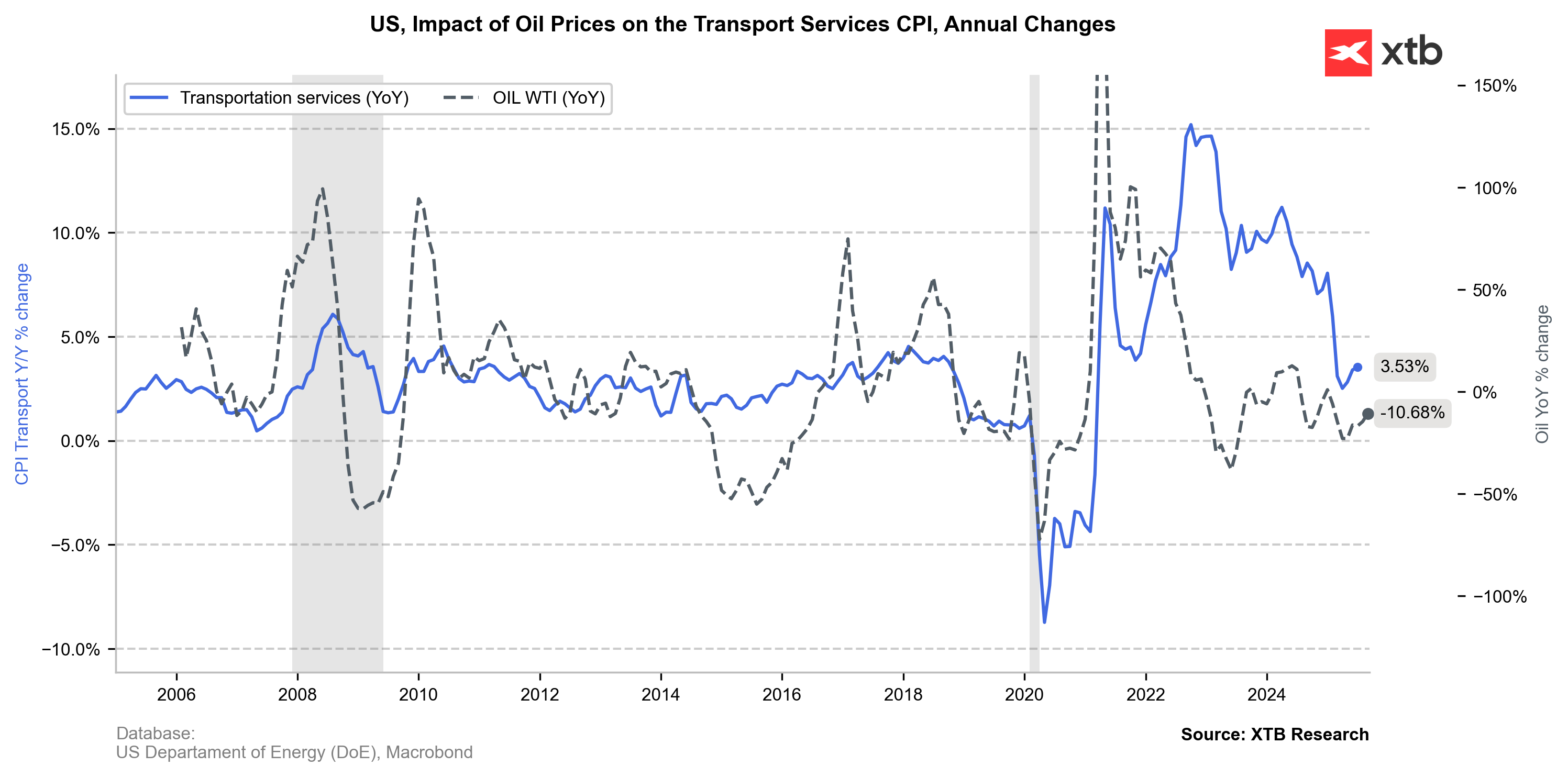

The Manheim Index suggests a smaller increase in used car prices. In July, this segment contributed 0.12 percentage points to the annual rate, and used cars also contributed to the monthly inflation rebound. Source: Bloomberg Finance LP, XTB Inflation related to transport services may continue to rebound, based on crude oil price dynamics. In July, transport inflation added 0.22 percentage points to the headline rate. Source: Bloomberg Finance LP, XTB

Inflation related to transport services may continue to rebound, based on crude oil price dynamics. In July, transport inflation added 0.22 percentage points to the headline rate. Source: Bloomberg Finance LP, XTBThe diminishing impact of tariffs, growing food-related challenges

The pass-through effect of tariffs on inflation is declining, with the index falling from 0.23 in July to an estimated 0.21 in August. In some categories, such as household appliances, personal computers, sporting goods, and apparel, analysts are forecasting deflation. However, the United States is importing more food, which could contribute to a further rebound in this category's inflation. One key issue is the rising price of beef, reflected in the price of cattle futures. Conversely, falling egg prices will help to moderate food inflation.

