Chinese stock indices, including HK.cash and CHN.cash are gaining more than 2% during today's session following further dovish comments from the Chinese establishment and PBOC officials. China will set up a new credit programme for technological innovation and transformation, People's Bank of China Governor Mr Gongsheng said at a briefing today, also adding that there is further room for reserve requirement rate cuts. It was these comments that largely supported bullish sentiment during today's session in APAC markets. Moreover, the banker added that monetary policy will be conducted in such a way as to "gently" support consumer prices in the state.

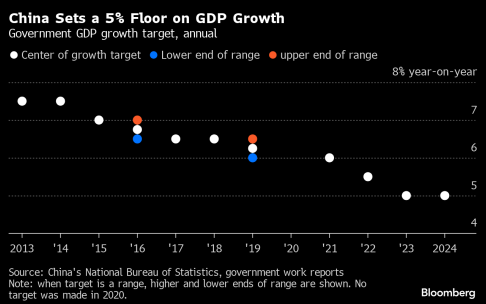

On the other hand, however, Bloomberg analysts add that the economic plan for 2024 presented by China is not quite what stock market investors can expect. Bloomberg cites the failure to provide details of the fiscal and monetary stimulus required to achieve it or other market-oriented reform plans as the main reason. Analysts added that China's leaders are focusing on something else. National security is expected to be a key theme for you, with an emphasis on technological and economic self-reliance, traditional and high-tech manufacturing and defence.

Equity purchases by Chinese government funds to support the market may also slow down in the near term if mainland equity benchmarks maintain their recent rebound, Jefferies analysts commented recently.

China is setting ambitious targets. You can find more detailed information here and here. Source: Bloomberg Financial LP

HK.cash is breaking out above the 50-day exponential moving average (blue curve), which is further reinforced by the 78.6% Fibo retracement of the upward wave initiated in October 2022. Source: xStation

HK.cash is breaking out above the 50-day exponential moving average (blue curve), which is further reinforced by the 78.6% Fibo retracement of the upward wave initiated in October 2022. Source: xStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report