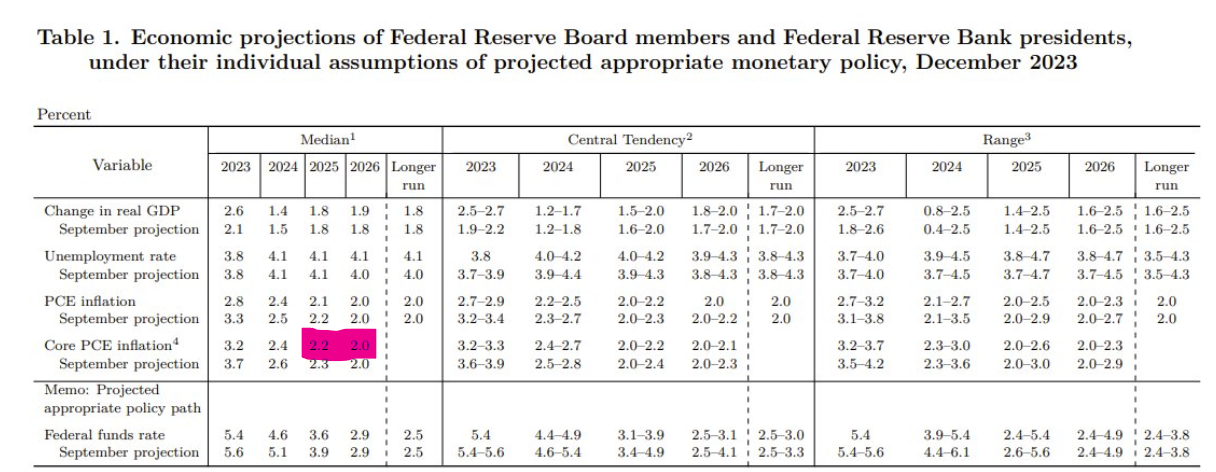

As expected, the Federal Reserve decided to keep interest rates in the range of 5.25-5.5%. Immediately after the decision was published, the EURUSD pair and US100 gained. This is mainly related to the new dot-plot, which represents the interest rate path expected by individual bankers. The new projections indicated a total of 75 basis points of cut in 2024.

However, the inflation forecasts are mixed, with the FED's 2% target expected to be reached only in 2025, creating some underlying market uncertainty, source: Bloomberg Finance L.P.

However, the inflation forecasts themselves come out mixed, with the Fed's 2% target not expected to be reached until 2026, creating some groundswell of uncertainty in the market. Source: FED

In response to the decision and interest rate projections for 2024 and 2025, the dollar significantly loses value. Today, volatility before the decision was exceptionally low, with the dollar not making any abrupt movements. High volatility returned to the dollar at the moment of publication. EURUSD gains 0.40% and slightly erases the initial move to around 1.0850. Nevertheless, we observe a significant reaction on the course at the 1.0800 levels, which also extends yesterday's gains from the support line levels at 1.075.

Source: xStation 5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Market Wrap: Capital Flees Europe 🇪🇺 📉