-

Federal Reserve Bank of Chicago President Austan Goolsbee advocates for cutting interest rates if US inflation continues to decline towards the 2% target, as maintaining current rates would tighten monetary policy.

-

Goolsbee believes that the US is on a path to 2% inflation, and his comments follow recent data showing the slowest increase in the Fed's preferred gauge of underlying inflation in six months.

-

He emphasized that decisions to tighten or loosen monetary policy should be made intentionally, not by default, and warned of potential warning signs in the job market.

-

Fed officials have held rates steady at a more than two-decade high since last July, waiting for more evidence that inflation is on track towards their 2% goal before considering lowering borrowing costs.

Federal Reserve Bank of Chicago President Austan Goolsbee suggested that Fed officials should consider lowering interest rates in the US if inflation continues to move towards the 2% target. Goolsbee's speech was relatively dovish, and he did not shy away from evaluating the current monetary policy. This is particularly interesting because today at 3:30 PM, Fed Chairman Jerome Powell will be speaking at the same conference in a panel alongside ECB President Christine Lagarde. Goolsbee expressed satisfaction with recent inflation data and highlighted the labor market in the context of potential warning signs of an economic slowdown.

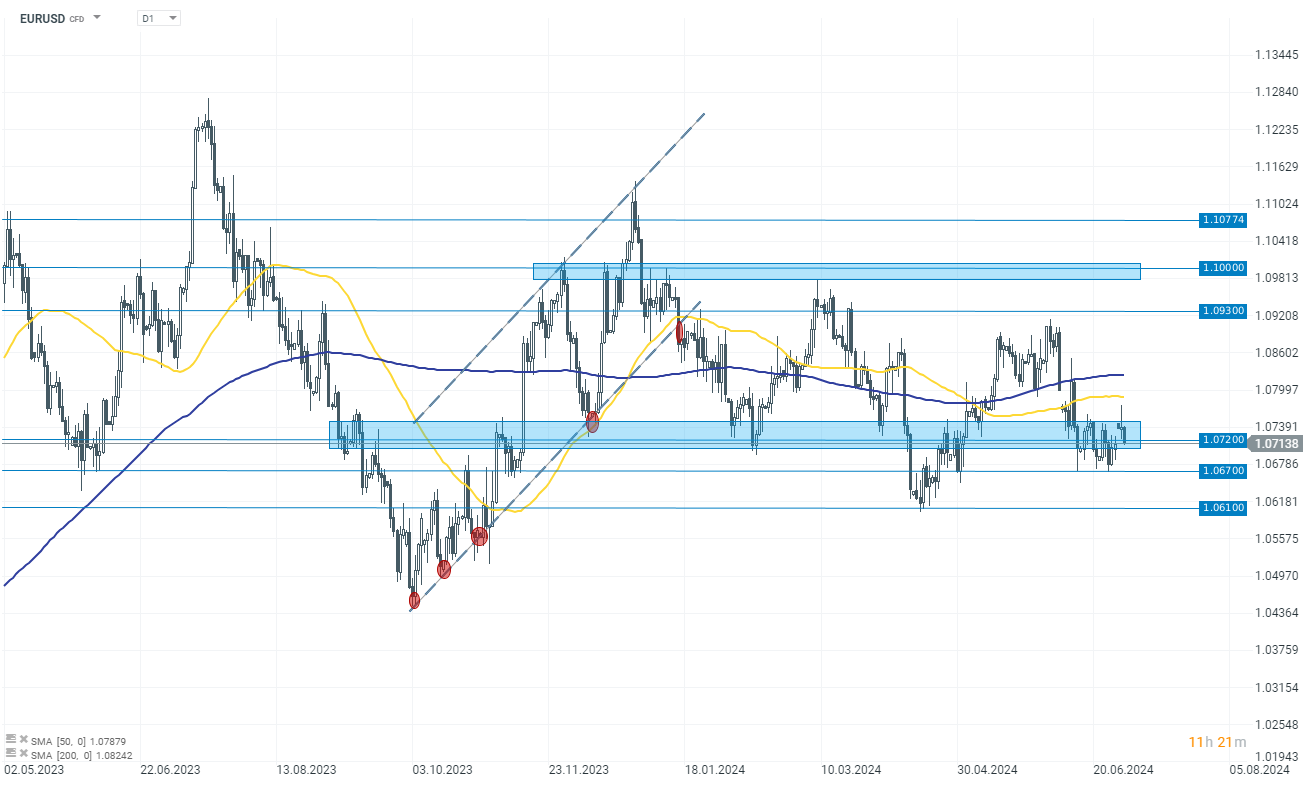

EURUSD (D1)

The EURUSD rate is down 0.25% today to 1.07100. This is mainly due to a strong USD, while the EUR remains relatively stable after inflation data from the Eurozone. The rate is approaching a key support zone around the 1.0700 level.

Source: xStation 5

Economic calendar: US CPI in the spotlight (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected