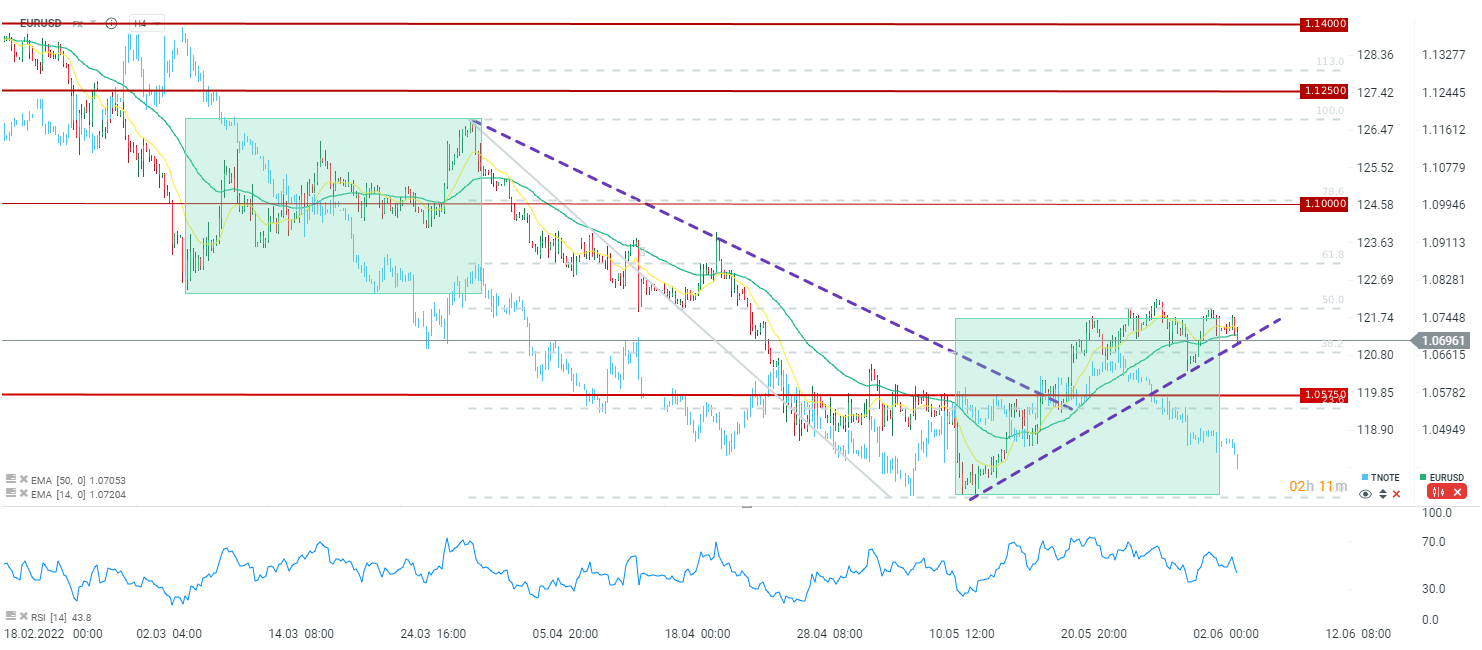

EUR/USD is in an important place, specifically at the support of the uptrend line. EURUSD is trading down with a sharp rise in yields, where 10-year yields have broken through 3% again and are at their highest since April/May. Interestingly, there were very hawkish forecasts in relation to the ECB decision. Barclays expects a 25bp hike at each meeting this year and one next year. Bank of America, on the other hand, points to 150 bp this year in total, with two 50 bp hikes in July and September. Despite such extreme expectations, the euro is not very strong. The dollar is on the offensive thanks to good data from the labor market, which shows that despite some signs of a slowdown, the economy is holding up really well.

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️