Goldman Sachs (GS.US) stock rose over 2,5% on Monday after earnings and revenues topped Wall Street projections by a huge margin despite an uncertain macroeconomic environment. “We delivered solid results in the second quarter as clients turned to us for our expertise and execution in these challenging markets," said CEO David Solomon.

-

Earnings of $7.73 a share, well above Refinitiv estimates of $6.58 per share

-

Revenue of $11.86 billion, also topped market expectations of $10.86 billion as bond trading department generated roughly $700 million more revenue than expected.

-

Also wealth management revenue increased by 25% to $2.18 billion.

-

On the flip side, asset management revenue fell 79% to $1.08 billion, while its investment banking revenue decreased by 41% to $2.14 billion as deal-making slowed dramatically from a strong year-ago quarter.

-

Megabank also increased its quarterly dividend by 25%, to $2.50 per share.

-

Analysts are cautiously optimistic about Goldman stock with a Moderate Buy consensus rating and average price forecast of $373.91.

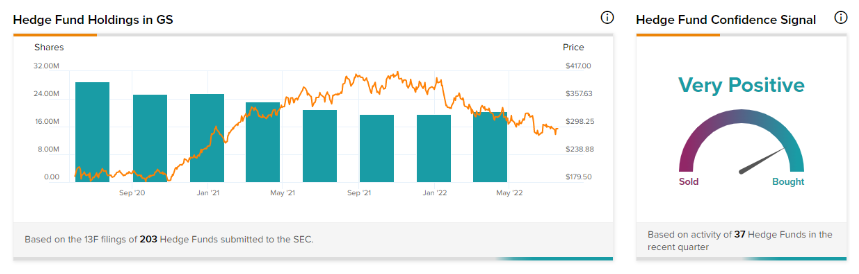

Confidence in Goldman Sachs is currently Very Positive, as 37 hedge funds increased their cumulative holdings of GS stock by 931,800 shares in the last quarter. Source: TipRanks Hedge Fund Trading Activity tool.

Confidence in Goldman Sachs is currently Very Positive, as 37 hedge funds increased their cumulative holdings of GS stock by 931,800 shares in the last quarter. Source: TipRanks Hedge Fund Trading Activity tool.

Goldman Sachs (GS.US) stock launched today's session higher, however sellers failed to break above major resistance at $312.65, which coincides with 38.2% Fibonacci retracement of the upward wave launched in March 2020 and lower limit of the descending channel. The nearest support to watch lies at $278.00. Source: xStation5

Goldman Sachs (GS.US) stock launched today's session higher, however sellers failed to break above major resistance at $312.65, which coincides with 38.2% Fibonacci retracement of the upward wave launched in March 2020 and lower limit of the descending channel. The nearest support to watch lies at $278.00. Source: xStation5

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