The GDPNow model last quarter went to great lengths to suggest the possibility of entering a technical recession. This has become a reality, although no one is talking about a "real" recession at this point. Now, the model indicates that we may be able to emerge from a technical recession as early as this quarter.

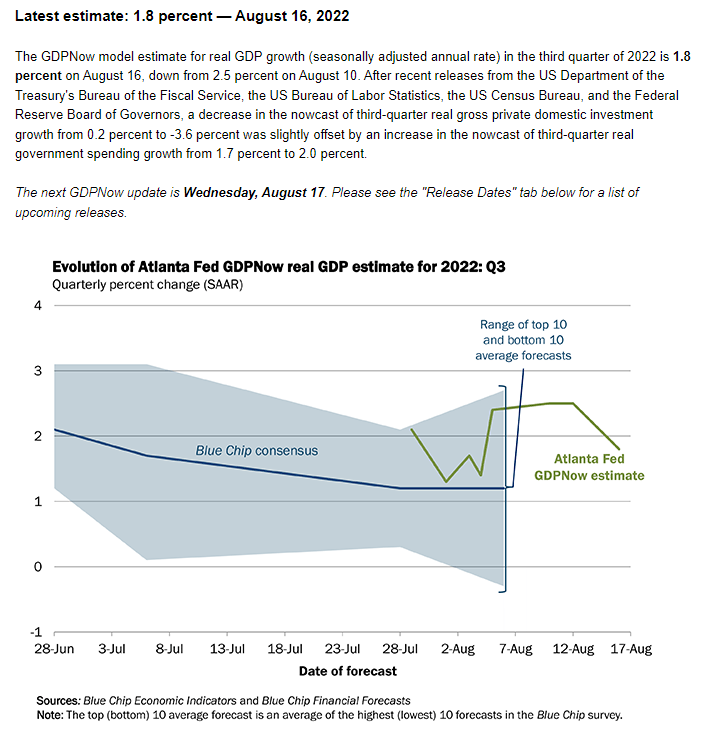

The model indicates real growth at 1.8%, which is, however, down from the previous 2.5%. This is due to a significant drop in the impact of private investment. On the other hand, there was an assessment of a higher impact of government spending.

It is worth mentioning that Q3 is a potential new wave of coronavirus, so growth in this period can be assessed very positively. On the other hand, there were very negative assessments as to Q3 in China.

Source: Fed Atlanta

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Strong Service ISM Reading as activity expanded most since 2022