Hormel (HRL.US) stock dropped nearly 4% after the company posted disappointing quarterly figures. Profit fell to $ 234.4 million, or 43 cents per share, missing analysts' expectations by a penny. Revenue also declined 3% to $ 2.4 billion. The food producer results were affected by a weakening of business in its food-service segment due to shuttered restaurants and cafeterias. Hormel also announced a dividend increase of 5%, bringing it to 98 cents per share. "I am optimistic about generating sales and earnings growth in fiscal 2021. Our One Supply Chain team delivered steady production improvements throughout the quarter, and our production capacity for key product lines is structurally higher as we move into next year. The balance we have across the retail, deli, foodservice and international channels gives us confidence in our ability to perform well in many different economic scenarios," said Jim Snee President and CEO.

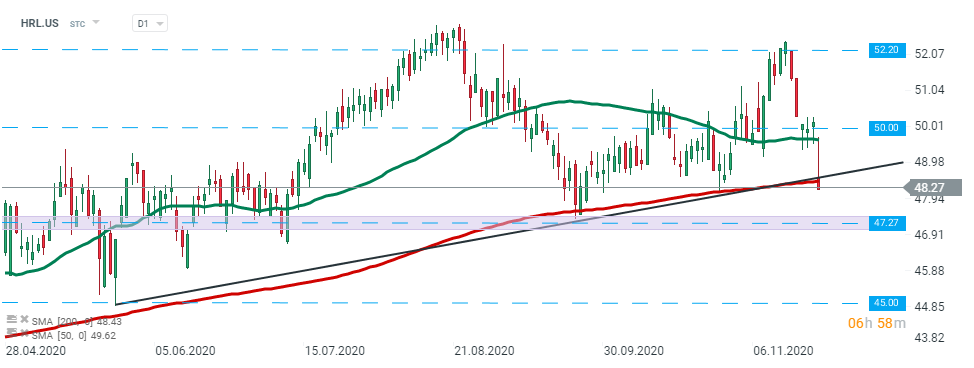

Hormel (HRL.US) stock launched today's session lower on the back of weak quarterly figures. Buyers managed to push the price higher and filled the bearish price gap but further gains were limited by the 50 SMA (green line). Price pulled back and is currently testing the upward trendline which is additionally strengthened by 200 SMA (red line). If the current sentiment prevails, support at $47.27 could be at risk. Source: xStation5

Hormel (HRL.US) stock launched today's session lower on the back of weak quarterly figures. Buyers managed to push the price higher and filled the bearish price gap but further gains were limited by the 50 SMA (green line). Price pulled back and is currently testing the upward trendline which is additionally strengthened by 200 SMA (red line). If the current sentiment prevails, support at $47.27 could be at risk. Source: xStation5

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment