Slightly higher inflation, strong rebound in claims

As expected, CPI inflation for August rose to 2.9% y/y from 2.7% y/y. Core inflation remained elevated at 3.1% y/y. The only surprise was a slightly higher monthly CPI, which rose 0.4% m/m versus expectations of 0.3% m/m. It is worth noting, however, that the m/m dynamic was twice as high as in July.

Core monthly inflation came in at 0.3% m/m, in line with expectations. On the other hand, we are seeing a very strong increase in jobless claims. This shows a growing divergence between the Fed’s mandates — labor market weakness and elevated inflation. What do the report details show and what could this mean for the Fed? And should Wall Street be worried?

Main drivers of inflation

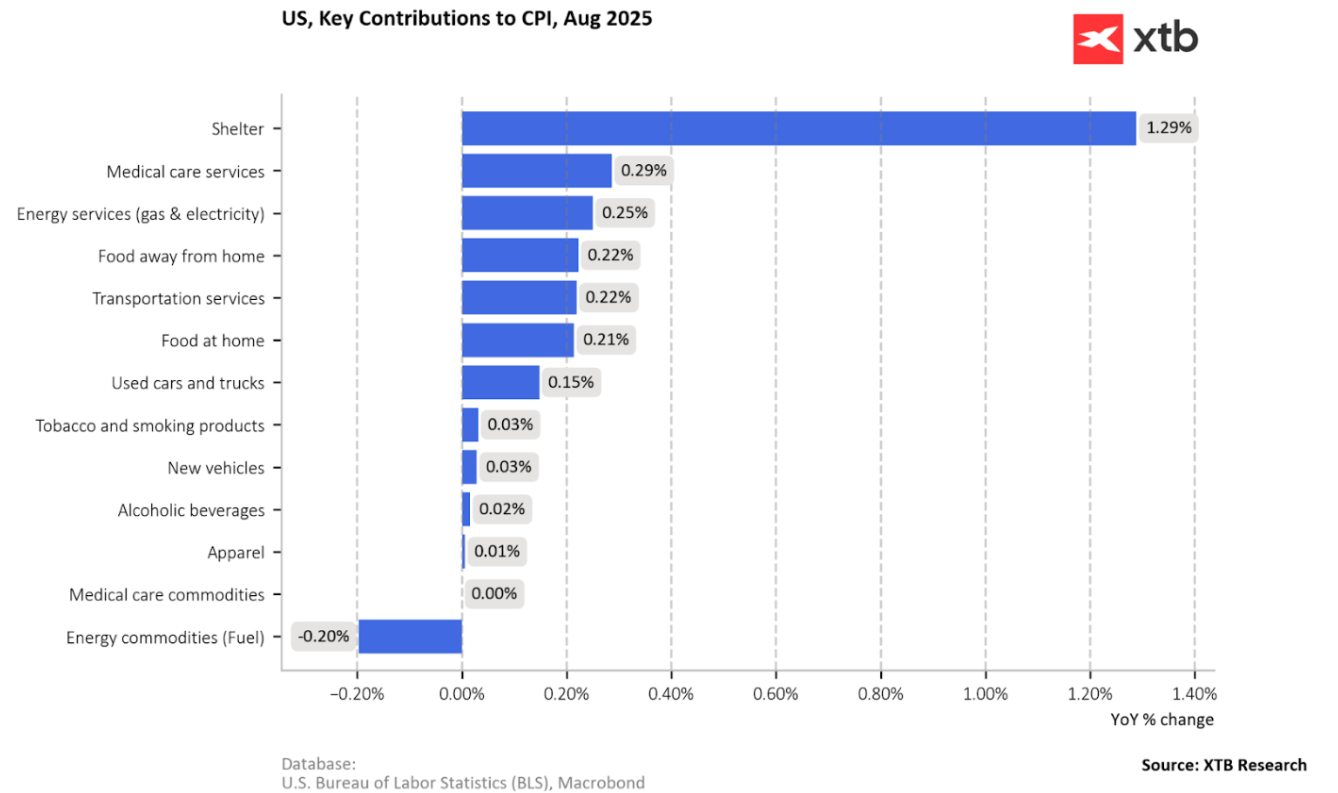

- Housing (shelter) was the largest contributor to the monthly increase, rising 0.4%.

- Transportation services were the key driver of so-called SuperCore CPI (well above 3% y/y and just over 0.3% m/m); airline fares jumped 5.9%.

- Energy rose 0.7% m/m, with gasoline up 1.9%. Food prices increased 0.5% m/m.

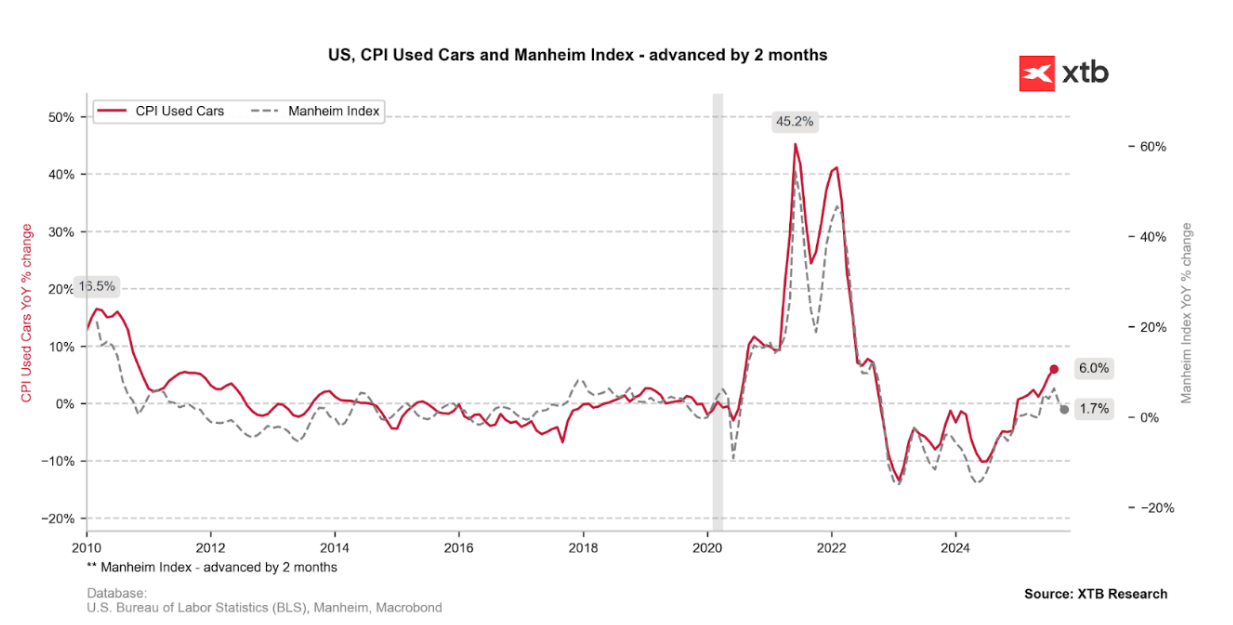

- Cars have started to rise in price again. New vehicle prices rose +0.3%, used cars +1.0%, and auto repairs as much as 2.4%.

Tariffs vs. services impact

The key point is that the inflation increase came mainly from services, not from tariffs introduced by the Trump administration.

- Prices in import-exposed categories showed mixed signals, with no clear acceleration linked to tariffs.

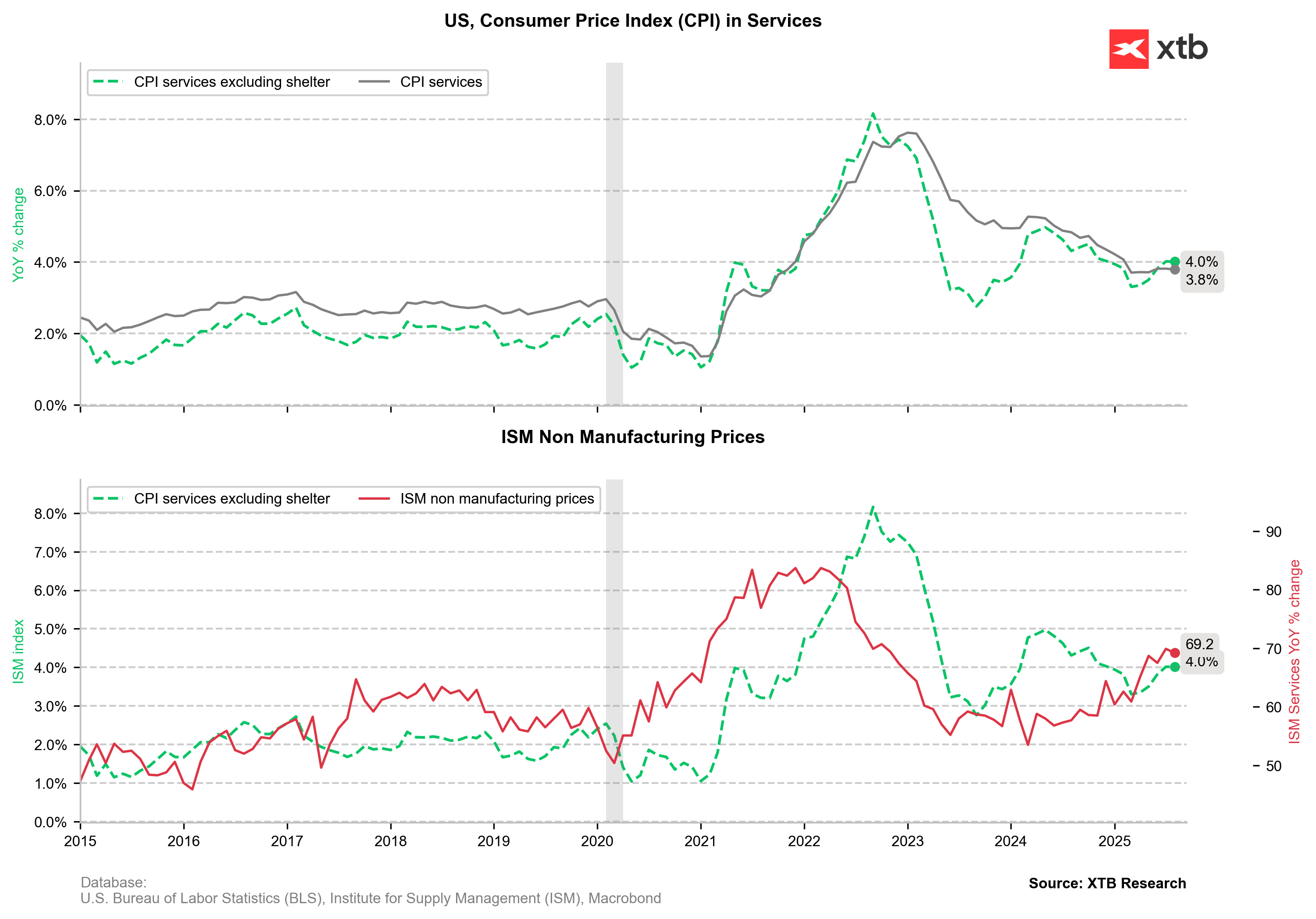

- SuperCore CPI (services excluding shelter) slowed slightly to 3.52% y/y, suggesting price pressures are not as intense as they might appear. Still, far from the target.

These data confirm that the Fed is likely to begin easing monetary policy but will remain cautious in the pace of cuts due to persistent inflation well above the 2% target. Services remain sticky, and with any potential jump in gasoline prices, the picture would look much worse.

Key charts

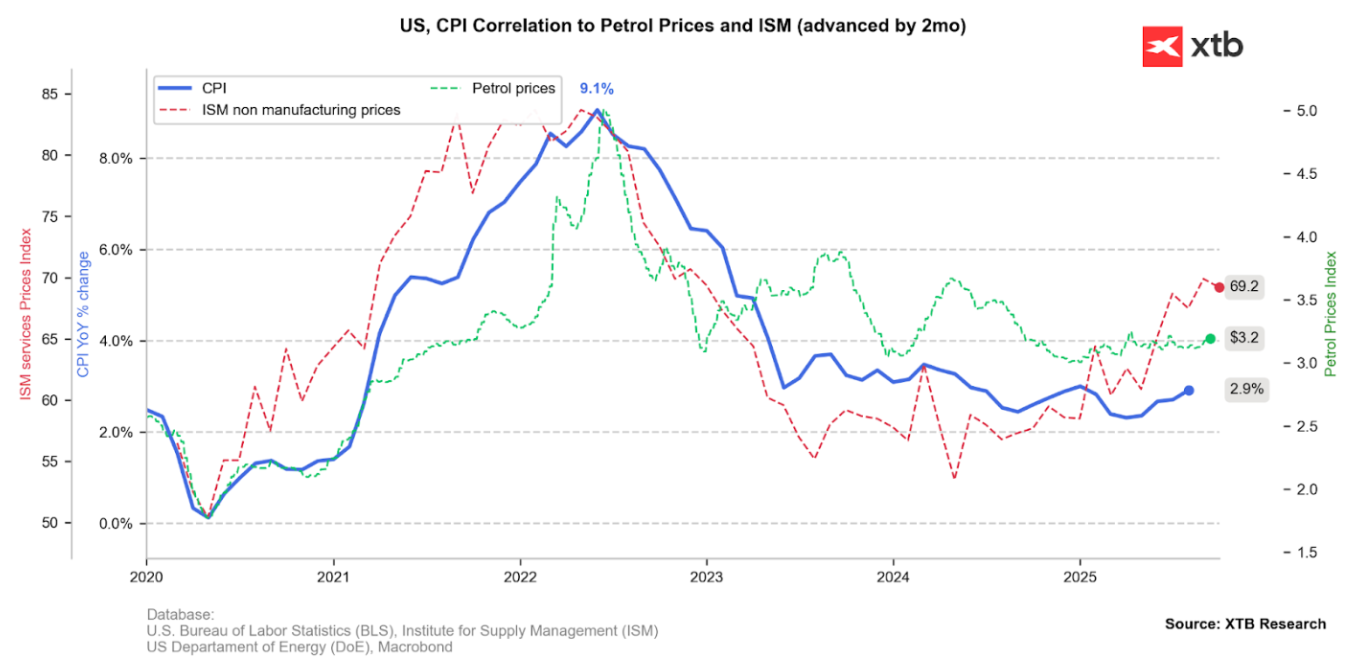

CPI inflation rebounds as expected to 2.9% y/y. As leading indicators show, the biggest problem in the U.S. remains rising service prices. This is clearly illustrated by the price subindex of the ISM services survey. Source: Bloomberg Finance LP, XTB

Looking at the main components, rental inflation remains the largest contributor. However, contributions tied to rising service costs are growing steadily. The main driver of inflation is not tariffs but services. Medical, energy, transport, and food costs are rising strongly (with food partly impacted by tariffs). Source: Bloomberg Finance LP, XTB

Food prices in the U.S. are rising faster than suggested by the FAO food price index, partly linked to tariffs. Source: Bloomberg Finance LP, XTB

Used car inflation is rising — new cars are subject to tariffs. Nonetheless, the Manheim index suggests this dynamic should slow in the coming months. Source: Bloomberg Finance LP, XTB

Service inflation remains high, though stabilizing at elevated levels. Source: Bloomberg Finance LP, XTB

