Why the results matter

Today, after the Wall Street session, Intel will release its report for the fourth quarter of 2025. This is a key moment for the company to demonstrate progress in executing its recovery plan, from Foundry and AI to improvements in the PC segment, despite challenging market conditions, competitive pressure, and global supply chain challenges. Today’s results could answer questions about Intel’s current financial position and indicate how the company sees its future in the upcoming quarters and throughout 2026.

Q4 2025 forecasts and consensus

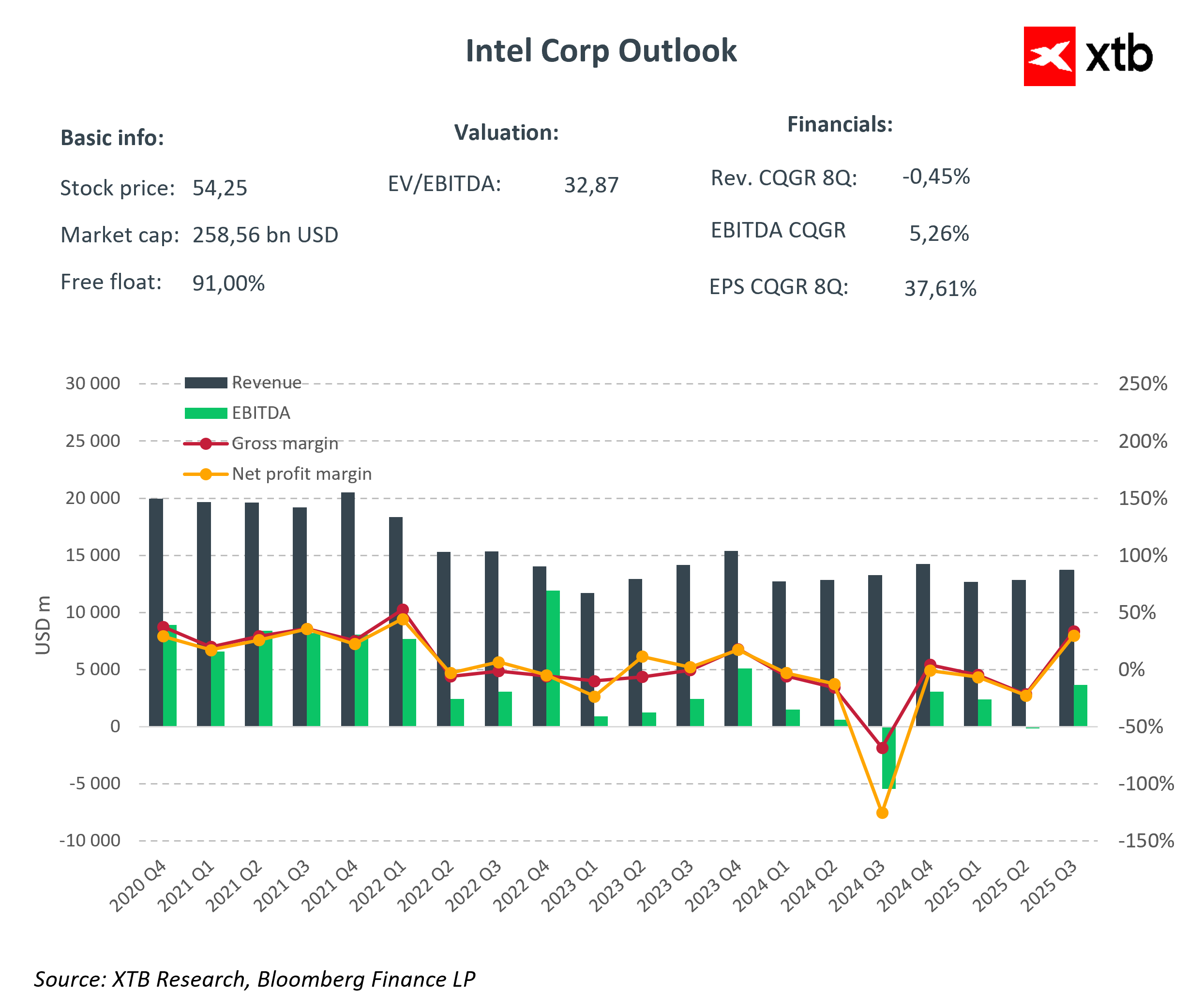

According to the Bloomberg consensus, Intel’s forecasts for the fourth quarter of 2025 are as follows:

- Total revenue: 13.42 billion USD, representing a year-on-year decline of around 6%

- Client Computing (PC/CCG): 8.28 billion USD

- Data Center & AI: 4.36 billion USD

- EPS: 0.09 USD

- Gross margin: 36.5%

- Operating margin: 6.29%

- Research and development (R&D) expenses: 3.29 billion USD

- Operating income: 872.8 million USD

First quarter 2026 forecasts

- Revenue: 12.54 billion USD

- EPS: 0.07 USD

- Gross margin: 36.5%

- Capital expenditures (CapEx): 3.84 billion USD

These figures indicate that Intel continues to face pressure in the PC segment, while the Data Center & AI and Foundry segments are becoming crucial for revenue recovery and margin improvement. Investors will closely watch whether the quarterly results confirm the positive signals the company has been sending for several months and whether the restructuring strategy is producing tangible results.

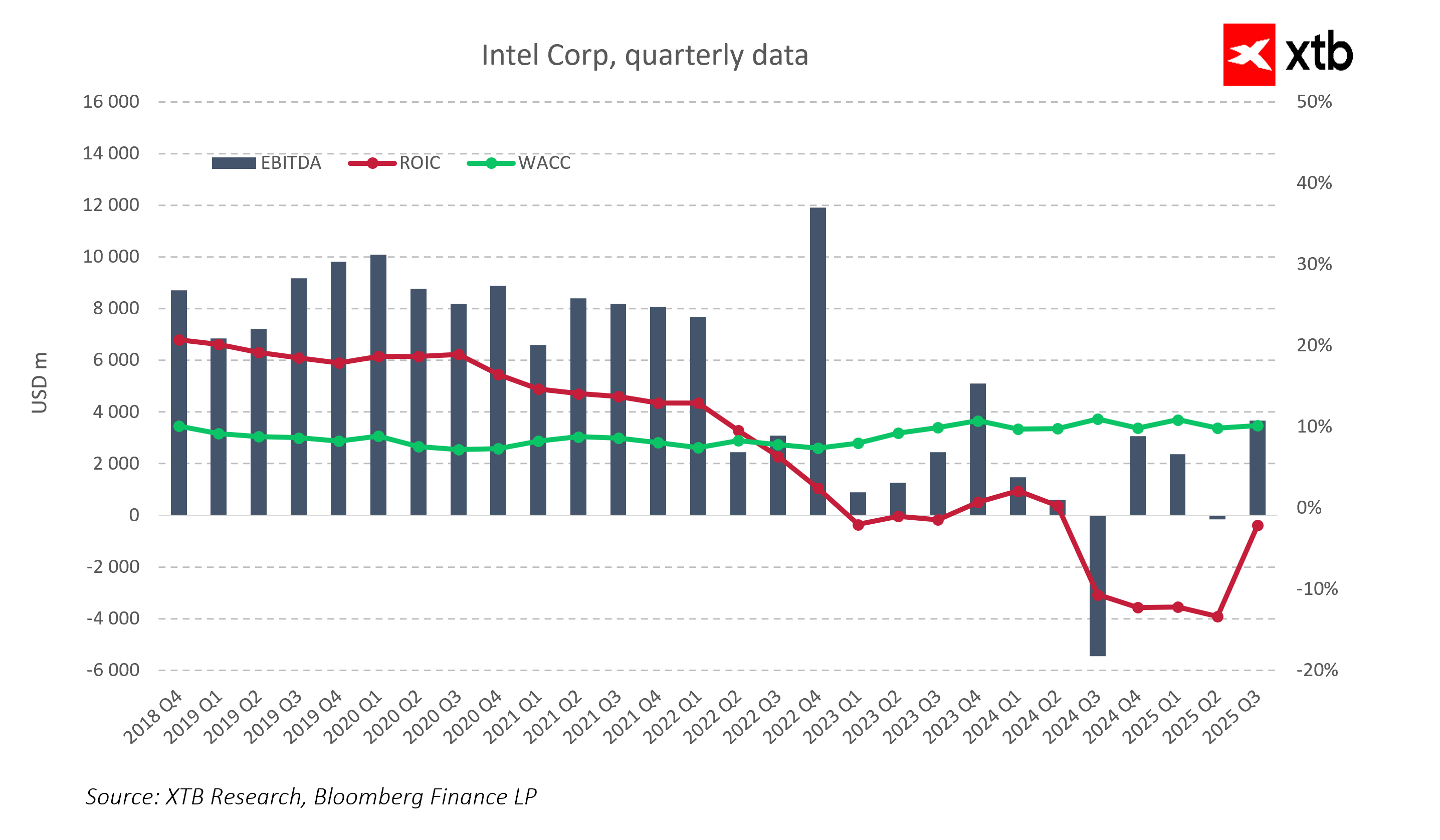

Foundry and AI – a test for the strategy

Strategic investments in the Foundry segment and the development of technological processes, including 18A in Arizona, are the foundation of Intel’s recovery plan. Improving production efficiency, attracting new customers, and securing the supply chain are key but costly initiatives.

In the AI and Data Center segment, the company is trying to regain market share in servers and processors for artificial intelligence applications. Collaboration with NVIDIA on GPUs and the development of agentic AI aim to boost revenues and margins, although supply constraints in Intel 7 and 10 processes may slow expansion in the short term.

The results in these segments will largely determine whether investors consider the “rescue operation” plan successful.

