Alphabet, the parent company of Google, is reportedly considering a bid to acquire HubSpot, an online marketing software company, currently valued at $34.2 billion. Sources familiar with the situation reveal that Alphabet is consulting with investment bank Morgan Stanley regarding the potential offer. The main considerations include the offer value and the likelihood of gaining antitrust approval amidst heightened regulatory scrutiny by U.S. President Joe Biden's administration. If Alphabet proceeds with the offer, it would be its largest acquisition to date and one of the largest in recent years among tech giants.

Founded in 2014, HubSpot provides marketing software primarily to smaller and medium-sized businesses, and its revenue in 2023 was $2.2 billion. Alphabet, which holds a cash reserve of $110.9 billion, has not yet made a formal offer to HubSpot, and there's no certainty that it will proceed with the bid. Neither Alphabet nor HubSpot has commented on these speculative reports.

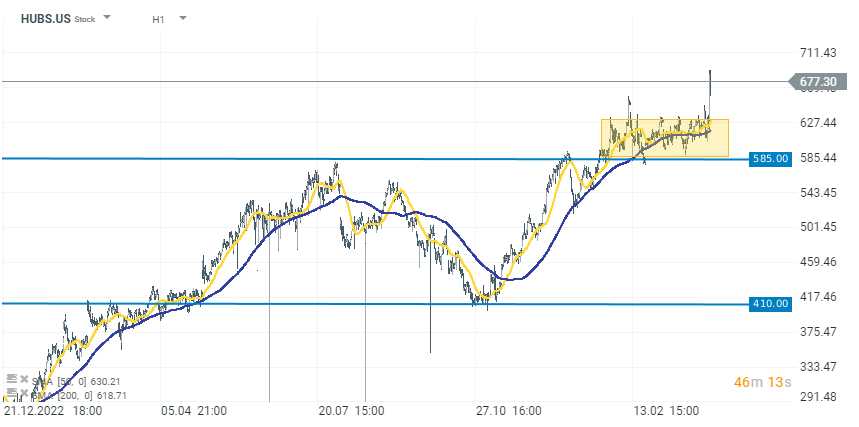

HubSpot's shares gained over 8% to $680 today following this news, as investor interest in the company rises despite its net loss of $176.3 million in 2023.

Source: xStation 5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records