Implications for Fed policy

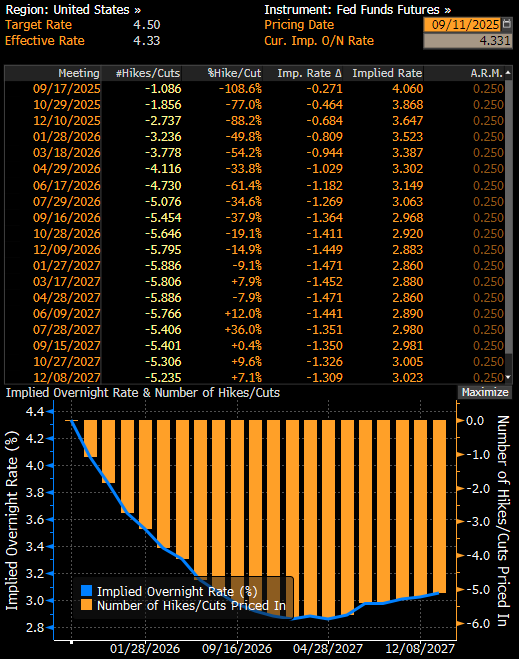

Markets currently price in a 100% probability of a 25 basis point cut, with minimal chances of a 50 basis point cut. The Fed meeting is scheduled for next week, on September 16-17. The Fed is expected to cut rates due to a weakening labor market, a sentiment communicated by Jerome Powell at the Jackson Hole Economic Symposium, followed by another negative NFP report for August and a major downward revision to annual employment figures.

While the labor market should justify a greater number of cuts this year—with markets pricing in nearly three full cuts by the end of 2025—Bloomberg suggests that a "hot" CPI reading today, followed by a strong PCE inflation reading at the end of the month, could make this the first and last cut of the cycle. Inflation remains above target, with core PCE expected to be 3% for August. However, it is important to remember the Fed's dual mandate: price stability and maximum employment. If there is a risk of a significant increase in the unemployment rate, the Fed must act.

The market sees only 8% change of larger cut next week. The weaker CPI reading may change that view. Source: Bloomberg Finance LP

What about EURUSD?

It is important to remember that 15 minutes before the CPI reading, the ECB will publish its interest rate decision, and 15 minutes after the data release, Christine Lagarde will hold a press conference. As a result, the EURUSD's movement following the CPI data may be either neutralized or amplified, depending on the tone of the ECB's decision.

In the baseline scenario, the EURUSD should hold above the 1.1670 level in a continued upward sequence, following the recent two-day sell-off. The ECB currently feels comfortable with its interest rate level, with inflation marginally above target.

If inflation were to come in significantly higher, at 3% or more, the pair could see a deeper decline towards the 1.1600 level. In this scenario, the September rate cut could prove to be the only one, or the Fed may wait until December for its next move.

A bullish scenario for the pair would involve an ECB that remains neutral and a CPI reading of 2.8% or lower. In this case, we should not only see a return to the 1.1700 level but also an attempt to test the 1.1800 level later this month, breaking out to new nearly four-year highs.

EURUSD is losing value for the third consecutive day. Today's events—the ECB decision and the US CPI release—could introduce new, higher volatility to the pair. It is worth noting that the recent decline in US yields suggests upward potential for the pair. Nevertheless, in the event of a higher inflation reading, a downward move in the TNOTE could also drag the EURUSD towards 1.1600. Source: xStation5

EURUSD is losing value for the third consecutive day. Today's events—the ECB decision and the US CPI release—could introduce new, higher volatility to the pair. It is worth noting that the recent decline in US yields suggests upward potential for the pair. Nevertheless, in the event of a higher inflation reading, a downward move in the TNOTE could also drag the EURUSD towards 1.1600. Source: xStation5Key structural risks

Bloomberg warns of potential stagflation, where high inflation coexists with a weakening labor market, forcing the Fed to make an impossible choice between fighting inflation and supporting employment. Additional risks include fiscal uncertainty in the US with a $4.1 trillion budget deficit, as well as uncertainty regarding the future of France and the recent situation involving Russian drones over Poland, which has caused weakness in the zloty and could undermine confidence in European stability.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