The U.S. labor market report for August is quite difficult to estimate, both due to the large amount of noise stemming from tariffs and migration policy, as well as seasonal effects (e.g., renewal of school staff contracts). Market consensus assumes a reading of 75k, just 2k more than in July. However, it is worth noting that the last release was dominated by record downward revisions for the two preceding months, amounting to nearly 260k.

Strategic layoffs as the current trend

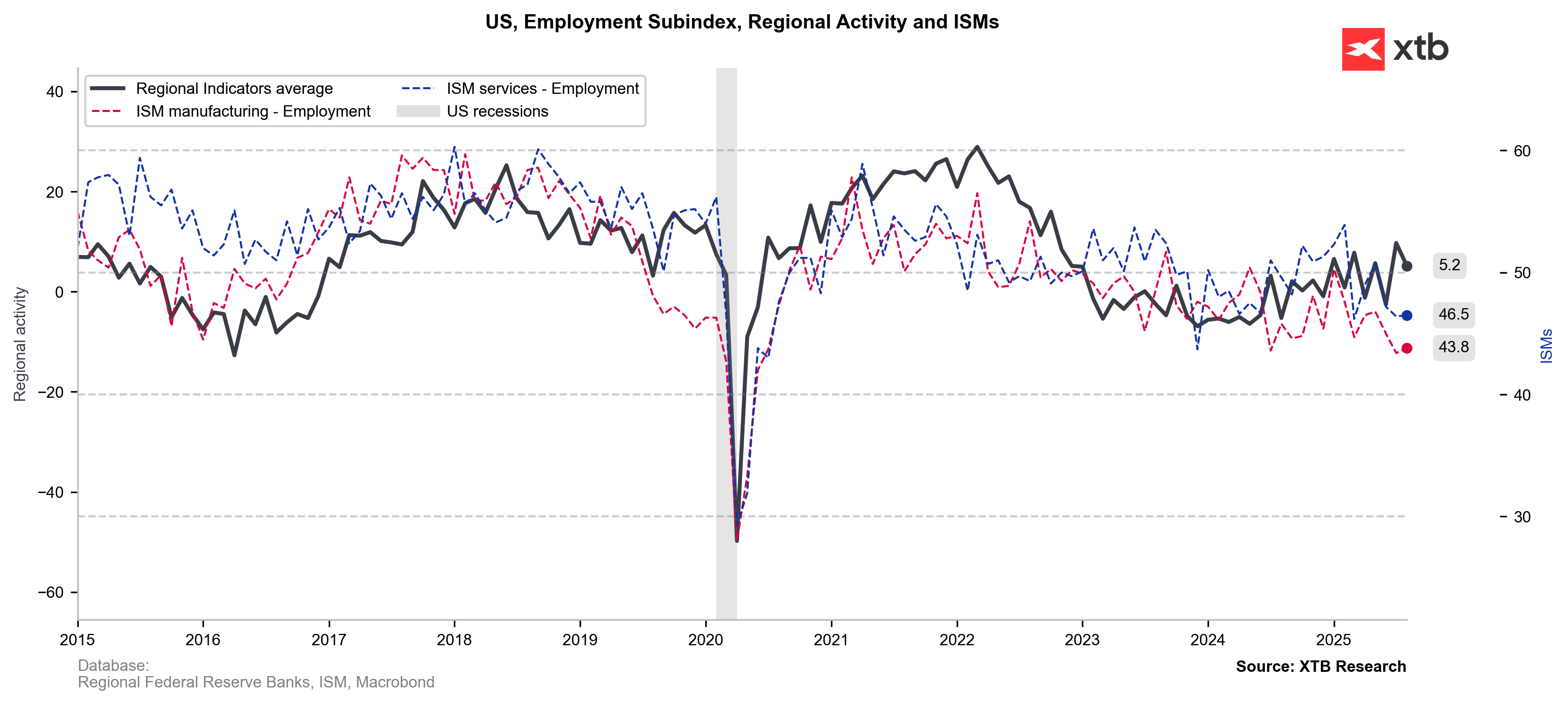

The latest ISM reports confirm that companies are seeking savings by managing headcount, often to support declining margins burdened by rising production costs. According to manufacturers, living up to the “Make in America” agenda is becoming increasingly difficult due to the ever-rising prices of imported components,while margins remain under pressure even after 2–3 price hikes. Moreover, layoffs are mainly affecting skilled and highly paid workers (e.g., engineers).

