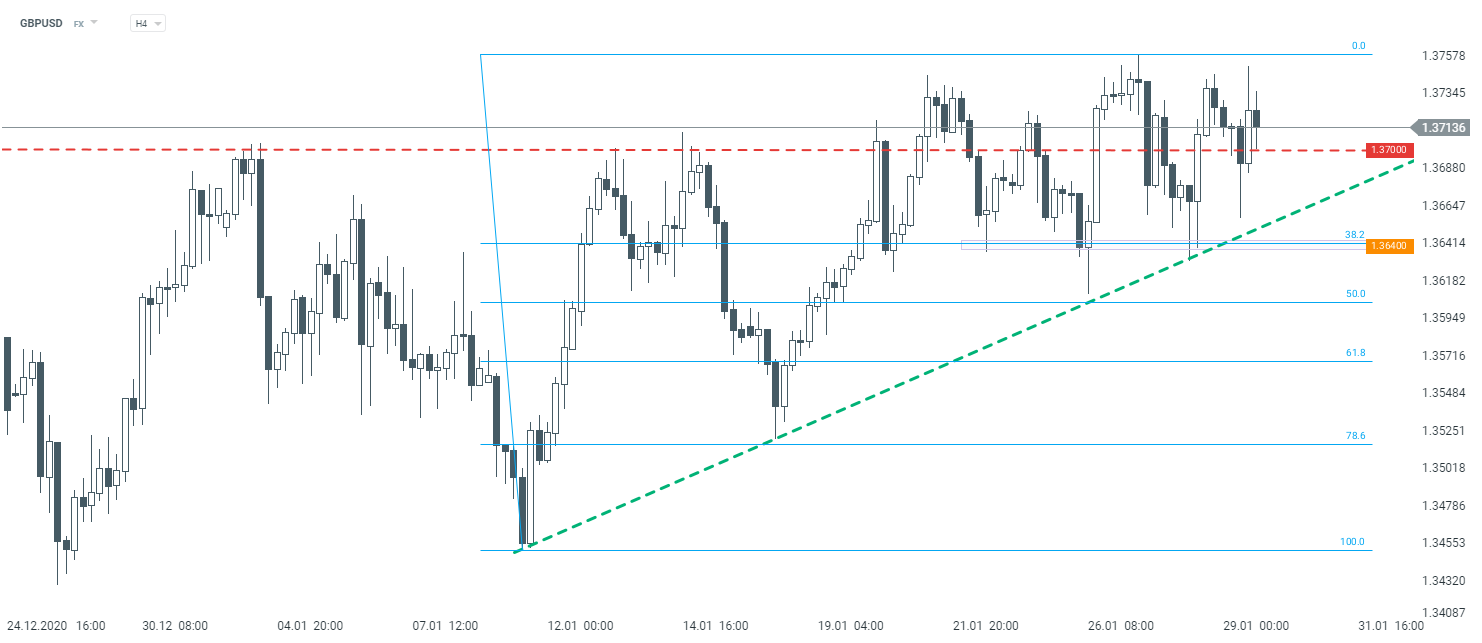

An upward move on GBPUSD has been halted in recent days. Looking at H4 timeframe from a technical standpoint, one might notice that a rally was restrained in the vicinity of 1.3700 area. Should the currency pair fall below support level marked by recent upward trendline, traders might be concerned as such scenario would indicate a sell signal. Apart form that, it is worth to pay attention to 1.3640, where traders may spot the 38.2% Fibonacci level of the recent upward impulse. Buyers did show some strength in that area several times, therefore breaking below that threshold might trigger a bigger move. On the other hand, traders should be aware that despite recent consolidation, the currency pair remains in an upward trend and new highs may be reached anytime.

GBPUSD, H4 interval. Source: xStation5

GBPUSD, H4 interval. Source: xStation5

⏬EURUSD softens ahead of the US CPI

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)