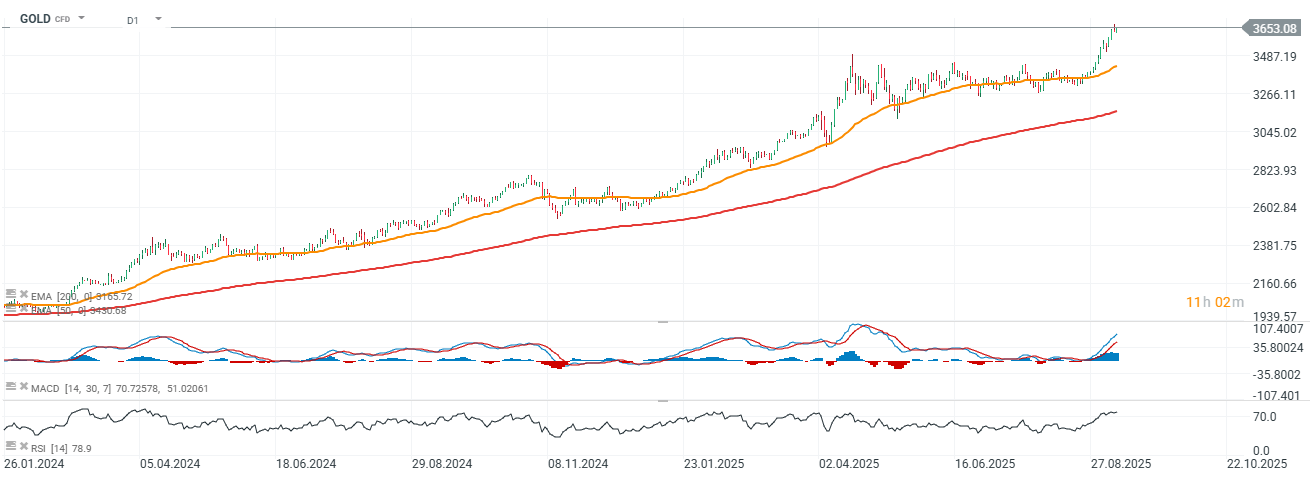

Gold is up nearly 0.8% today, ahead of the August U.S. producer price inflation data, which will be released at 12:30 PM GMT. Silver and platinum are also gaining, rising by over 1% and nearly 3%, respectively. A lower-than-expected U.S. inflation reading could serve as an additional catalyst for metals. The market is forecasting a 3.5% year-on-year increase, compared with 3.7% in July.

Given the very strong fundamentals—further reinforced by geopolitical factors and massive government deficits—along with rising expectations of interest rate cuts in the United States, we can expect the rally in precious metals to continue. In the longer term, the $4,000 per ounce area may serve as a strong resistance zone. Today, the geopolitic is probably the major gold mover, as NATO is near the Article 4 after the drones incident in Eastern Poland.

Source: xStation5

BREAKING: GBPUSD ticks lower after mixed UK CPI print

Economic calendar: Nvidia and Fed Minutes in the spotlight

Morning Wrap (19.11.2025)

Daily summary: Wall Street tries to rebound 📈Amazon and Microsoft under pressure of Rotschild & Co Redburn