It is expected that US CPI inflation report for November (1:30 pm GMT) will show a deceleration in headline price growth from 7.7 to 7.3% YoY while core gauge is seen dropping from 6.3 to 6.1% YoY. Both measures are seen at 0.3% MoM. Markets are somewhat positioning for a slightly hotter-than-expected CPI reading, given strong labor market data for November and a higher-than-expected PPI reading. On the other hand, CPI inflation includes a number of items that are less dependent on changes in producers' inflation therefore there is a chance for a downside surprise in today's US inflation data.

Used car prices drop significantly

Manheim index shows that prices of used cars continue to drop significantly. Source: Bloomberg

Manheim index shows that prices of used cars continue to drop significantly. Source: Bloomberg

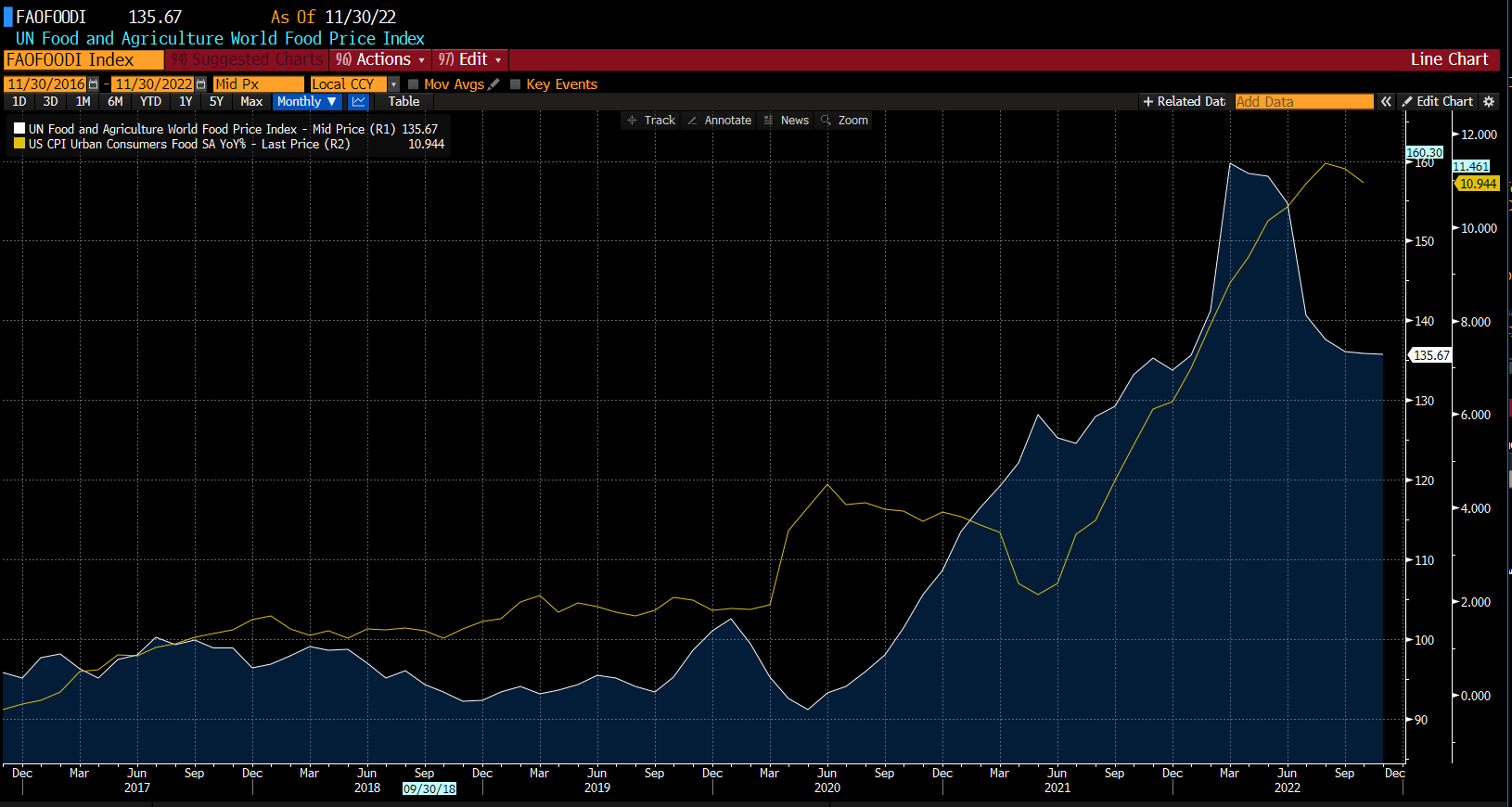

Food prices no longer increase

UN food price index dropped recently, a development that is yet to be seen in US inflation data. Source: Bloomberg

UN food price index dropped recently, a development that is yet to be seen in US inflation data. Source: Bloomberg

Cheaper fuel!

US gasoline prices continue to drop towards $3 per gallon. Prices dropped around 7.5% in November alone and are now trading at the lowest level in a year. Source: Bloomberg

US gasoline prices continue to drop towards $3 per gallon. Prices dropped around 7.5% in November alone and are now trading at the lowest level in a year. Source: Bloomberg

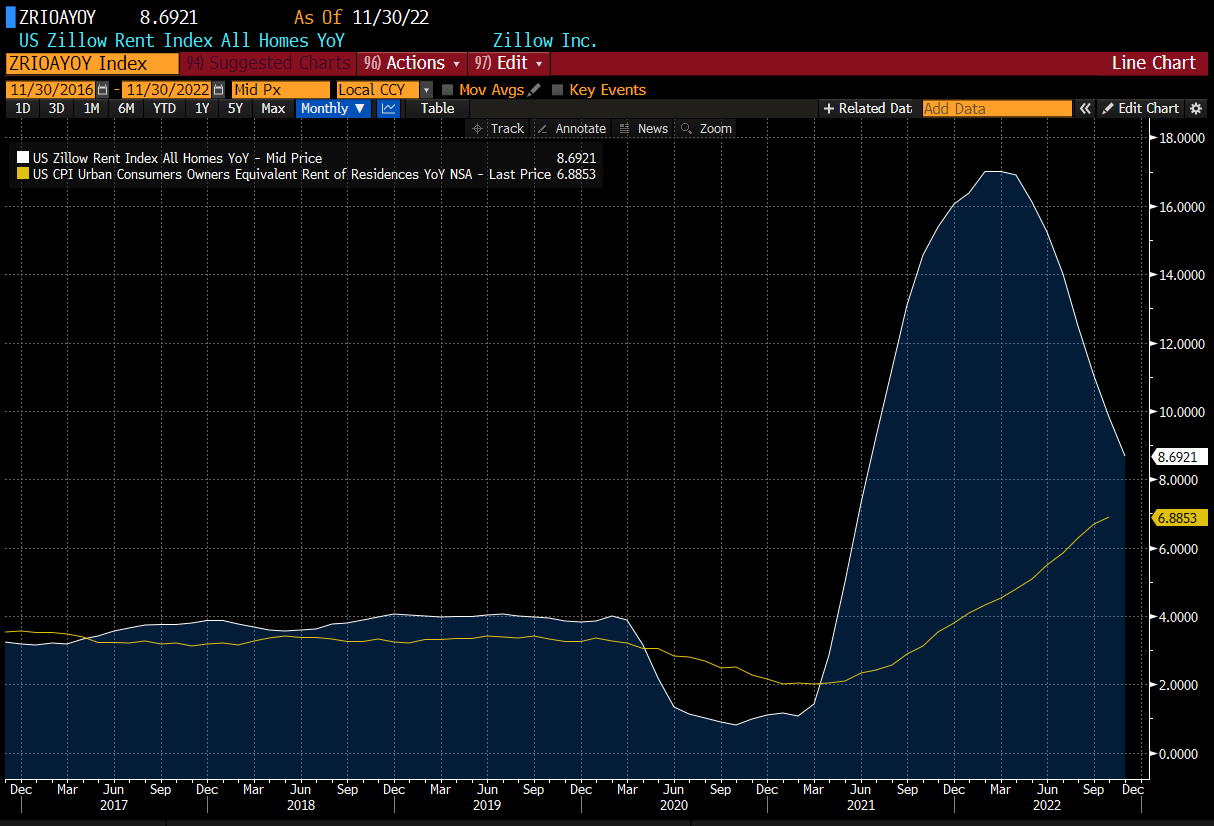

Rental price increases start to ease as well

According to Zillow Research, increases in rental prices start to decelerated and it should be noted that rents have a big impact on CPI readings. As such, there is a chance for rents to start to negatively contribute to inflation. Source: Bloomberg

According to Zillow Research, increases in rental prices start to decelerated and it should be noted that rents have a big impact on CPI readings. As such, there is a chance for rents to start to negatively contribute to inflation. Source: Bloomberg

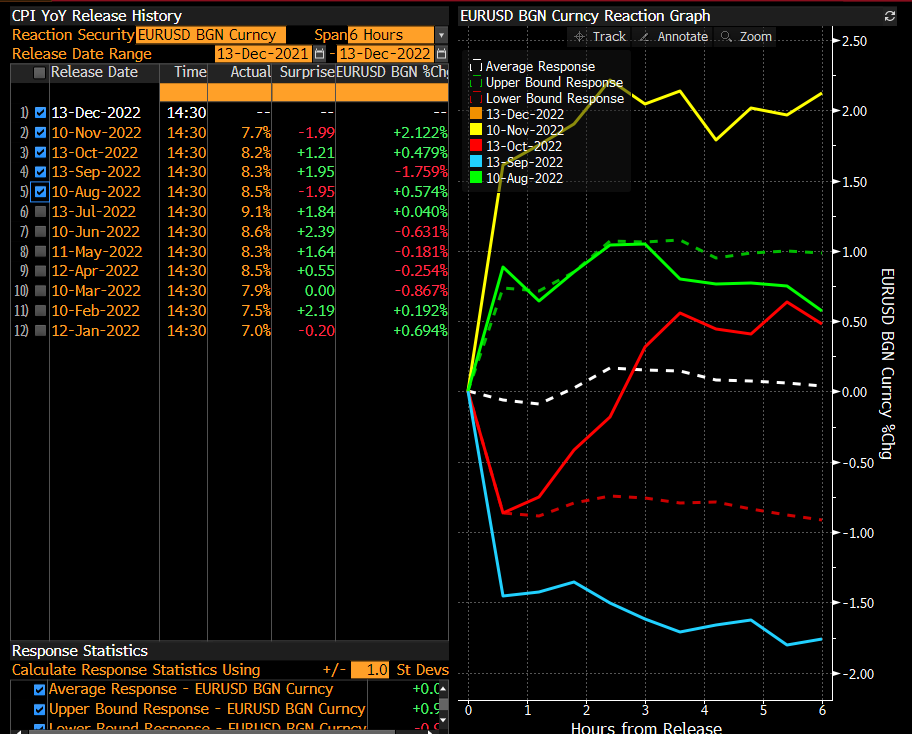

How will markets react?

It should be noted that US CPI showed negative surprises in November (data for October) and in August (data for July). EURUSD gained quite significantly following those readings. As such, a downside surprise in US CPI data today could see USD weaken and EURUSD gain. Also, indices from Wall Street should benefit in such a scenario. On the other hand, should we see a higher-than-expected reading, volatility may remain elevated ahead of FOMC meeting as uncertainty would increase as well.

EURUSD reactions to latest US CPI data releases. Source: Bloomberg

EURUSD reactions to latest US CPI data releases. Source: Bloomberg

EURUSD continues to trade below 38.2% retracement of the latest major downward impulse. Should bulls manage to break above this level and stay there in the aftermath of Fed decision, it would be a strong signal that trend on the main currency pair is about to reverse. Source: xStation5

EURUSD continues to trade below 38.2% retracement of the latest major downward impulse. Should bulls manage to break above this level and stay there in the aftermath of Fed decision, it would be a strong signal that trend on the main currency pair is about to reverse. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