Fed's Waller, Logan, and Goolsbee presented perspectives that collectively leaned towards a cautious approach to monetary policy adjustments, indicating a generally dovish stance. Overall, the bankers' remarks reflected a preference for a careful, measured approach to monetary policy, aligning more with dovish sentiments. Below are the highlights from each of the speeches:

Waller:

- Emphasized that the pace of balance sheet reductions will be independent of policy rate changes.

- Noted that the current overnight repo usage of around $500 billion indicates that the Fed can continue reducing its holdings for some time.

- Expressed a preference for the Fed's Treasury holdings to shift towards a larger share of shorter-dated securities.

Logan:

- Advised that moving more slowly in the current environment could reduce the risk of a premature stop in monetary policy adjustments.

- Hasn't observed a reduction in reserves yet under the current Fed Quantitative Tightening (QT).

- Pointed out that after draining the Overnight Reverse Repo (ON RRP), QT will reduce reserves on a one-for-one basis.

Goolsbee:

- Stated uncertainty about where interest rates will settle.

- Noted that if inflation continues to fall, the Fed should consider the impact on employment.

- Believes the current Fed funds rate is quite restrictive.

- Emphasized the need to monitor housing inflation.

- Speculated that January's inflation might have been an anomaly.

- Commented on the unusual nature of housing inflation.

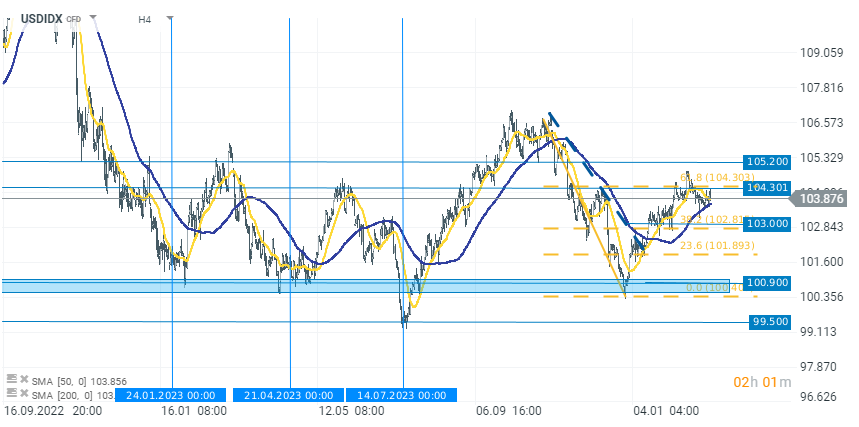

The US dollar index halted its rise at the 61.8% Fibonacci, retracement of its most recent downward move. Today, the USDIDX is losing almost 0.20%. The declines accelerated after the publication of the ISM data, which were significantly worse than expected and revived speculations about faster interest rate cuts.

Source: xStation 5

Economic calendar: US CPI in the spotlight (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected