Jobs data from the United Kingdom was released today at 7:00 am BST. However, the UK statistics office had to delay some of the releases until next week due to falling response rates to its survey. As a result, only wage growth data for August was released today.

Report was expected to show a slight increase in headline wage growth as well as no change in core wage growth (excluding bonuses). Actual data showed a bigger slowdown in headline wage growth than expected - from 8.5 to 8.1% YoY. Meanwhile, core wage growth met market expectations and stayed unchanged at 7.8% YoY.

UK, wage data for August

- Average weekly earnings: vs 8.3% YoY expected (8.5% YoY previously)

- Average weekly earnings (ex-bonuses): vs 7.8% YoY expected (7.8% YoY previously)

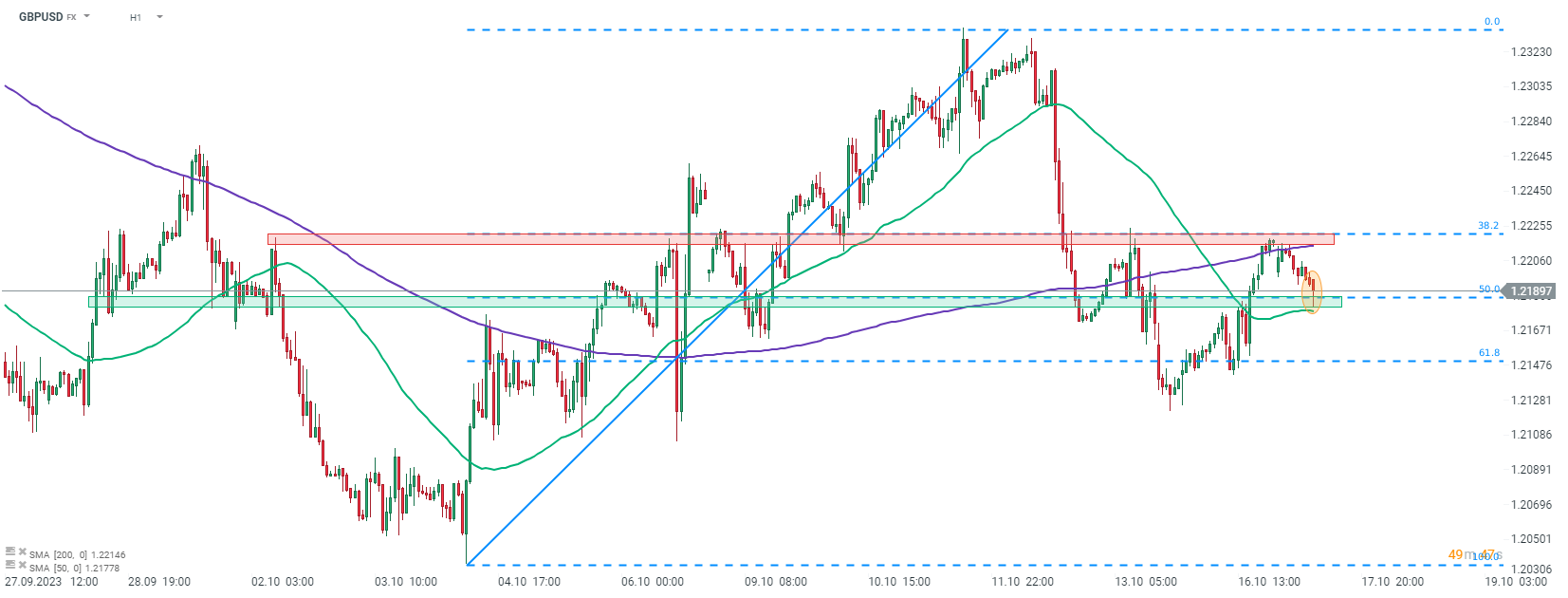

GBP saw negative reaction to data as slower wage growth will fuel inflation less and it may hint at less hawkish BoE ahead. GBPUSD dipped following the release and tested support zone marked with 50% retracement of the upward move started on October 4, 2023.

Source: xStation5

Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!