GBPUSD is on the move this morning, following a BBC report. BBC reported that a plan of cutting tax rate for high earners from 45% to 40% may be scrapped altogether. Idea of including tax cuts for high earners in an enormous tax cut plan that does not have financing has drawn public and insider backlash. Earlier, Telegraph reported that Tory MPs rebelled against UK Prime Minister Truss, threatening they won't vote on a planned cut to 45% tax rate until sources of financing are presented in the next budget (November 23, 2022). However, report from BBC hints that whole idea of a tax cut for high earners may be dropped.

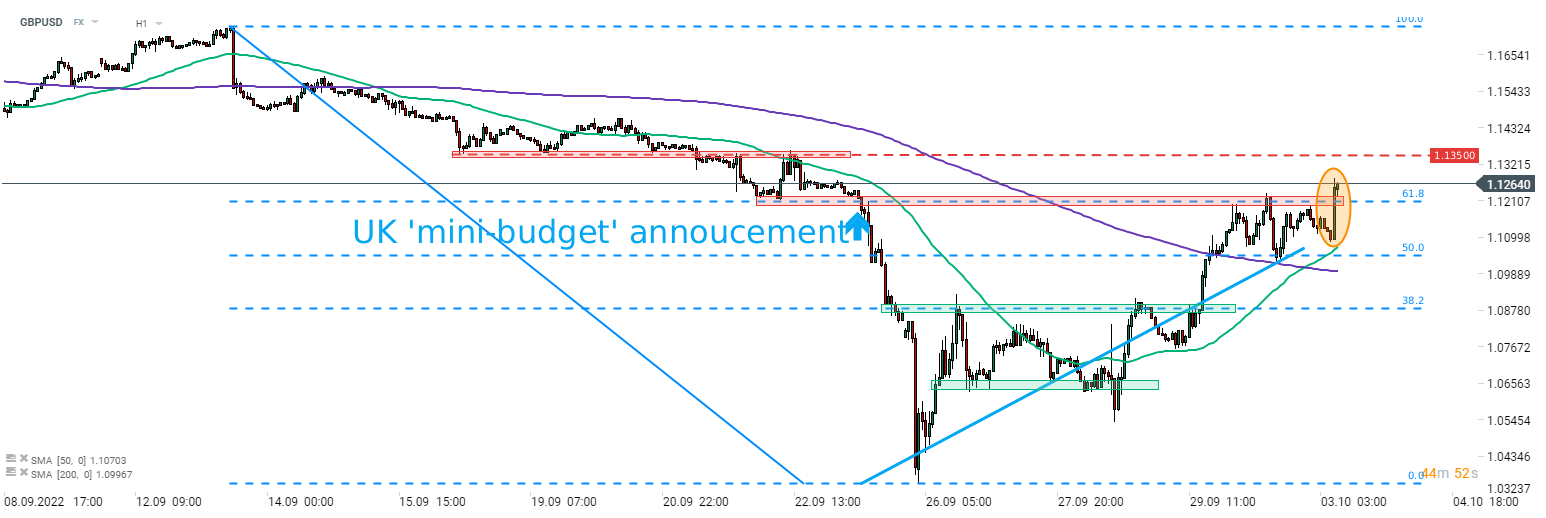

GBPUSD broke above the resistance zone marked with 61.8% retracement of the downward impulse launched on September 13, 2022. Pair is trading at 2-week highs and above levels from the 'mini-budget' announcement that triggered a slump in GBP and UK bonds.

Source: xStation5

Source: xStation5

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts