Mass profit-taking and mounting pressure on leveraged long positions are weighing on precious metals today. Gold is down nearly 5%, and the pullback from its all-time high is now around 10%. Silver is also sliding sharply, down almost 8%. Palladium is off nearly 9%, while platinum is retreating by as much as 10%.

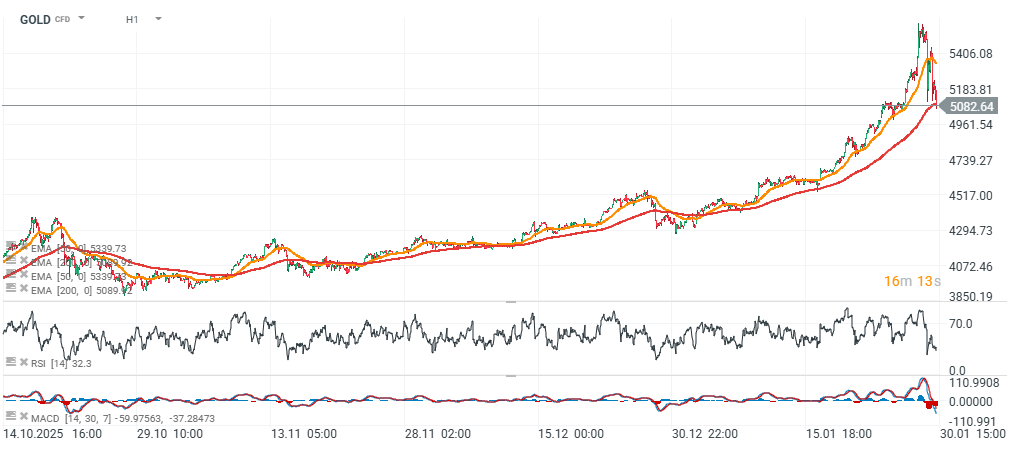

The move comes despite major banks such as JPMorgan and UBS raising their forecasts, suggesting that short-term momentum has turned against precious metals. Gold’s RSI plunged yesterday from around 89 to just under 28, during one of the largest precious-metals sell-offs in modern market history.

Gold is currently testing the EMA200 (red line) near $5,100 per ounce. Volatility remains elevated and bulls may attempt to reverse the move quickly. A potentially solid support zone appears around $4,600–$4,700 per ounce (one standard deviation).

GOLD (H1)

Source: xStation5

On the daily timeframe, the current correction range looks roughly 1:1 compared with the October decline, although it’s worth noting that the latest pullback followed a much stronger prior upswing, which naturally increases the likelihood of a larger deviation.

Source: xStation5

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks