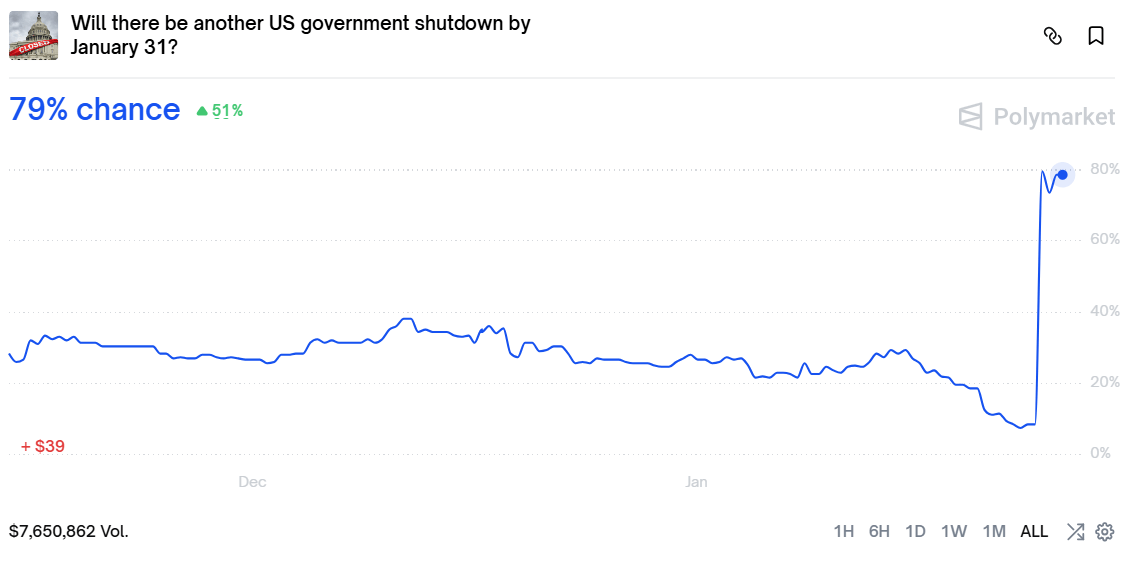

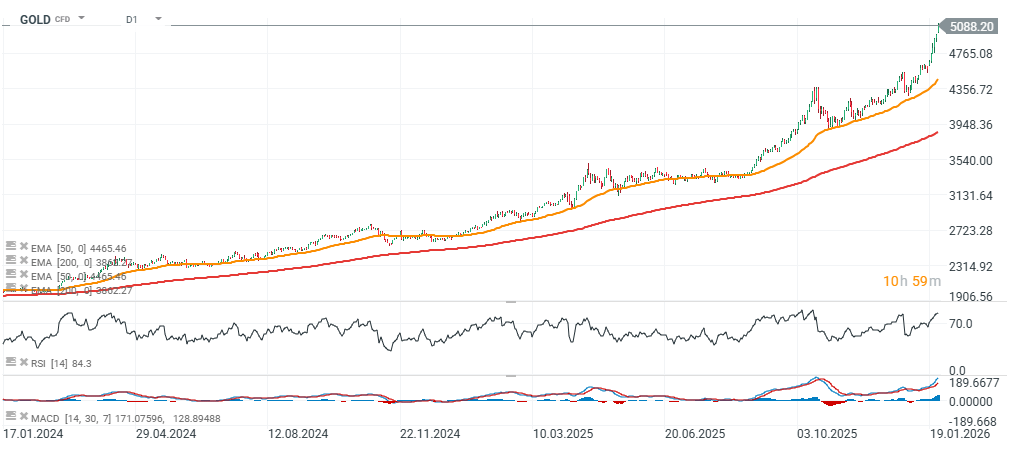

Gold prices are up more than 2% today, climbing to nearly $5,100 per ounce as the U.S. dollar weakens. Polymarket is now pricing in an 80% chance of a U.S. government shutdown after Senate Democrats, led by Chuck Schumer, vowed to block a spending bill unless funding for the Department of Homeland Security (DHS) is removed. This follows the killing of an American nurse in Minnesota by a Border Patrol agent, intensifying opposition concerns that DHS is abusing its powers.

- The US president, Donald Trumps stays for huge rate cuts from current 3.5% to 1% level, and now leading in Fed chair race, BlackRock's Rick Rieder remarts signals he is very dovish, commenting that cutting rates may even help fighting inflation.

- Broader uncertainty, destabilization and political polarization in the U.S. is another factor weighing on the dollar’s standing and directing market attention to the country’s rising debt burden, which is approaching $39 trillion and is expected to keep growing.

- A natural consequence of this environment is rising interest in precious metals -especially gold, which for centuries has served as a “safe haven,” preserving value over time. Capital is flowing into gold today, while the dollar is being sold (the U.S. Dollar Index futures contract, USDIDX, is slipping below 97).

In recent months, it has been hard to shake the impression that gold is not only pricing in the “past loss of purchasing power of fiat currencies,” but also already “consuming” the value by which currencies may weaken in the years ahead—if central banks come under pressure to keep interest rates structurally lower despite elevated inflation, in order to avoid cracks in the fiscal system.

Source: Polymarket

Source: xStation5

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks