The Polkadot Project has announced a launch date for the first auctions of its "parachains". Following the announcement, the price of its native cryptocurrency POLKADOT jumped, exceeding $50 for the first time.

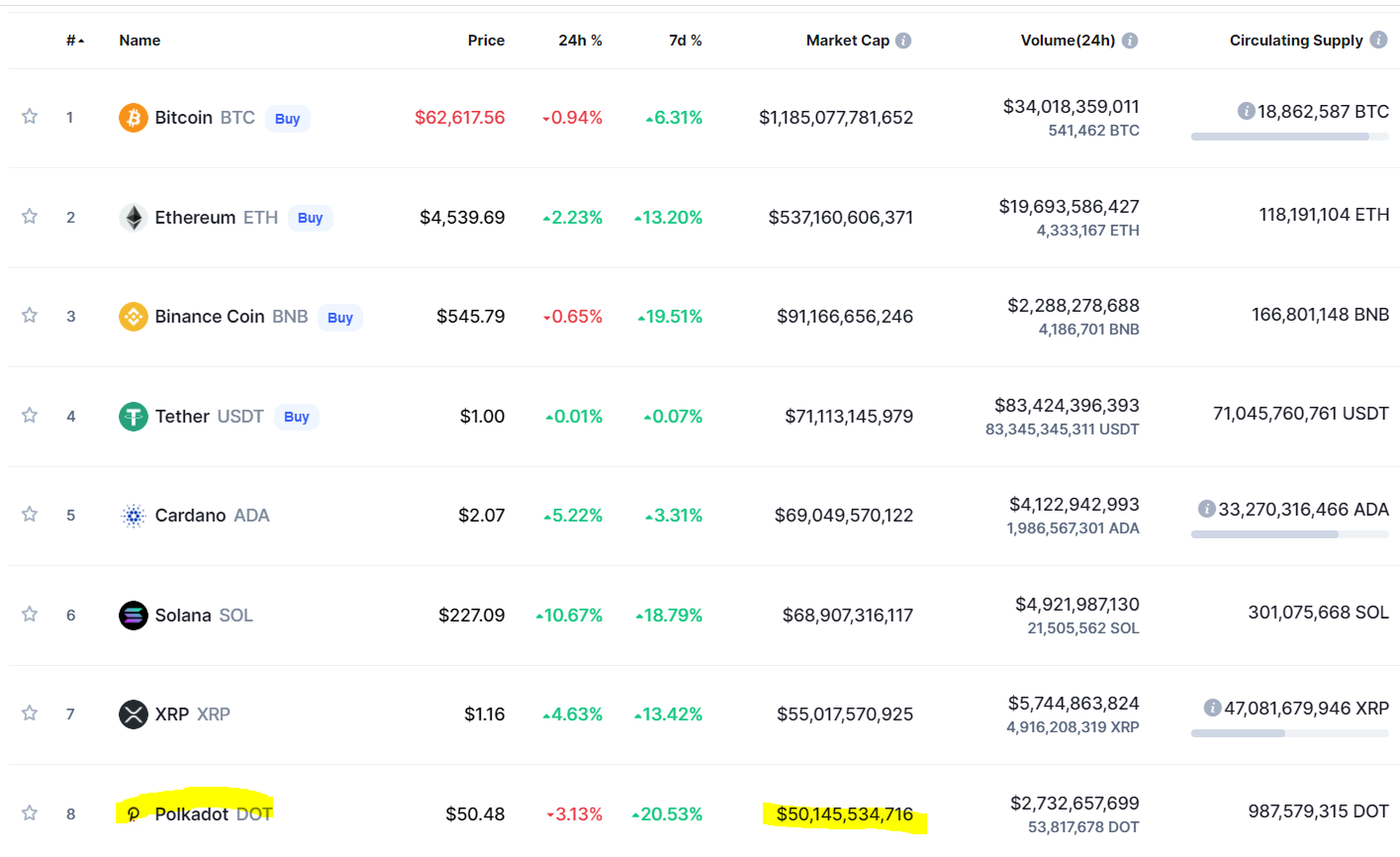

POLKADOT briefly overtook Ripple as the most capitalized cryptocurrency, before falling back slightly. It ranks 8th today, just ahead of altcoins-memes Shiba Inu and DOGECOIN. POLKADOT's capitalization now exceeds $50 billion. Source : coinmarketcap

D1 interval :

In daily data, the bullish outlook was confirmed when prices crossed the $38.50 area corresponding to the local B peak. According to Goishi Hosoda's price projection, prices could continue to rise to $66.27 to complete the wave at A, B, C, D. The Fibonacci retracement of 127.2% would be an intermediate target.