Hence, both inflationary pressure and declining labour demand are permeating the US economy and the freezing of hiring and investment projects is often attributed to economic and trade uncertainty. For the Fed, this may be a signal that even a return to easing might not necessarily support the labor market if producers still lack clearer business prospects.

The ISM employment subindex in manufacturing marginally rebounded in August but remained below market consensus. Overall, both sectors are reporting employment contraction (reading below 50). Source: XTB Research, Macrobond data

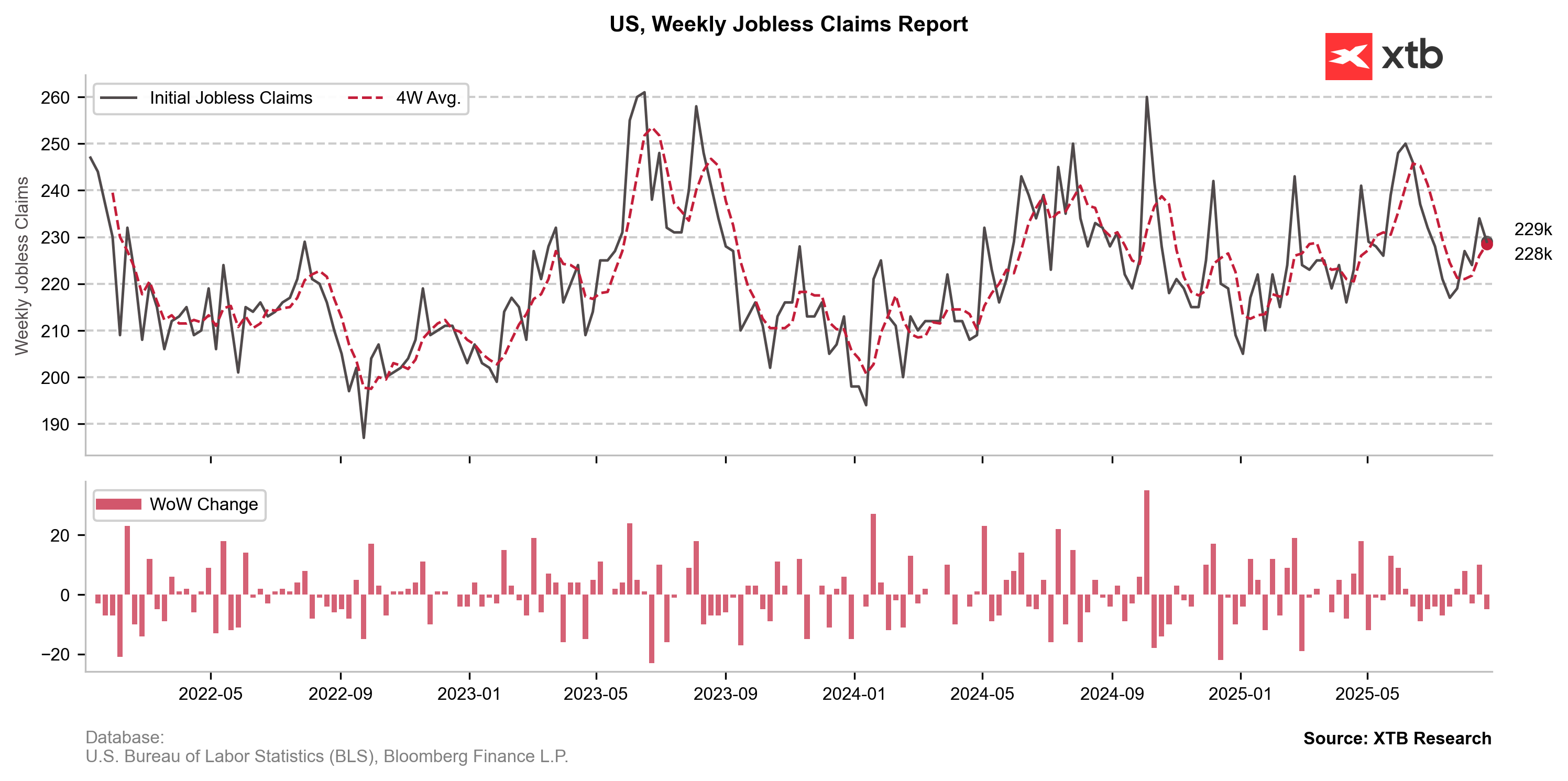

The number of jobless claims is consistently rebounding, although not yet at an alarming level. Nevertheless, recent readings do not suggest that the labor market situation will improve. Source: Bloomberg Finance LP, XTB

