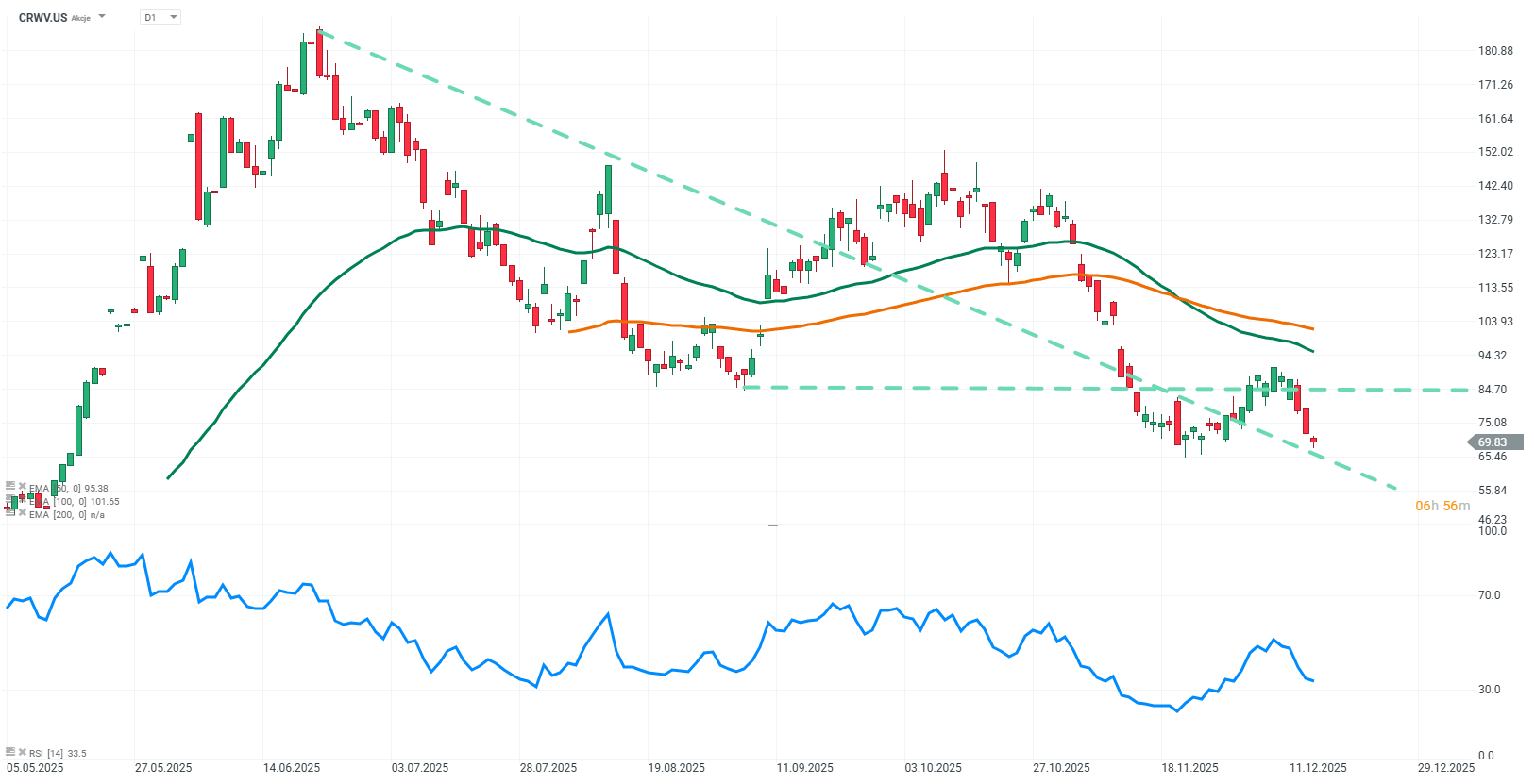

CoreWeave has recently become a symbol of cracks in the narrative of the seemingly endless AI infrastructure boom. The company, which until recently was considered a “pure play” on generative artificial intelligence, lost tens of billions of dollars in market capitalization within a few weeks. Its stock price dropped by several dozen percent, and markets are beginning to question whether its valuation reflects the real fundamentals of the business. This is not just a problem for a single company but a warning signal for the entire AI infrastructure segment, including specialized data centers, cloud providers, and hardware manufacturers.

The reasons behind CoreWeave’s decline are multiple. The company is facing delays in building data centers, including a key facility in Denton for OpenAI, a failed attempt to merge with Core Scientific, and criticism from investors holding short positions. Its business model relies on purchasing advanced GPU processors and renting computing power to large clients such as OpenAI, Microsoft, and Meta. Financing investments with high debt burdens cash flows and margins, and the pace of investment growth exceeding revenue growth raises concerns about a potential bubble in the AI sector.

Several key challenges come to the fore. A business model based on expensive hardware and large investments in data centers works well in an environment of cheap money and AI euphoria, but it becomes risky when interest rates rise and profitability is uncertain. The market is beginning to see the risk of overinvestment, as computing capacity is growing faster than the certainty that clients will fully use and pay for it. The company has come under scrutiny from critics and short-selling investors, accelerating capital outflows and increasing pressure on the entire segment of AI-related firms.

The CoreWeave situation has broader implications for the entire technology market and investors. Companies exposed to artificial intelligence and major tech corporations could benefit from potential interest rate cuts, which would improve access to credit and support investment and consumption. However, massive investments in AI do not benefit everyone. Leaders in the investment race can gain significant advantages, while less capital-intensive companies may soon face challenging financial conditions.

Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment