Christopher Waller, Fed member, delivered some hawkish comments on monetary policy this afternoon, providing support for the US dollar. Key takeaways from Waller's speech:

- Fed needs to remain flexible for June meeting

- Would support a rate hike in June or July

- Decision whether to hike in June or July will depend on incoming inflation data

- Also, situation in the banking sector could justify waiting until July with a rate hike if credit conditions have tightened excessively

- Jobs market remains very tight and inflation remains high

- Concerned inflation won't come down much unless wage growth nears 3%

- Fed should not halt hikes until it is clear that inflation is tamed

- Uncertainty about credit conditions is higher than usual

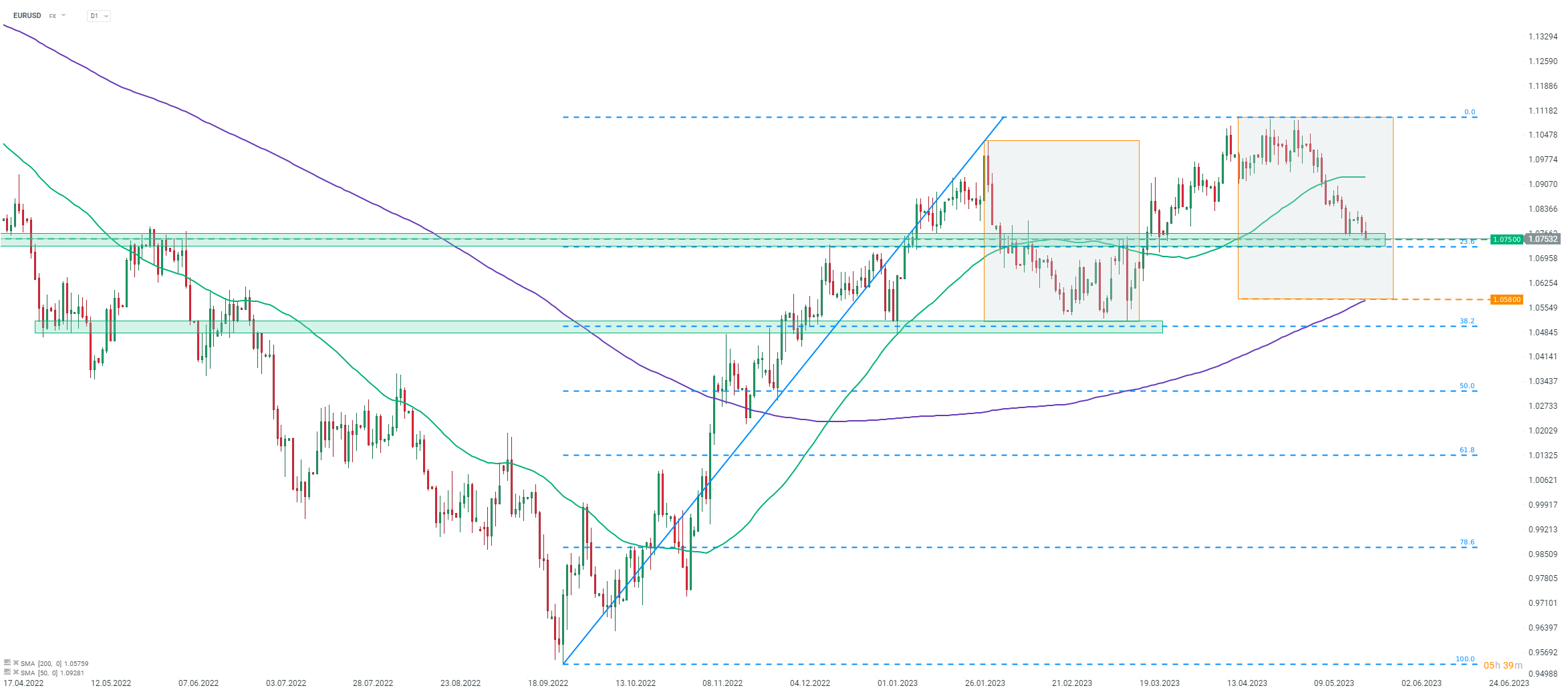

EURUSD moved to new daily lows after hawkish comments from Fed Waller. The main currency pair is attempting to break below the 1.0750 support zone. Should it manage to do so and sellers remain in control of the market, attention will shift to the 1.0580 area, where the lower limit of the Overbalance structure as well as the 200-session moving average (purple line) can be found. Note that the pair is likely to get more volatile this evening when FOMC minutes are released at 7:00 pm BST.

EURUSD at D1 interval. Source: xStation5

EURUSD at D1 interval. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)