Shares of Disc Medicine (IRON.US) fell more than 7% today following a Reuters article on the FDA's accelerated drug approval program. The main reason for the decline is the suspension of the regulatory review of the company's flagship drug, bitopertin due to serious concerns about its efficacy and risk of abuse. The regulators' decision has been postponed by two weeks, to February 10, 2026, which is a clear warning signal for the capital market.

What happened – details of the FDA decision

The FDA has suspended its review of bitopertin under the FDA Commissioner's National Priority Voucher Program — an accelerated drug approval program unveiled by the Trump administration in June 2025. The program promised regulatory decisions in just 1-2 months, which would shorten the standard priority process by as much as 4-6 months.

Bitopertin is an experimental drug being developed for patients with a rare blood disorder that causes extreme sensitivity to sunlight. Regulators have identified three key issues in the regulatory documentation:

First reservation – research methodology: The FDA questions whether "pain-free time in a relaxed, outdoor setting" – the second objective of the clinical trials – is a statistically robust measure of the drug's efficacy, or whether it simply shows that patients feel better mentally in conditions that are pleasant for them. The agency is requesting additional biomarker-based data to confirm that the decrease in toxic metabolites actually translates into measurable therapeutic benefits for patients.

Second concern – potential for abuse: FDA staff responsible for classifying drugs with addictive potential are conducting additional studies on bitopertin to assess its potential for misuse. Reuters could not confirm details about the abuse potential, but warnings from regulators could lead to special restrictions on the drug's distribution.

Context – issues broader than Disc Medicine itself

Disc Medicine is not alone. Almost simultaneously, Reuters revealed that Sanofi (SAN.FR) , the French pharmaceutical giant, had to face the suspension of the review of its drug Tzield (intended for the treatment of type 1 diabetes). The suspension of Tzield is even more alarming, as the FDA cites patient deaths associated with the treatment and serious adverse events such as seizures (in December 2024 and September 2025) and thromboembolic complications (May 2025).

Trump's voucher program is proving to be much more stringent than initially thought. Only one drug — a generic antibiotic — has been approved under the program, even though the FDA announced in October 2025 that 18 drugs would participate in the accelerated approval process. Most reviews are scheduled to begin in 2026, with two additional ones planned for 2027-2028.

Disc Medicine Position and Implications

John Quisel, CEO of Disc Medicine, told Reuters that bitopertin data show "a solid safety profile and multiple medical benefits." He pointed to a significant decrease in toxic metabolites (the primary endpoint of two mid-stage studies) and a reduction in phototoxic reactions in patients.

However, the CEO's optimism did not stop the stock from falling. For investors, the FDA's hold is a clear sign of risk — meaning that approval is not certain, and the next two weeks (until February 10) may only be the beginning of the process. History shows that when regulators raise questions about research methodology or the potential for abuse, the road to approval often becomes longer.

Implications for the sector

This incident is significant for the entire biotechnology and pharmaceutical sector. The voucher program was seen by investors as a potential fast track to profits for selected companies. However, today's suspensions show that the FDA will not cut corners, regardless of political pressure or promises of acceleration.

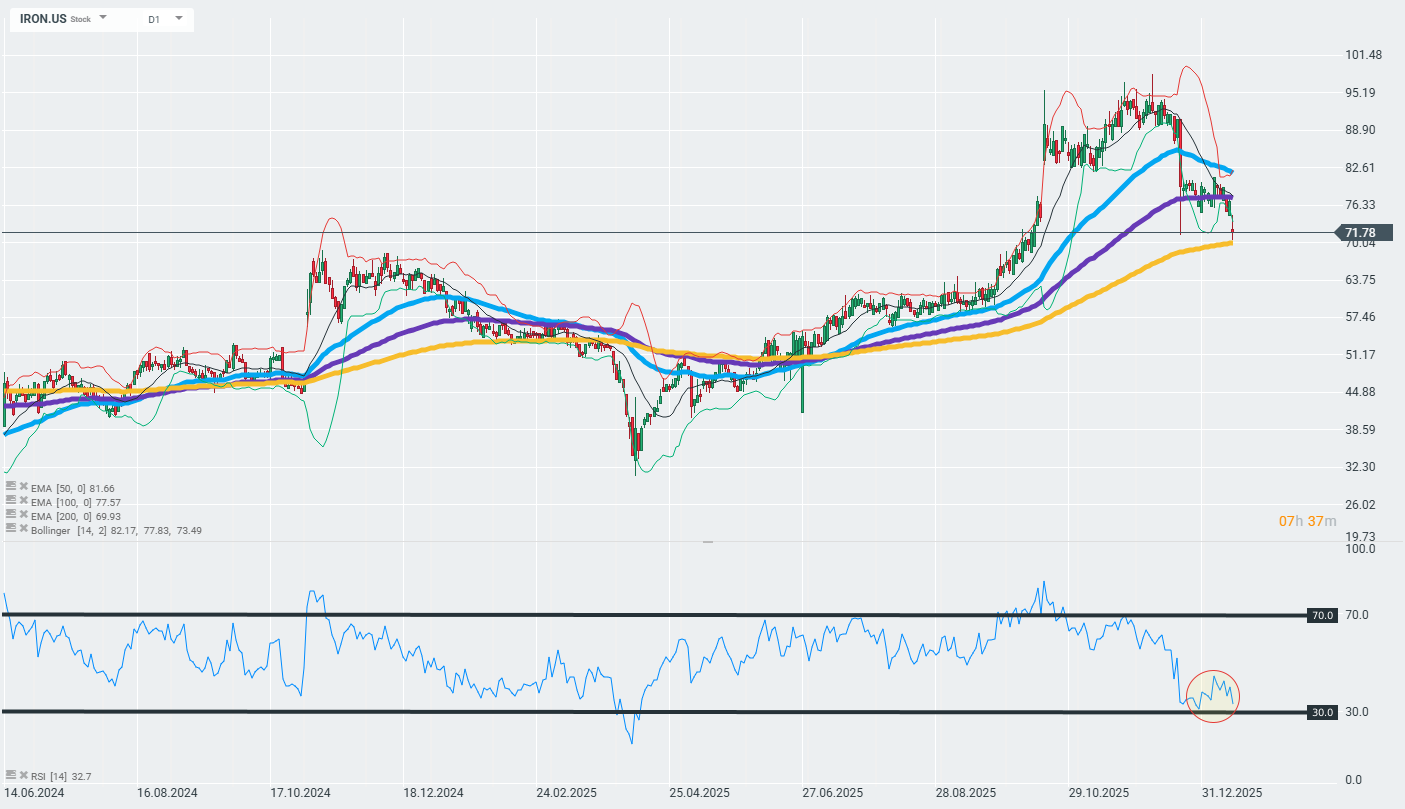

The company's shares are losing ground today and falling into important technical support zones marked by the 200-day exponential moving average (the gold curve on the chart). The further reaction to this zone may determine whether the current trend will continue or whether we will see a reversal.

Source: xStation

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment