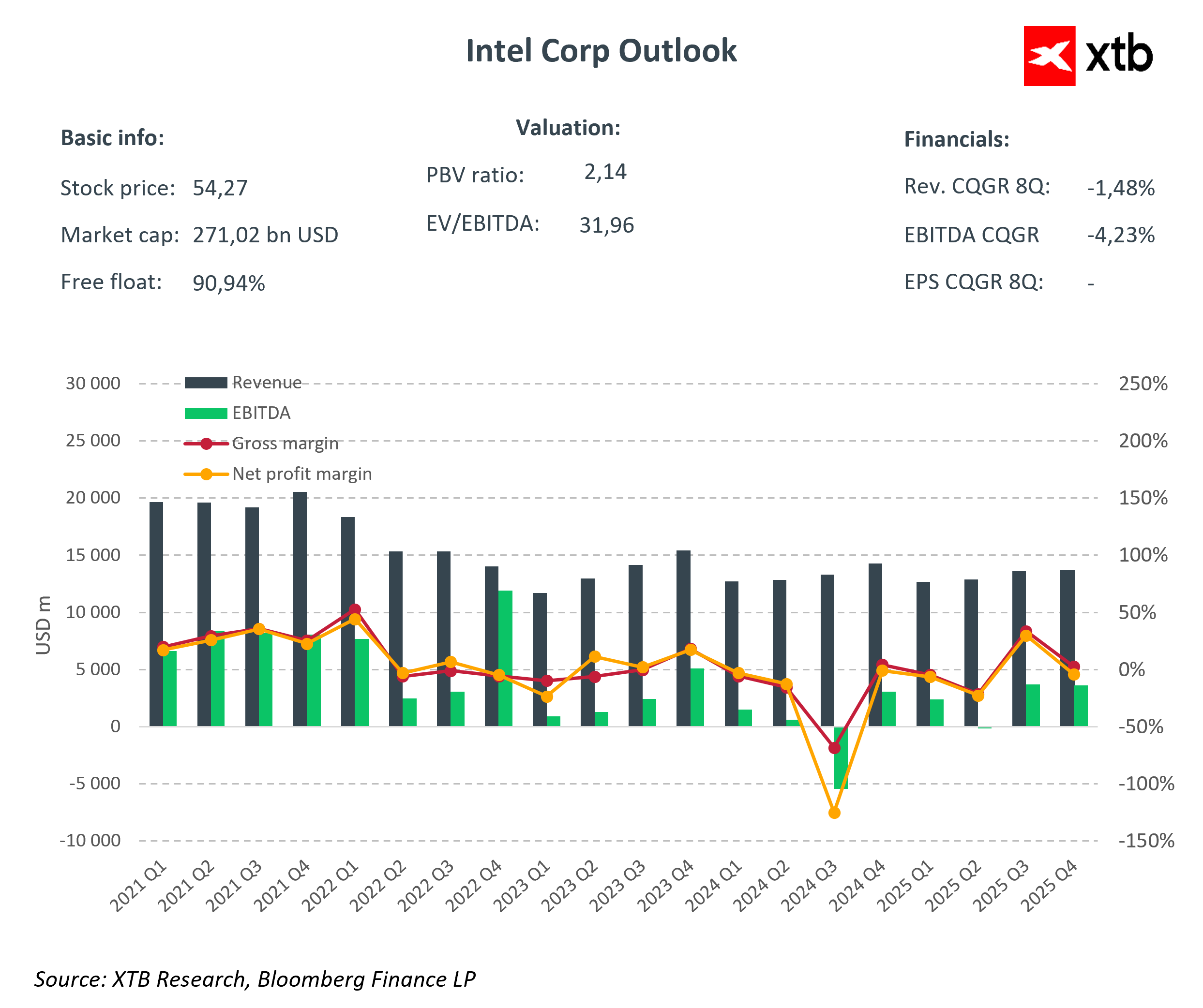

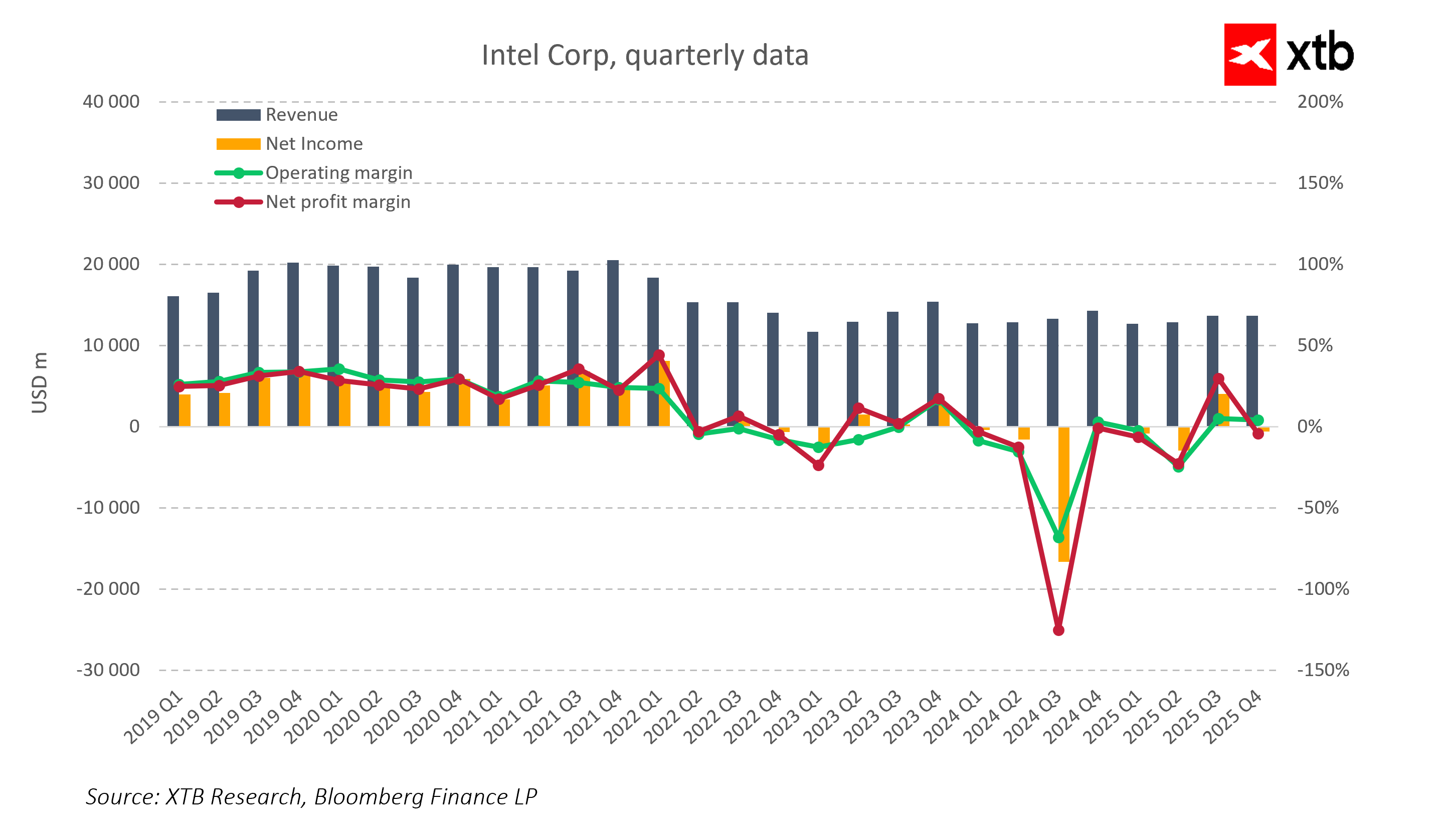

Intel reported results for the fourth quarter of 2025, which at first glance appear solid. The company’s revenue reached USD 13.7 billion, exceeding analyst consensus by 2.2%. Adjusted earnings per share (EPS) came in at USD 0.15, nearly double the expected USD 0.08. The Data Center and AI segment grew 9% year-over-year, reaching USD 4.7 billion, reflecting the growing demand for processors in the era of artificial intelligence.

