EURUSD pair returned above $ 1.18 after the US Federal Reserve said that it was in no rush to withdraw stimulus. Today, apart from the US GDP data, investors' attention will also focus on the inflation data from Germany. Inflation is expected to accelerate significantly to 3.3% YoY from 2.3% YoY (the HICP is expected to rise to 2.9% YoY). Nevertheless, data from individual federal states are much more surprising - in Bavaria 3.8% y / y, in Hessen 3.4% y / y, in Brandenburg 4.3% y / y, in Baden 3.4% y / y, in Saxony 3.7% y / y In addition, the labor market records a significant drop in unemployment. Despite the fact that we do not observe any significant movement of German yields, the euro may strengthen due to possible speculation on changes in monetary policy in Europe. Of course, taking into account the recent actions of the ECB, the chances of any significant changes are slim, but the market response to such issues can sometimes be surprising.

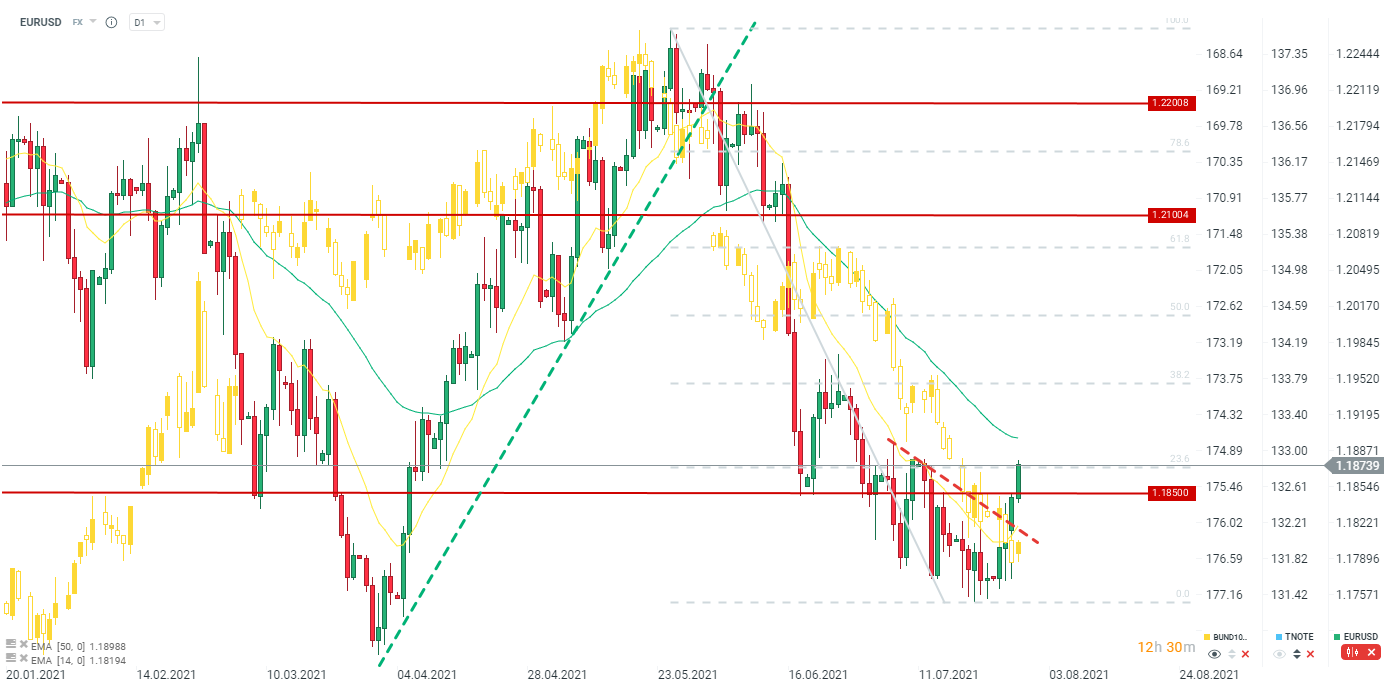

EURUSD is heading towards the 1.1900 area which coincides with the 50 EMA (green line). Source: xStation5

Three Markets to Watch Next Week (16.01.2026)

Chart of the day: USD/JPY under pressure from BoJ and Japanese policy (January 16, 2026)

Morning wrap (16.01.2026)

📉EURUSD loses 0.3%