- Canada, Ivey PMI for April. Actual: 63.0. Expected: 58.1. Previous: 57.5

It is worth noting that much of the rebound in the Ivey PMI index is related to the price factor. The price sub-index is back above the 50-point level. In theory, mounting price pressures could limit the chances of an interest rate cut. The valuation for June still points to the 70% level. This Friday, labor market data, which could still stir up a lot in the Canadian dollar market.

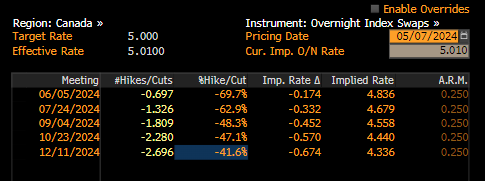

The likelihood of a rate cut in Canada in the coming months. As you can see, the market is pricing that the cut will take place in June or July. Source: Bloomberg

Despite clearly exceeding analysts' expectations; USDCAD pair does not react excessively to macro data reading

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)