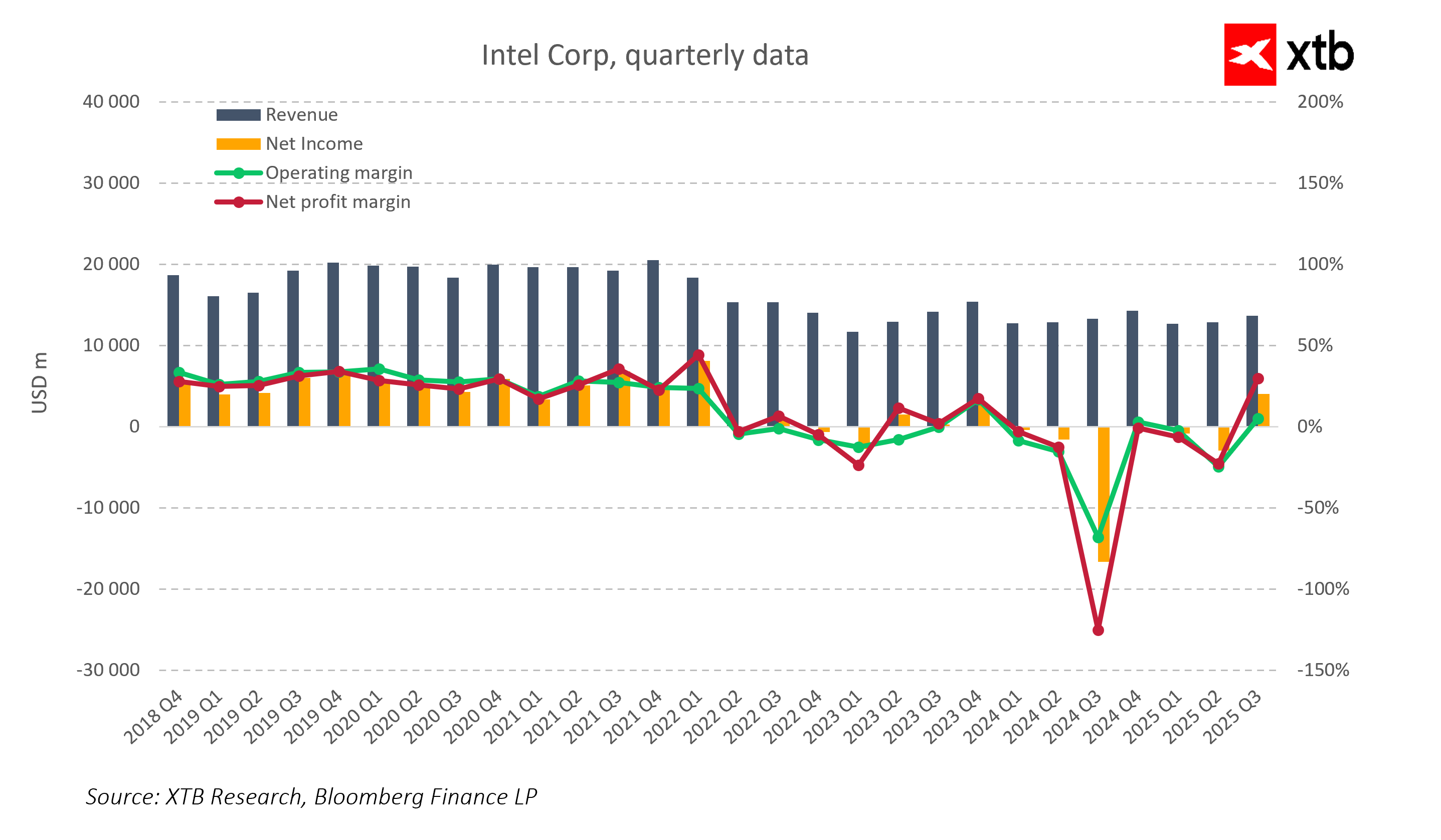

PC and Client Computing – still a challenge

The PC segment remains one of Intel’s biggest challenges. Although a rebound in average selling prices is expected in high-end and mid-range computers, the company continues to lose share in the budget segment, particularly in Chromebooks, to competitors such as MediaTek. This affects not only sales volumes but also the perceived strength of the brand in the consumer market.

The development of AI PCs may partially offset volume declines by introducing more technologically advanced products and allowing Intel to maintain its position in the premium segment. Nevertheless, the market will closely watch whether the company can regain significant share in this core segment, which still generates a substantial portion of the company’s total revenue. Success in the PC segment is therefore a prerequisite for the recovery strategy to be seen as complete and sustainable, as sales of consumer and business computers continue to drive Intel’s cash flow.

External support – government, SoftBank, and NVIDIA

Intel benefits from broad financial and technological support from external sources, which helps ease short-term pressure and finance long-term investments. The CHIPS Act provides the company with 5.7 billion USD in cash and tax incentives, improving liquidity and enabling the development of production infrastructure, especially in the Foundry segment.

Strategic partnerships with NVIDIA and SoftBank aim to increase Intel’s technological capabilities, accelerate AI development, and diversify business risks. Collaboration with NVIDIA allows integration of GPUs into AI servers and increases the appeal of the enterprise offering, while SoftBank support provides access to financing and potentially new markets.

Even such significant support, however, cannot replace sustainable revenue growth and margin improvement, which must result from operational effectiveness. Investors will verify in the quarterly reports whether external support truly translates into increased company value and stable results.

Risks for investors