It is worth noting, however, the so-called “one-off events.” One such factor could be the return of a large number of federal employees to work after last month’s release of frozen funds. Statistically, August is also a particularly difficult month to forecast. In recent years it has been slightly better, but looking at the 30-year average, August has usually brought disappointment relative to consensus. Bloomberg, however, points out that based on high-frequency data, August’s labor market data should come out better than in July. At the same time, Bloomberg expects a negative revision for July, which would confirm the negative trend in the U.S. labor market.

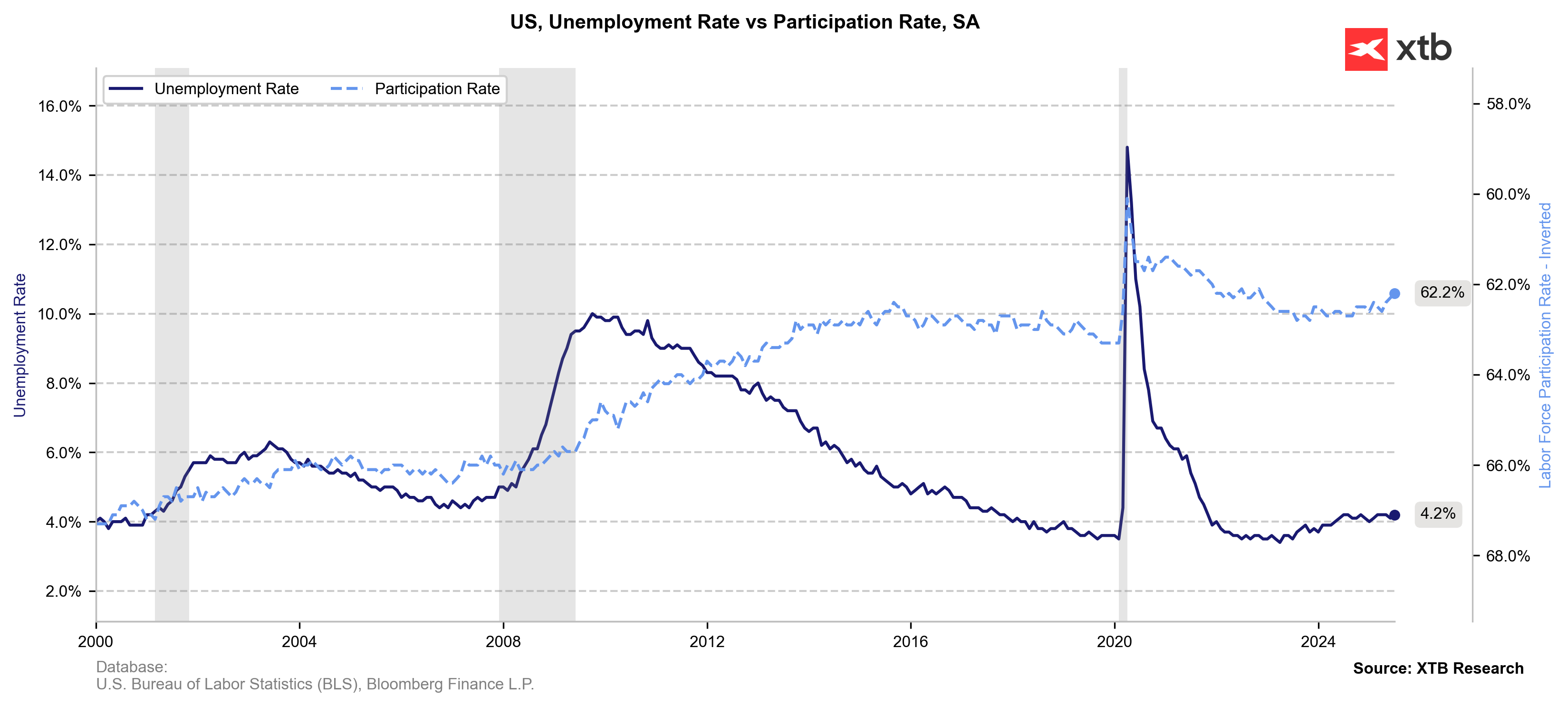

Of course, other report components should not be overlooked, such as the unemployment rate, which is expected to rebound to 4.3% y/y, and wage growth, which is expected to decline to 3.7% y/y from 3.9% y/y. Wage growth is slowly approaching the 3.0% level, consistent with achieving the inflation target in the longer term. The unemployment rate still remains below the Federal Reserve’s forecast, but its rebound would essentially guarantee a rate cut in September. A stronger increase, however, could raise concerns that the Fed has been late with cuts this year.