POLKADOT, D1 interval, Source : xStation5

POLKADOT, D1 interval, Source : xStation5

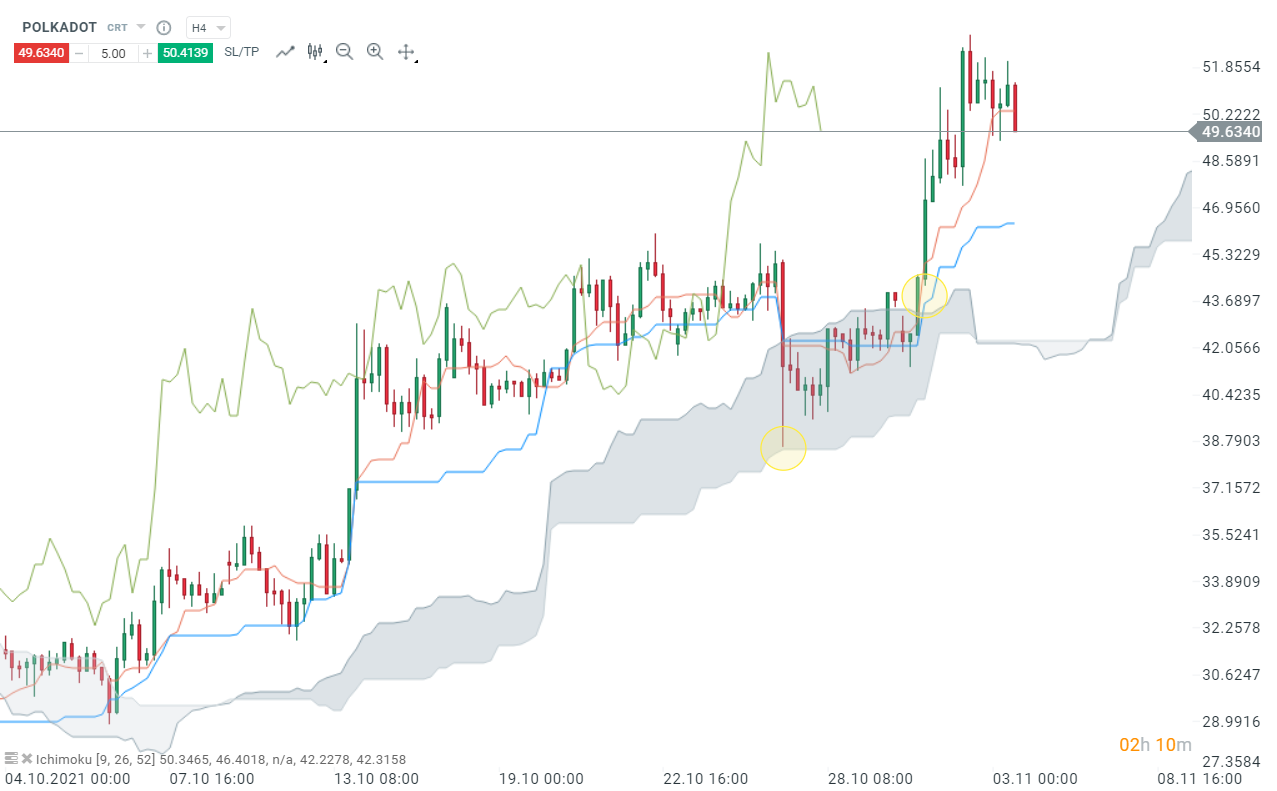

H4 interval :

After a sharp decline in late October (first yellow circle), prices managed to come out of the cloud. This bullish signal (second yellow circle) led to a new ATH. This morning prices lost ground and fell back slightly below $50. If the support at $49 is broken, the decline could extend to the Kijun (blue line) at $46.50. On the other hand, if the bulls manage to keep the price above the $50 mark, the bullish momentum could be strengthened.

POLKADOT, H4 interval, Source : xStation5

Reda Aboutika, XTB France

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?