Despite progress, Intel still faces significant challenges. Production and capacity constraints in the Foundry segment, along with high investment expenditures, may slow growth and limit the company’s financial flexibility. The company anticipates losing around ten percent of its PC market share in 2026, which adds pressure on recovery in the Client Computing segment.

Competition from AMD, NVIDIA, and MediaTek remains intense, requiring continuous technological improvement and innovation. Geopolitical factors and supply chain security, particularly the situation in Taiwan, may generate additional costs and uncertainty. The high stock valuation, which already reflects positive market expectations, means that any disappointment in results could strongly impact the share price and erode investor confidence.

Is the “rescue operation” working?

Today’s Q4 2025 results will be the first tangible signal of whether Intel can translate its restructuring plan into real financial results. Stabilization of revenues, improved margins, and positive indicators in the Foundry and AI segments could convince investors that the strategy is working.

For the operation to truly succeed, the company must maintain progress in Foundry, rebuild market share in PCs, effectively manage costs and geopolitical risks, and consistently develop high-margin segments. Intel is at a critical juncture, as the Q4 report could either confirm investor confidence or show that the path to full recovery will be longer and more challenging than the market anticipated.

Since the beginning of last year, Intel’s stock has risen by almost 150 percent, reflecting growing market hopes tied to restructuring, Foundry investments, and expansion in AI and Data Center. However, much of this growth has already been priced in by investors. Markets now expect tangible results, including specific data on revenues, margin improvements, and real market share gains. Today’s results will be the first test of whether Intel can turn ambitious plans into measurable successes, proving that the recovery strategy is not just theoretical but a real foundation for future growth.

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records