Unemployment, which remains at pre-pandemic levels, has so far not been a source of risk to the Fed’s full employment mandate. Source: XTB Research, Bloomberg data

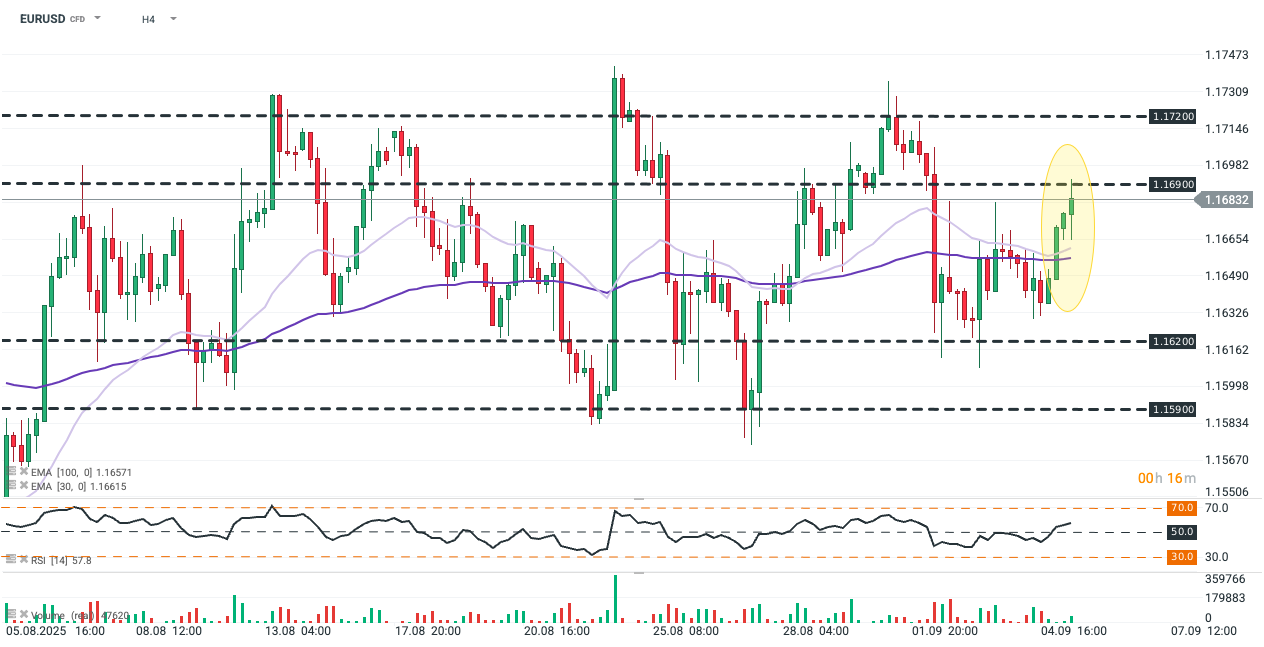

EURUSD (H4)

After yesterday’s weakness and a rebound from the 30-period exponential moving average (EMA30, light purple), EURUSD is breaking out bullishly above both EMAs today, testing key resistance around 1.169 in anticipation of confirmation from the NFP of the growing weakness in the U.S. labor market. A significantly weaker-than-expected report, leaving no room for seasonal excuses, could help EURUSD break out of the month-long consolidation above 1.172. A lack of surprises, on the other hand, should keep the pair trading between EMA100 and 1.169.

Source: xStation5

Daily summary: Stocks in Europe and US return to declines; Brent above $100 again ❗

BREAKING: NATGAS ticks higher after EIA data release 💡

Chart of the Day: EURUSD – Why is the Euro Losing to the Dollar?

Cattle futures fall amid JBS plant strike, rising corn and Middle East 📌