Despite these positive results, the market reacted with a sharp sell-off, as investors focused primarily on the weak first-quarter guidance, cost pressures, and execution risks rather than historical EPS or revenue results.

Financial Results

-

EPS: USD 0.15, surpassing analyst expectations of USD 0.08

-

Revenue: USD 13.7 billion, above expectations (USD 13.4 billion), down 4% YoY

-

Gross margins: under significant pressure due to higher production costs and limited chip supply

-

Data Center & AI segment: +9% YoY, USD 4.7 billion

-

Client Computing (PC segment): revenue down 7% YoY, USD 8.2 billion

-

18A and 14A processes: progress in ramp-up, but production yields remain below expectations

-

Memory squeeze: tightening global supply of DRAM and NAND could limit volumes and margins in the PC segment

Technological Progress and Execution Risks

Management highlighted progress in developing the 18A and 14A processes, the most advanced lithography technologies produced in the U.S., yet execution risk is rising, and production yields remain below targets. This adds uncertainty for the market and impacts investor reaction.

Stock momentum rose by 11% ahead of the results, expecting a positive surprise, but after the release, concerns dominated about weak first-quarter guidance, cost pressures, declining margins, and a disappointing PC segment. This shows that, in the current market cycle, investors focus primarily on the future and the quality of strategy execution rather than just the results of the past quarter.

Guidance for Q1 2026

-

Projected revenue: USD 11.7–12.7 billion, representing a 2.4% shortfall versus market consensus

-

Adjusted EPS: approximately USD 0.00, while the market expected USD 0.05

-

Main reasons: depletion of buffer inventories and the shift of wafer production to servers, which will leave the factories only at the end of the quarter

-

Impact on growth and margins: limited chip supply continues to suppress revenue growth and margin expansion potential, despite rising AI demand

New Structural Risks

Beyond short-term guidance issues, new structural risks may intensify pressure on Intel’s results in upcoming quarters. Execution risk, or the lack of consistency in implementing the strategy, is cited as a key weakness, especially given high market expectations.

Additionally, tightening memory supply could weaken PC demand, directly threatening the Client Computing segment. Weakness in this segment may also reduce returns on Foundry investments and the 18A process, which largely relies on internal sales volumes.

Long-Term Outlook

Intel forecasts Q1 2026 revenue of USD 11.7–12.7 billion and adjusted EPS close to zero, underscoring the company’s caution. Limited chip supply, despite rising AI demand, continues to constrain potential revenue growth and margin improvement. The PC segment remains a clear area of risk, while Data Center, AI, and Foundry offer growth opportunities, provided the strategy is executed effectively and profitability is restored. Management changes and business restructuring are part of broader Intel efforts, but until the company demonstrates consistent plan execution, the market will remain skeptical about long-term recovery.

Higher market expectations after a spectacular rise: over the past 12 months, Intel shares have increased by nearly 150%. The market has already priced in most information and now expects positive results. Q4 showed solid fundamentals, but given high investor expectations, the current results were not sufficiently convincing, explaining the sharp sell-off.

Key Takeaways

The fourth quarter of 2025 showed that Intel has strong fundamentals and growth areas, particularly in Data Center and AI, but the market remained disappointed due to weak first-quarter guidance, margin pressures, limited chip supply, and additional execution risks, including the memory shortage. Intel faces significant challenges, such as scaling advanced production processes, rebuilding the PC segment, improving margins and controlling costs, and consistently executing strategy in a challenging demand environment. The company still has much work to do before investors translate market expectations into real stock price growth and higher fundamental valuation.

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood