GAP(GPS.US) stock fell over 20.0% during today’s session after the apparel retailer posted disappointing quarterly figures in part due to supply chain issues. Company earned 27 cents per share, well below Wall Street estimates of 50 cents per share, while revenue fell to $3.94 billion from $3.99 billion in the year-ago quarter. Gap said it swung to a net loss of $152 million, or 40 cents per share, from net income of $95 million, or 25 cents a share, a year earlier. Company also lowered its full-year forecast. The apparel retailer has been hit by higher costs for shipping, as well as extended factory closures in Vietnam where it sources about 30% of its products.

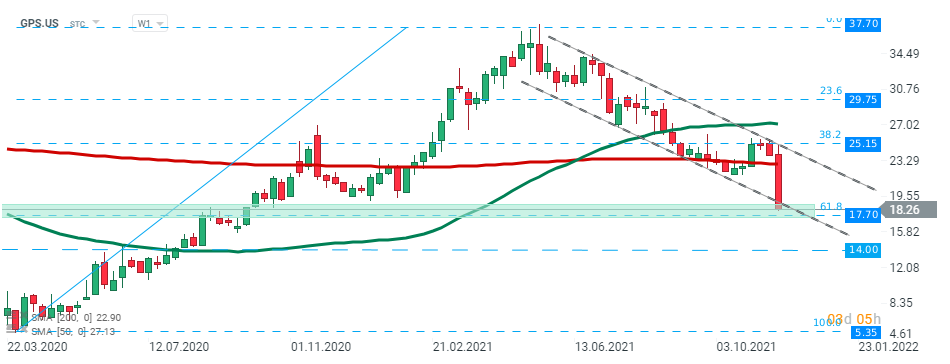

GAP (GPS.US) stock launched today's session sharply lower and broke below the lower limit of the descending channel. Currently price is testing major support at $17.70 which coincides with 61.8% Fibonacci retracement of the last upward wave. Should a break lower occur, the next target for sellers is located at $14.00 level. Source: xStation5

GAP (GPS.US) stock launched today's session sharply lower and broke below the lower limit of the descending channel. Currently price is testing major support at $17.70 which coincides with 61.8% Fibonacci retracement of the last upward wave. Should a break lower occur, the next target for sellers is located at $14.00 level. Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records