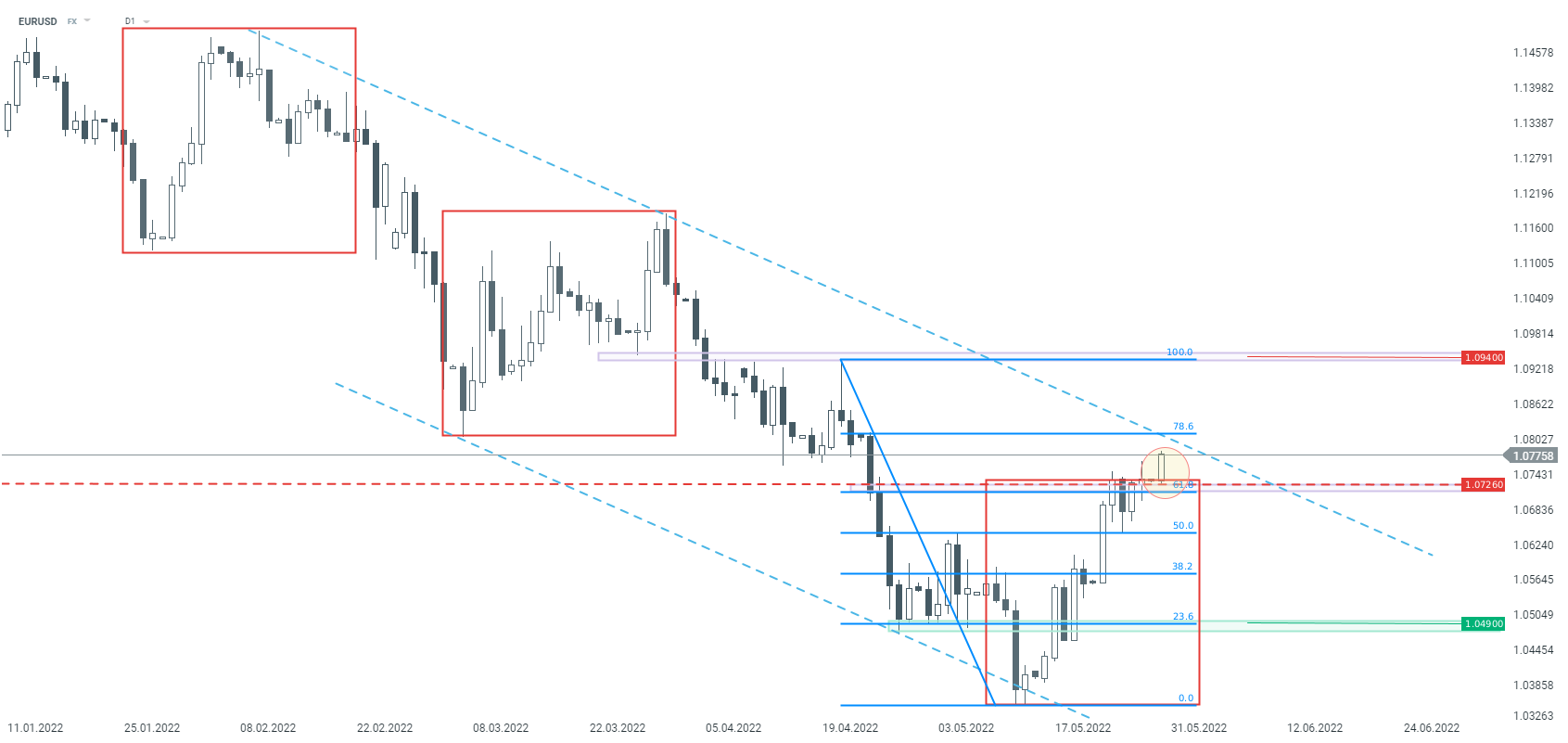

The main currency pair EURUSD started the new week with gains, thus we see a continuation of last week's sentiment. Despite the fact that before the weekend the market bears successfully prevented the price from going above the resistance zone at 1.0726, it was eventually exceeded. Looking at the D1 interval, there is a chance for a negation of the broad 1:1 pattern. According to the Overbalance methodology, the negation of the geometric pattern will mean a change in sentiment in the short term to an upward one. Confirmation of this scenario will be crossing the 78.6% Fibonacci retracement, which groups with the upper limit of the downtrend channel. If growths continue, the next important resistance falls at 1.0940.

EURUSD D1 interval. Source: xStation

On the other hand, looking at the lower time frame - H1, quotations remain in the upward channel. It seems that as long as the lower limit of this channel is not broken, the upward sentiment is valid. Even if a larger downward correction is generated, the lower limit of the local 1:1 structure at 1.0677 should be considered as an important support. Only its negation could mean that the supply will take the initiative.

EURUSD H1 interval. Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)