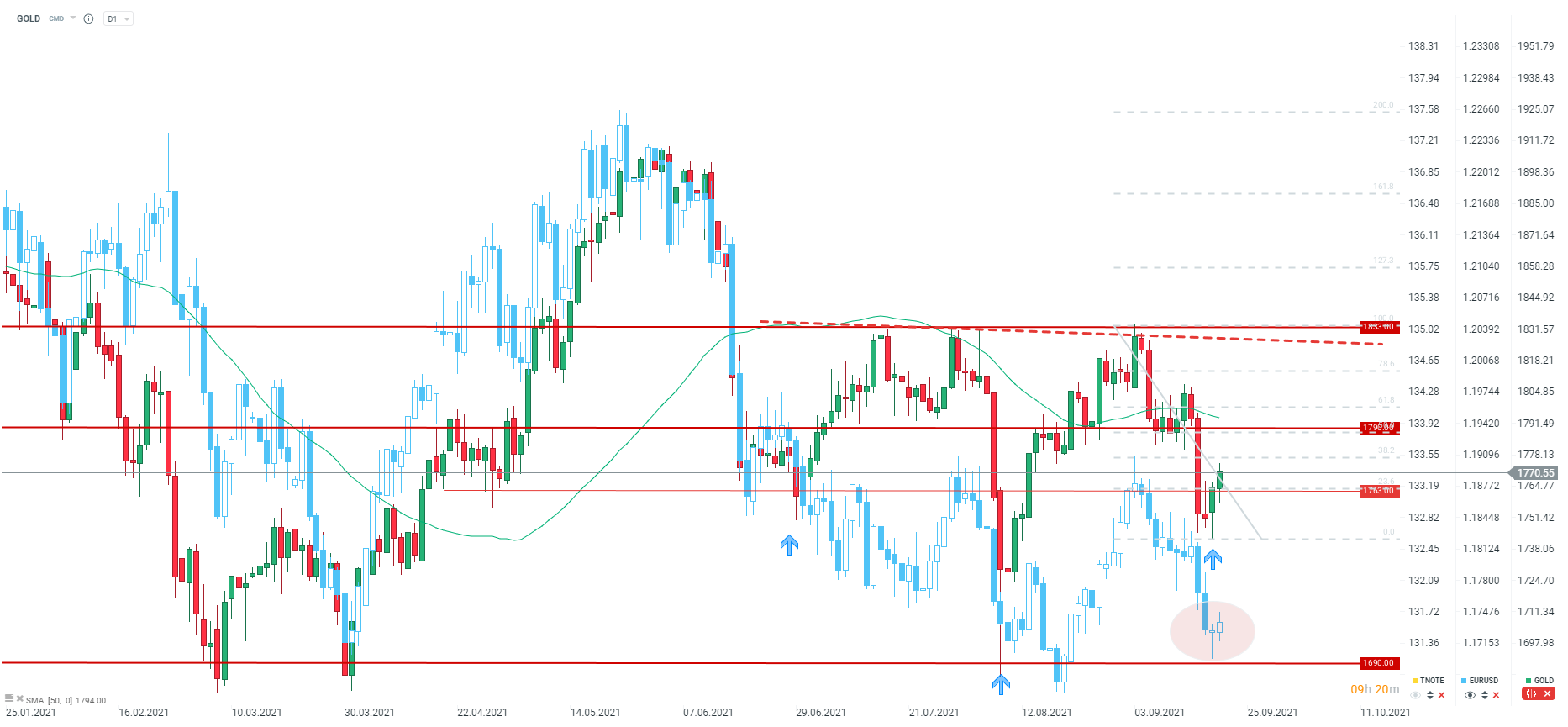

Yesterday, the price of gold dropped to around $ 1742 an ounce, the lowest level since August 12. During today's session buyers became active and the price rose by about $ 30 and managed to break the first important resistance which is marked with the 23.6% Fibonacci retracement of the last downward wave. It is worth noting that from mid-July the bulls are unsuccessfully trying to break above the $ 1,833 level.

If current sentiment prevails, then the next target for buyers is located at $1790 and coincides with the 50.0% Fibonacci retracement. Additionally, an inverse head and shoulders formation may be painted on the D1 interval. Meanwhile, on the EURUSD chart, we see a potential morning star formation. The improvement in global sentiment and possible actions by China to rescue Evergrande may be positive for gold! This is because the dollar is the more important factor when it comes to precious metals, not the market sentiment. The neckline of the aforementioned formation coincides with the key resistance at $ 1,833 per ounce.

Source: xStation5

Source: xStation5

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74