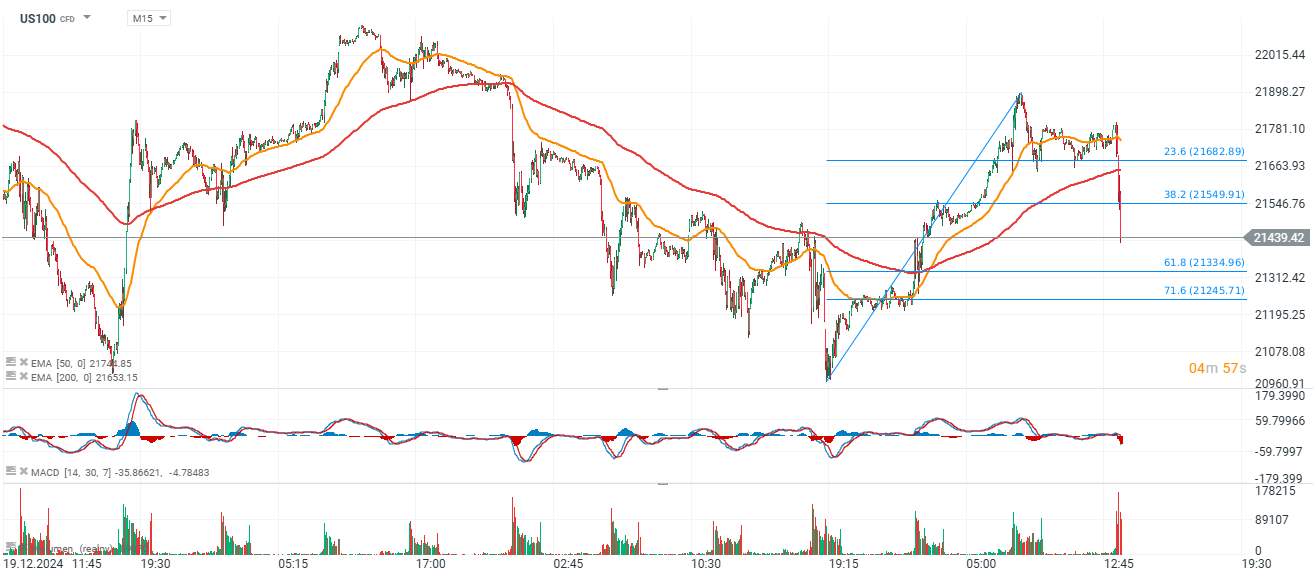

The Nasdaq 100 (US100) contract is losing over 1.5% following ISM services data that showed a record increase in the price index. Consequently, the CBOE VIX (VIX) futures are gaining nearly 5%, as the pullback on Wall Street has triggered a sudden need for hedging by dealers and hedge funds, boosting demand for volatility protection products. Currently, the market is grappling with two significant risk factors.

Firstly, the U.S. economy remains robust. However, this comes at the cost of a substantial decline in expectations for further easing of monetary policy by the Federal Reserve. Secondly, bond yields are consequently rising, with 10-year Treasury yields approaching nearly 4.7%. This could incentivize capital allocation away from the historically expensive stock market. Another key factor is the real inflationary risk, illustrated by the ISM price index reading near 64 points.

As a result, investors may conclude that investing in equities could prove too risky in the short term, while 10-year yields nearing 5% and the growing appetite for fixed-income funds are presenting an attractive alternative.

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report