Facebook

(FB.US) reported profit of $2.72 per share for the third quarter, beating the consensus estimate of $1.91 a share. Revenue also came in above analysts' expectations. However, user base in US and Canada dropped from 198 to 196 million and company expects it will remain flat or decrease in the fourth quarter. Facebook also warned of a “significant amount of uncertainty” for the coming year as the accelerated shift to online shopping and the

digital advertising boom during a pandemic could soon be over, and platform changes and new regulations could hamper the social media giant's operations. Investors reacted nervously to these statements and Facebook shares fell during today's session by over 6.5%.![]()

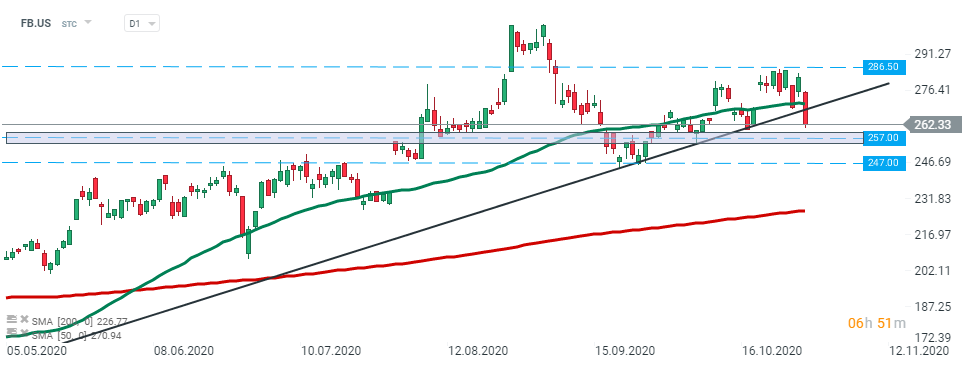

Facebook (FB.US) stock launched today's session lower and broke below the 50 SMA (green line) and the long term upward trendline. Currently price is approaching major support at $257.00. If a break below occurs, then downward move could be extended to the $247.00 level. However if buyers will manage to halt declines there, then another upward movement towards $286.50 could be launched. Source: xStation5