On the day of the Federal Reserve’s first interest rate cut this year, gold initially reached new historical highs, breaking above $3,700. However, due to mixed interpretations of the decision, gold underwent a correction during Wednesday and Thursday's sessions. On Friday, as the market’s sentiment became clearer, investors resumed purchasing gold, and today the price of the metal has climbed another 1%, reaching a new historical peak.

The market's confidence that the Fed will enact two more rate cuts this year is currently the primary driver. We can expect US central bankers to provide further clarity on monetary policy as they speak throughout the week. Today, we will hear from John Williams, a key figure at the Fed who, as the head of the New York branch, is a permanent voting member of the FOMC. Additionally, Alberto Musalem, Mark Hammack, Tom Barkin, and Adriana Miran will also speak. Tomorrow is arguably a more significant day, as we will hear from Jerome Powell again, along with Raphael Bostic. Thursday will also be important for speeches, with appearances from John Williams, Michelle Bowman, Michael Barr, Lorie Logan, and Mary Daly. On Friday, we will get the Fed's preferred inflation measure: PCE inflation. The headline reading is expected to accelerate to 2.7%, while core PCE is forecast to remain at 2.9%.

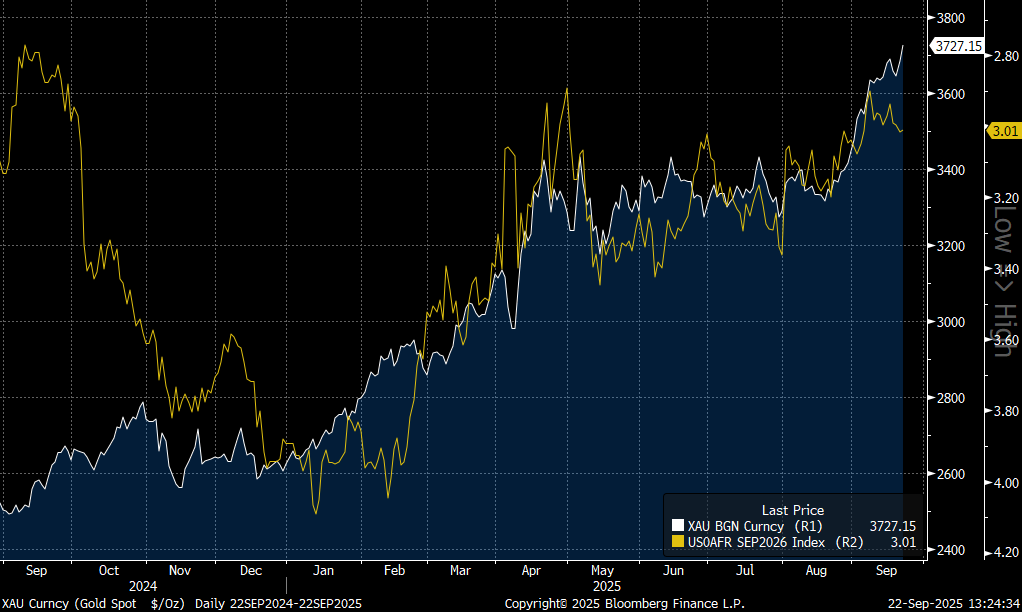

Expectations for interest rate cuts by next September have been rising sharply but are not currently in line with gold’s high prices. However, a similar situation occurred in May and June, and gold still gained in value. Source: Bloomberg Finance LP

Expectations for interest rate cuts by next September have been rising sharply but are not currently in line with gold’s high prices. However, a similar situation occurred in May and June, and gold still gained in value. Source: Bloomberg Finance LP Gold is currently testing the $3,720-$3,730 per ounce range, which is also the external retracement of the downward wave from April and May. Source: xStation5

Gold is currently testing the $3,720-$3,730 per ounce range, which is also the external retracement of the downward wave from April and May. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report