High inflation is a problem, but labor market weakness is an even bigger one

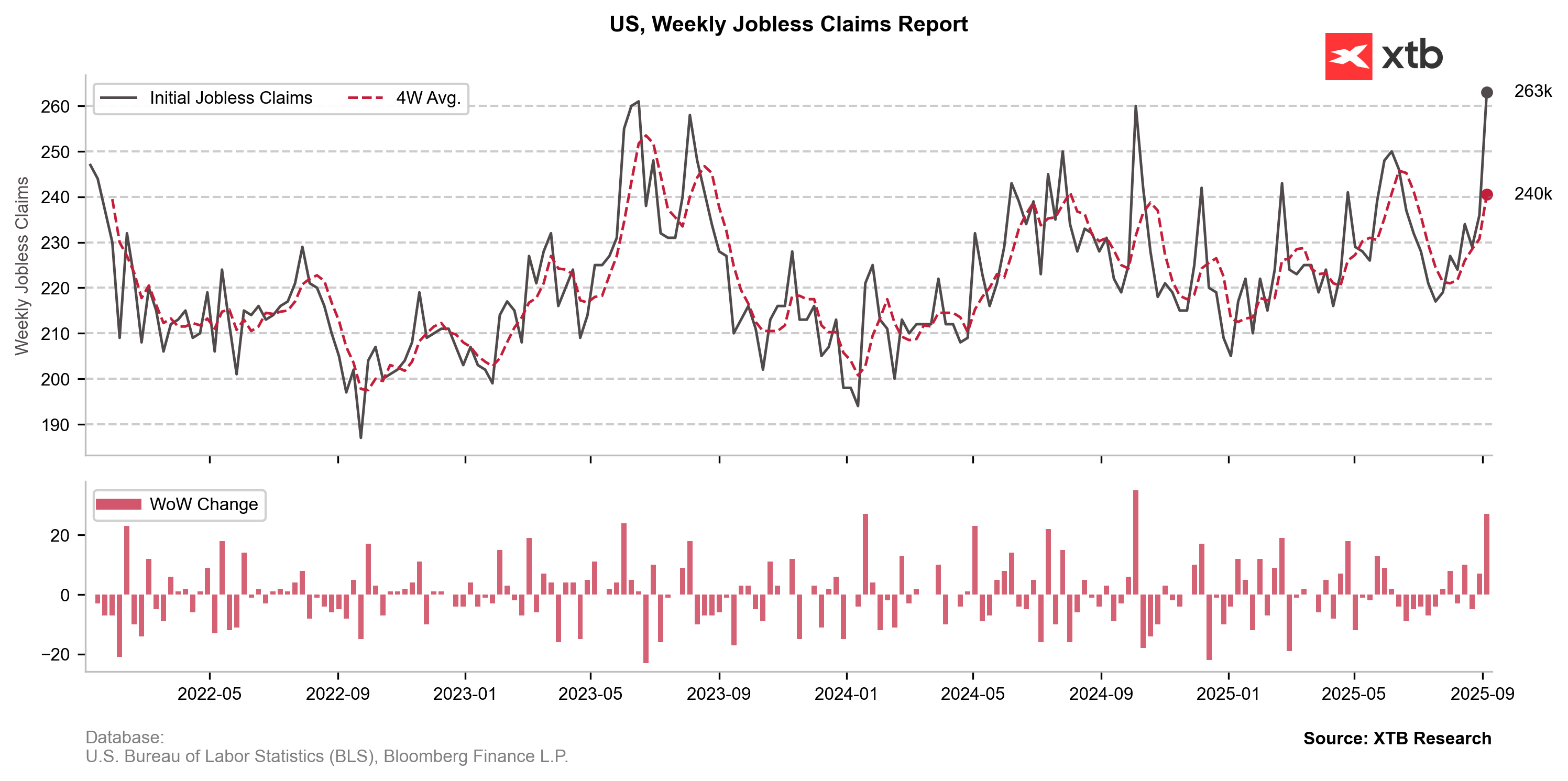

Initial jobless claims are rising to their highest levels in 4 years, though in 2023 and 2024 we saw levels above 250k. The biggest increase is linked to a strong rise in claims in Texas. While not yet a cause for panic, claims around 300k have usually been a recession signal.

A huge jump in initial jobless claims, with the level now the highest since 2021. Source: Bloomberg Finance LP, XTB

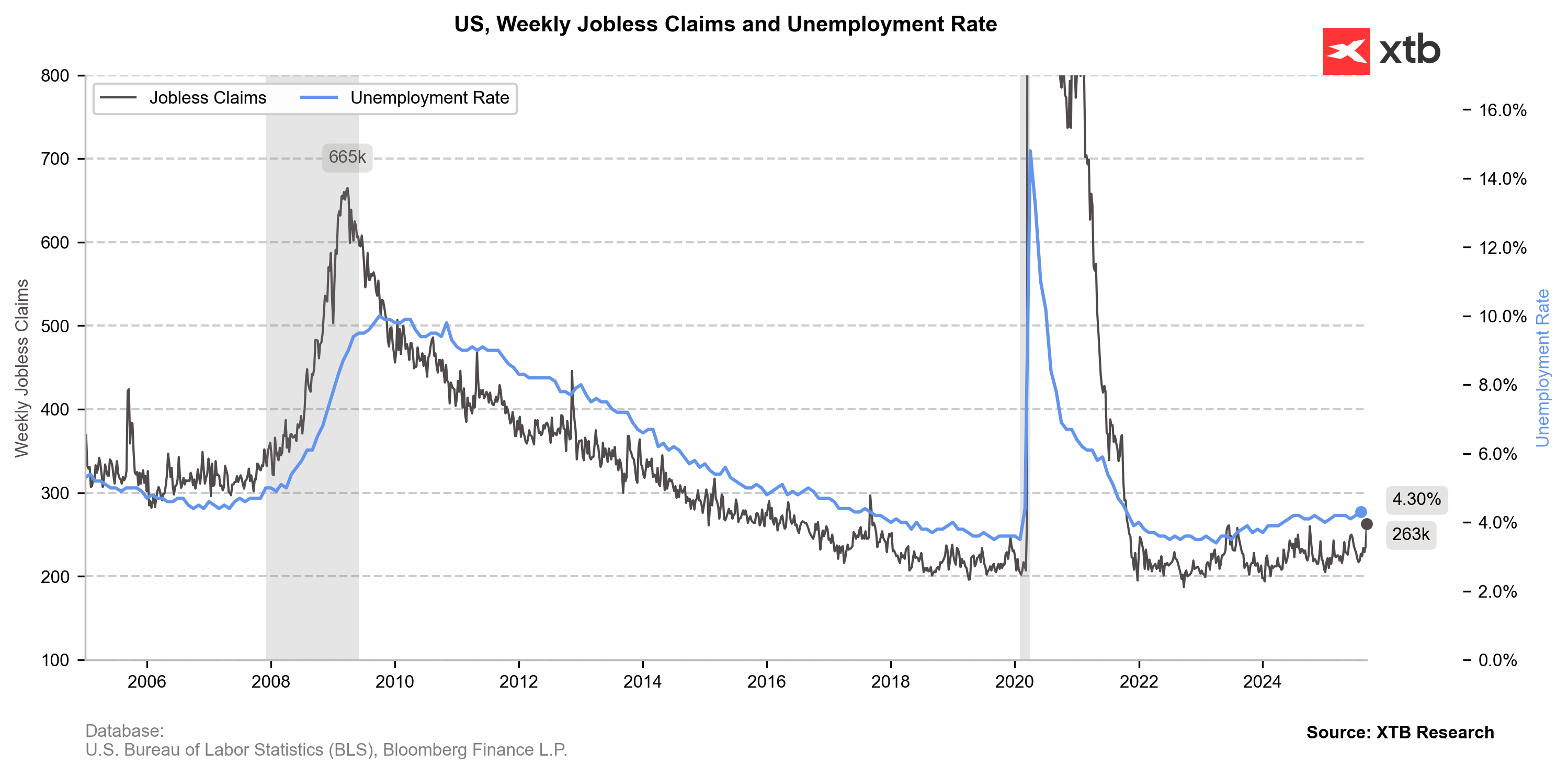

If this is not a one-off, the sharp rise in claims may suggest an uptick in the unemployment rate. Source: Bloomberg Finance LP, XTB

Fed will cut rates

It seems the Fed should not opt for a larger 50bp cut, given still-elevated inflation risks. However, it is clear that tariffs — the main source of price uncertainty — have had limited impact on U.S. prices. Therefore, the Fed will cut rates, but likely without pre-committing to a full cycle, remaining very data-dependent.

Economic calendar: Canadian labor market and Michigan Index (06.02.2026)

🔵 ECB Press Conference (LIVE)

BREAKING: ECB maintains rates in line with expectations!💶

BREAKING: Bank of England holds rates as expected 📌 GBPUSD ticks down on dovish vote split 📉