IBM announced its intention to acquire Confluent Inc. for 11 billion USD, offering 31 USD per share in a cash transaction. Confluent is a California-based company specializing in real-time data streaming, built on the open-source Apache Kafka platform.

The transaction, which is expected to close by mid-2026 after receiving regulatory approvals and shareholder consent, will be financed in cash by IBM. This is the company’s largest acquisition since the purchase of Red Hat in 2019 and aligns with IBM’s strategy focused on the development of software and cloud services.

Through the acquisition of Confluent, IBM plans to expand its offerings with an advanced real-time data processing platform. This technology is critical for enterprises that need to manage growing volumes of data and implement artificial intelligence solutions. Integrating Confluent’s products with IBM’s automation and security tools will enable clients to make better data-driven decisions in real time.

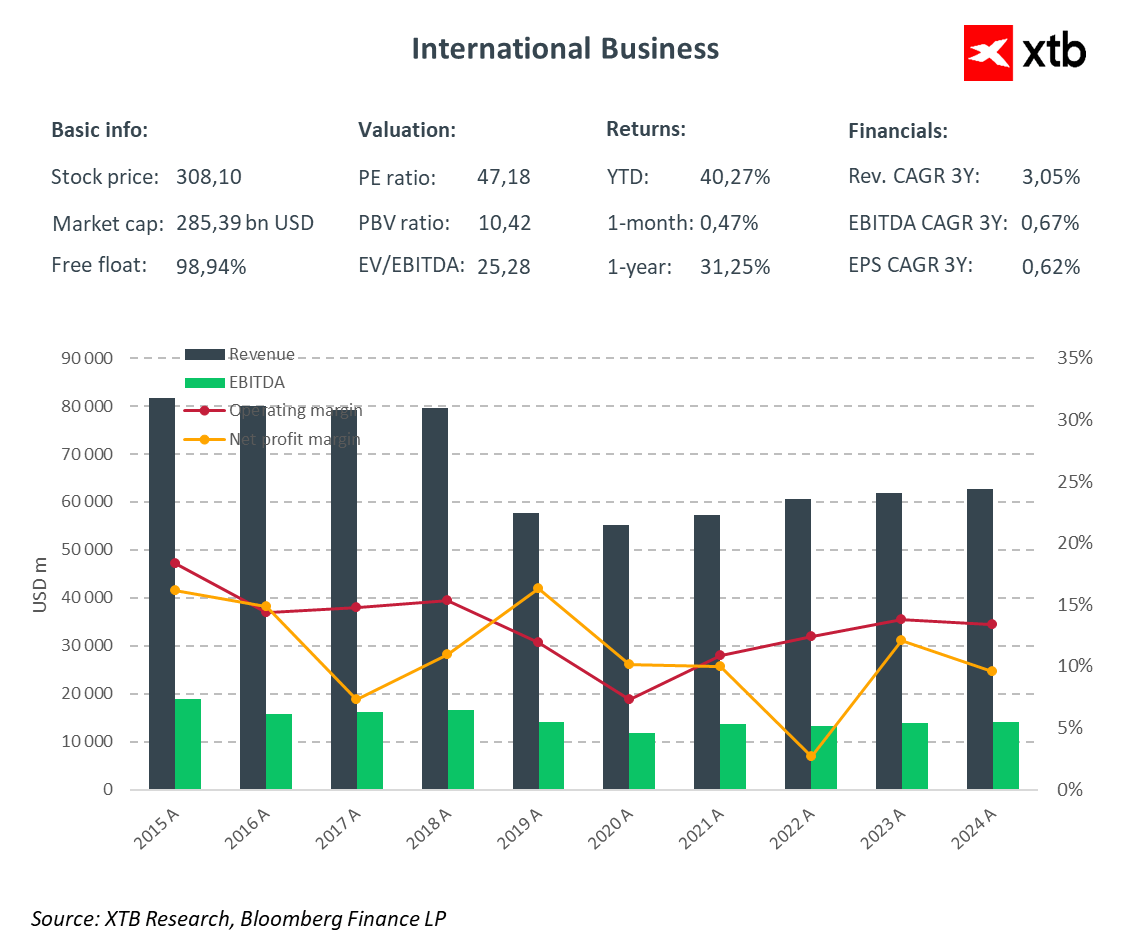

Confluent has recently reported significant year-over-year revenue growth, exceeding market expectations, which further underscores the company’s attractiveness in the data processing technology market. Analysts indicate that the acquisition could deliver benefits to IBM as early as the first full year after the transaction closes, with a positive impact on EBITDA and free cash flow.

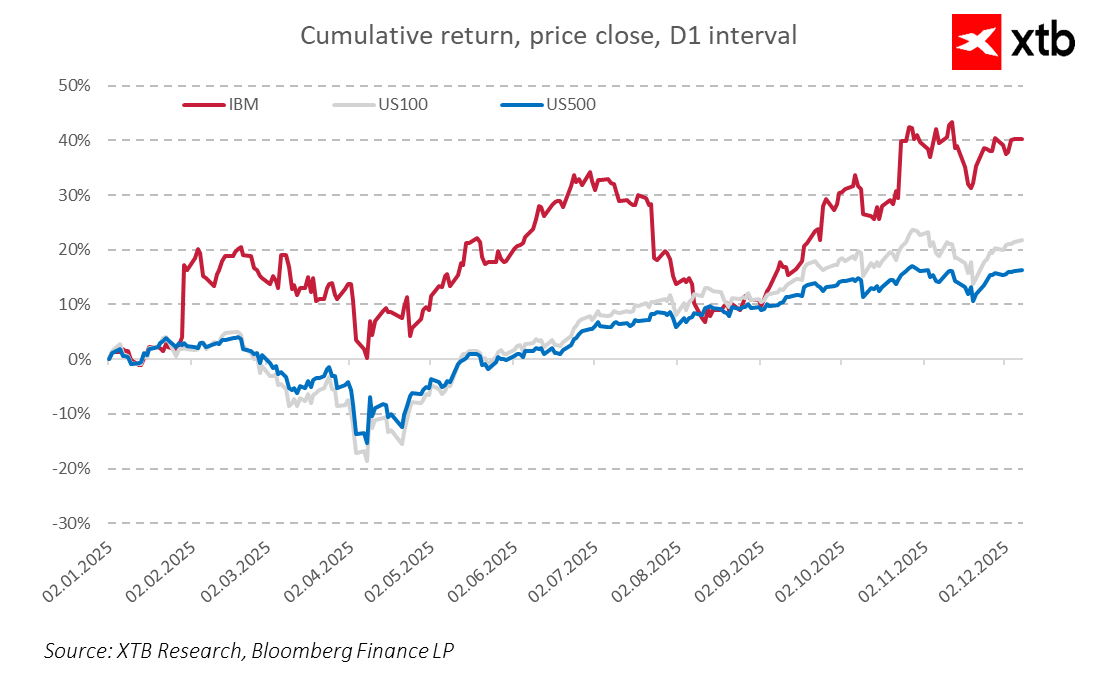

For the markets, this signals that IBM is actively investing in growth and strengthening its position in the cloud and artificial intelligence sectors, responding to increasing demand for advanced data processing technologies. Although IBM shares initially saw a slight decline, the transaction reflects the company’s long-term commitment to growth and innovation in the IT industry.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%