Monday’s session across commodities markets secured its place in the history books as a day of shattered psychological barriers. Investors, seeking shelter from escalating political and geopolitical uncertainty, have driven bullion prices to unprecedented heights. Gold gained more than 2% today, marking its sixth consecutive day of gains, while silver surged by as much as 7% in its third straight day of appreciation.

Gold reaches new heights

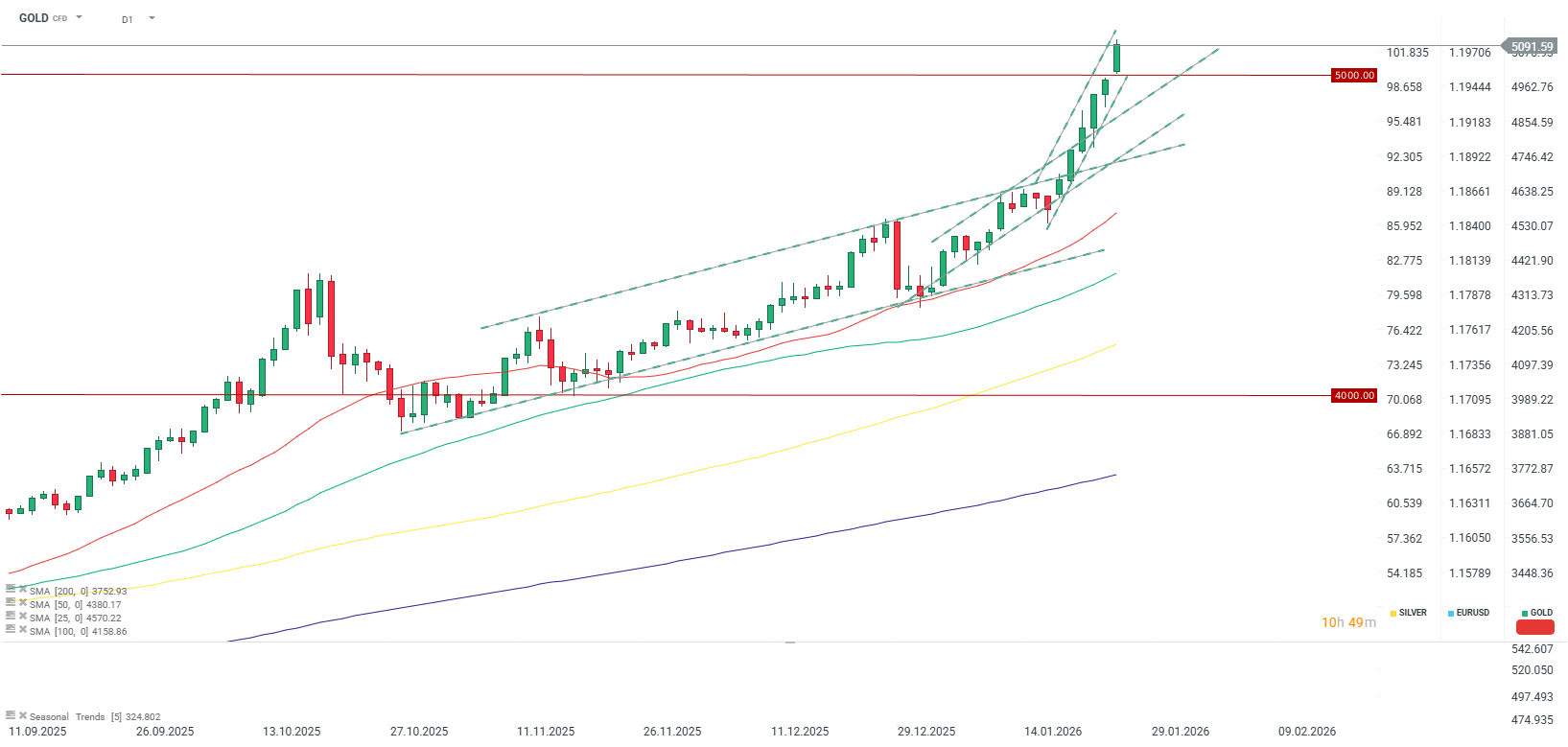

Spot gold prices crossed the $5,000 per ounce threshold for the first time in history on Monday.

-

The yellow metal established a fresh all-time record, peaking near $5,111 per ounce.

-

Prices are currently experiencing a minor technical retracement just below these peaks.

-

This surge continues the powerful momentum seen last week, when gold systematically breached the $4,700, $4,800, and $4,900 milestones.

