Today we will learn the transcripts of the US central bankers' discussions from the July meeting, which saw a 25bp interest rate hike to 5.5%. The market is now wondering whether the July move was the last one, given the marked cooling of inflation. Although more information on the outlook for major markets like EURUSD, TNOTE and US500 will give us the upcoming economic symposium in Jackson Hole, today's minutes will show what the mood is across the monetary policy committee, given Powell's somewhat more dovish words during the July press conference. What do we need to know before the release of today's minutes?

- Credit conditions have worsened in the U.S., reducing demand for credit

- Some FOMC members were said to have expressed at the July meeting a desire to keep interest rates unchanged at future meetings

- However, Powell stressed that much will depend on the data

- During the July meeting, FOMC members had the CPI report, which showed inflation falling to 3.0% y/y. Now we know that for July, inflation rebounded to 3.2% y/y, less than market expectations

- US wages continue to rise, but the Fed's preferred measure showing unit labor costs for Q2 scored increases of 1.6% at an annualized rate, which should not add to the inflation outlook

- Monthly price changes in inflation are moving at 0.2%, which if annualized would put the inflation target at 2.0%

- The labor market remains strong, but a cooling is evident. Retail sales and industrial production for July score a sizable rebound, which signals a soft landing for the economy

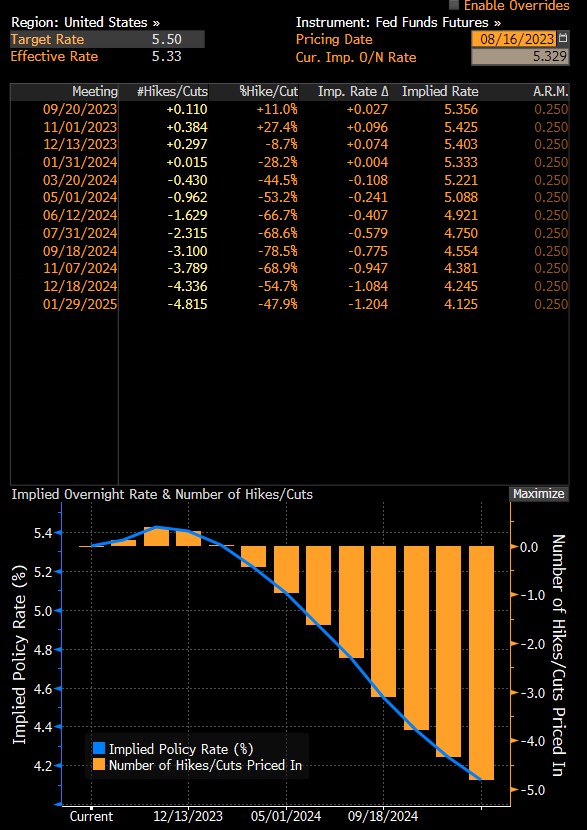

The market no longer sees any chance of a full interest rate hike this year. Minutes are unlikely to lead to an increase in expectations of a hike. There is a chance to reinforce the moderately dovish message from the July meeting, potentially leading to dollar weakness. Of course, the Fed has yet to officially acknowledge that it is done with hikes. Source: Bloomberg Finance LP

How might the market react?

EURUSD is after a series of fairly pronounced declines, which was linked to the rally in US yields. 10-year yields rose above 4.2%, levels not seen since last November. If the Fed were not to raise rates again, then there will be a chance for a significant reduction in the recent yield rally, or the rise in bond prices (TNOTE). On the other hand, the Fed has not officially admitted that interest rates will be kept unchanged for an extended period. The data does not clearly indicate a hike, but at the same time the data is not "bad" enough to give a clear message leading to the maintenance of interest rates.

Nevertheless, we see today the potential for profit taking on the dollar, declines on TNOTE and rise on the US500. FOMC bankers still see prospects for a US soft landing, which could lead to capital inflows to riskier assets.

EURUSD scored a test of the 1.0900 level. The 23.6 Fibonacci retracement is an important support, looking at the reaction of the weekly candles in June. Slightly below is the range of the previous downtrend correction. If TNOTE will rebound, it could mark a turning point for EURUSD. At the same time, however, if the Fed minutes will show determination toward another hike, then EURUSD could retreat even to the 1.0800 level, and TNOTE to the vicinity of 109 points. Source: xStation5

EURUSD scored a test of the 1.0900 level. The 23.6 Fibonacci retracement is an important support, looking at the reaction of the weekly candles in June. Slightly below is the range of the previous downtrend correction. If TNOTE will rebound, it could mark a turning point for EURUSD. At the same time, however, if the Fed minutes will show determination toward another hike, then EURUSD could retreat even to the 1.0800 level, and TNOTE to the vicinity of 109 points. Source: xStation5

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

Chart of the Day: EURUSD after data from Europe and weaker US labor market

Economic calendar: Canadian labor market and Michigan Index (06.02.2026)