Gold hits successive milestones almost daily, further accelerating its upward trajectory. Source: xStation5

Silver rally and industrial demand

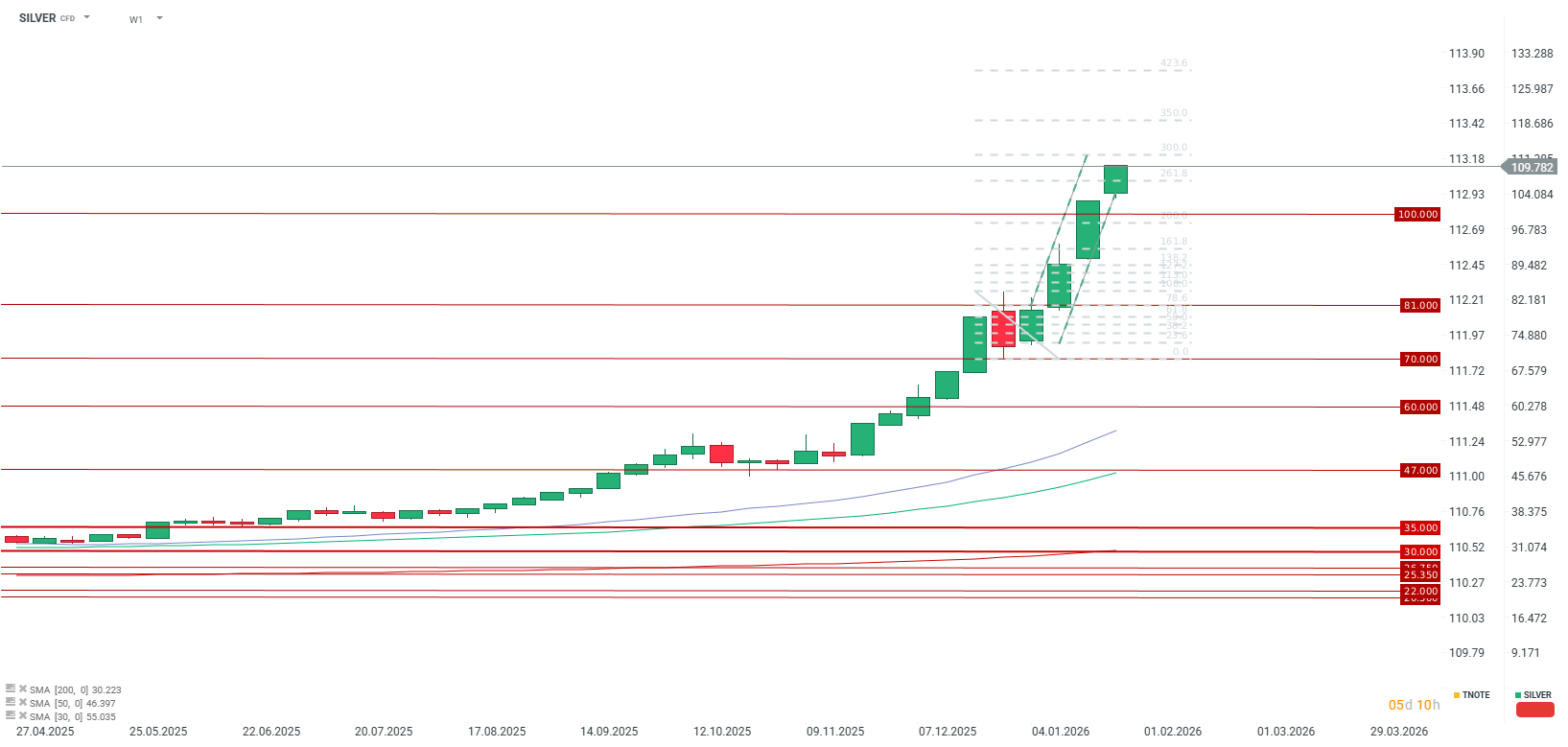

Silver has refused to be overshadowed, exhibiting even greater volatility than gold.

-

On Monday, silver prices touched a record high of $110 per ounce.

-

This follows a decisive break above the $100 level on Friday.

-

Analysts point to unprecedented demand, fueled by both silver's safe-haven status and robust industrial requirements.

-

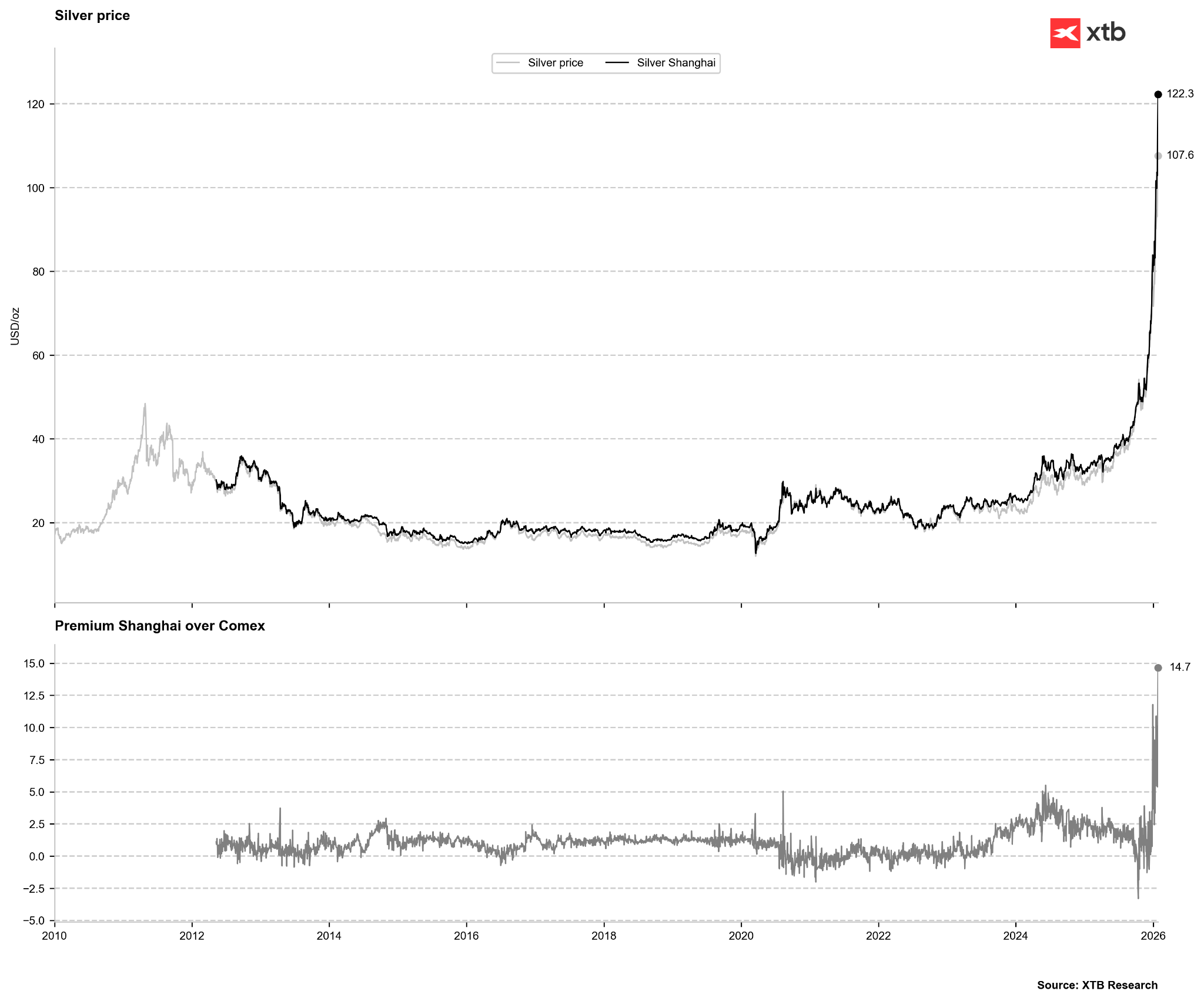

While the metal is considered strategic in both China and the US, the primary industrial pull is emanating from the former. This is evidenced by a substantial price premium on the Shanghai Gold Exchange relative to New York spot prices.

Silver prices have nearly tripled in value over the past 12 months. Source: xStation5

Drivers of the global bullion fever

The current "gold rush" is being propelled by a convergence of systemic risks:

-

US Political Uncertainty: President Donald Trump’s threat to impose 100% tariffs on Canada should Ottawa pursue a trade deal with China has ignited fears of a fresh escalation in global trade wars.

-

Geopolitics: Persistent tensions between Russia and Ukraine, ongoing conflicts in the Middle East, and simmering instability in Venezuela continue to keep geopolitical risk premiums high.

-

Fed Anticipation: Markets are focused on Wednesday’s Federal Reserve interest rate decision. While rates are expected to remain unchanged, investors are scanning for "dovish" guidance that could further fuel the rally. Conversely, recent US data suggests a potentially more "hawkish" stance may be required.

-

Supply Scarcity: Silver has remained in a structural deficit for several years. Concerns are now mounting regarding the physical availability of the metal for delivery, particularly in China, though heightened activity is also being observed on the COMEX exchange.

The price premium in China stands near $15 compared to US prices, indicating extremely high demand for physical silver in Shanghai. While the US market remains largely "paper-based," pressure for physical delivery on Chinese contracts continues to mount. Source: Bloomberg Finance LP, XTB

The price premium in China stands near $15 compared to US prices, indicating extremely high demand for physical silver in Shanghai. While the US market remains largely "paper-based," pressure for physical delivery on Chinese contracts continues to mount. Source: Bloomberg Finance LP, XTB

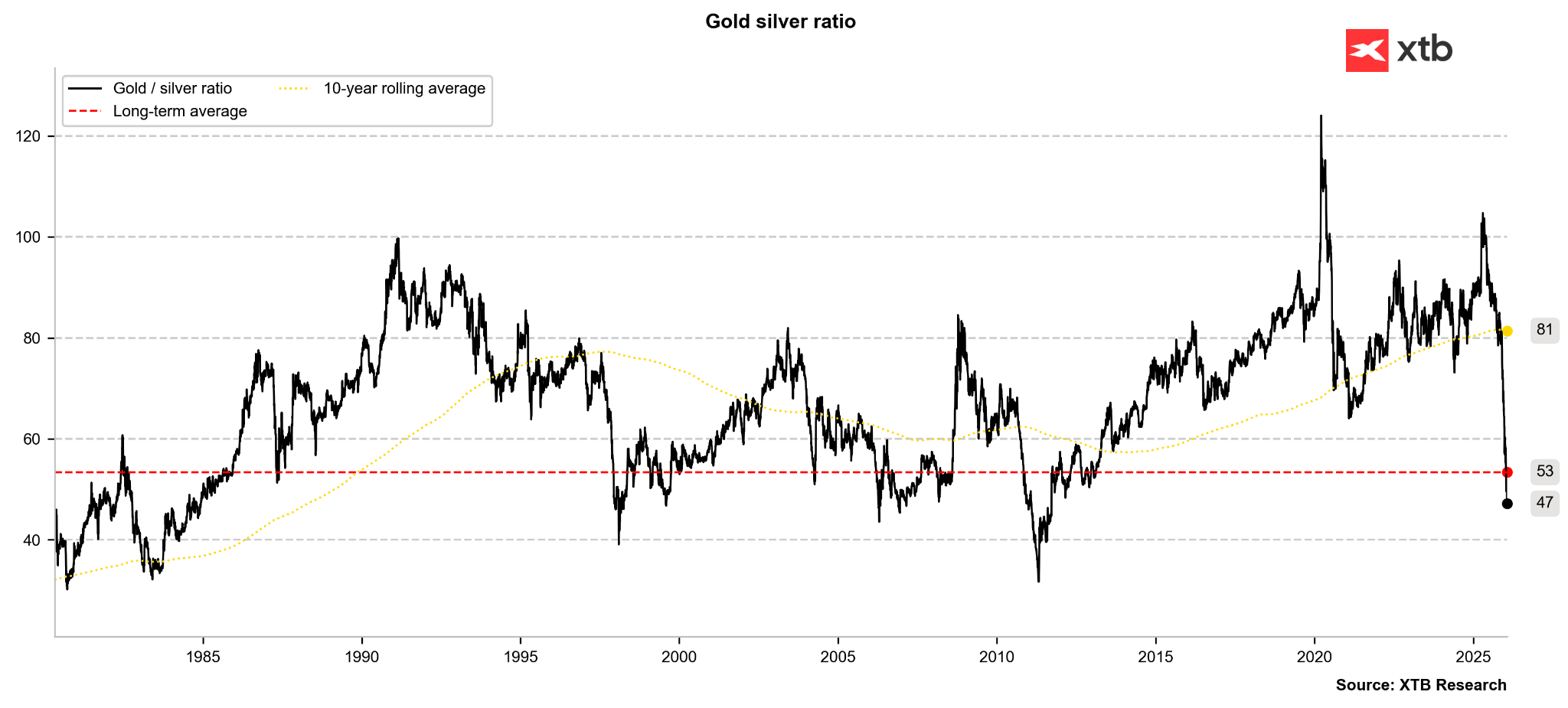

The gold-to-silver ratio is dropping decisively below the 50-point mark. Assuming gold reaches $5,300 and the ratio compresses to 40, silver would theoretically be valued at $132.50. Source: Bloomberg Finance LP, XTB

The gold-to-silver ratio is dropping decisively below the 50-point mark. Assuming gold reaches $5,300 and the ratio compresses to 40, silver would theoretically be valued at $132.50. Source: Bloomberg Finance LP, XTB

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment