JPMorgan Chase kicked off the earnings season with a mixed signal, leaving the stock flat in the premarket trading (currently at around $325). The bank capped a record 2025 with its highest-ever annual revenue of $182 billion, despite a fourth-quarter profit hit from its strategic takeover of the Apple Card portfolio.

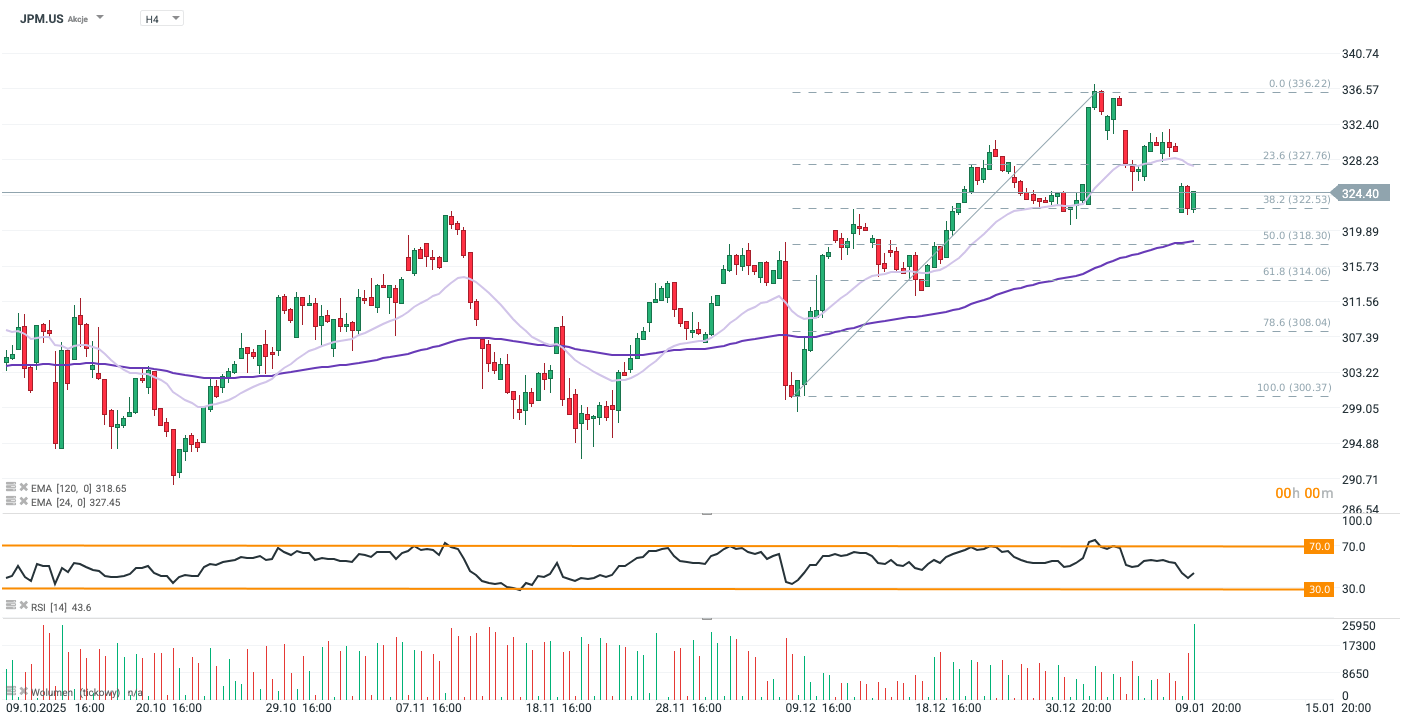

JPM stock has retreated to the 38.2% Fibonacci retracement level, weighed down by pre-earnings caution and President Trump’s recent comments on credit rate caps. The decline broke through immediate support around $330—a key level coinciding with the 30-day Exponential Moving Average (EMA30). This breach suggests that a quick return to recent highs is unlikely, potentially setting the stage for a deeper bearish test of the 100-day moving average (EMA100). Source: xStation5

Caution despite many beats

The bank reported Q4 net income of $13 billion, down 7% from the previous year. However, excluding the $2.2 billion provision for the Apple deal, EPS of $5.23 comfortably beat Wall Street's $4.85 forecast. (total EPS: $4.63). CEO Jamie Dimon cited a "resilient" economy but warned of "sticky inflation" and geopolitical hazards.

Shares initially rose 1% after volatility from President Trump’s proposed credit card rate caps, as the bank issued strong 2026 guidance projecting $95 billion in net interest income. Nevertheless, the overall EPS miss and premium-client-driven performance spark caution among investors, in spite of Jamie Dimon’s optimism regarding the U.S. economy, bringing stock’s premarket down to around 0.15-0.2%.

Top Line Results

-

Net Income: $13.03 billion, down 7% y/y.

-

EPS (Earnings Per Share): $4.63, down 4% y/y.

-

Note: EPS was $5.23 excluding significant items.

-

-

Adjusted Revenue: $46.77 billion vs. Estimate $46.35 billion. (BEAT)

-

Managed Net Interest Income: $25.11 billion (+7% y/y) vs. Estimate $24.99 billion. (BEAT)

Trading & Banking Highlights

-

Equities Sales & Trading: $2.86 billion (+40% y/y) vs. Estimate $2.7 billion. (BEAT)

-

FICC Sales & Trading: $5.38 billion (+7.5% y/y) vs. Estimate $5.27 billion. (BEAT)

-

Investment Banking Revenue: $2.55 billion (-1.9% y/y) vs. Estimate $2.65 billion. (MISS)

-

Note: Both Equity and Debt underwriting revenues missed estimates, with Equity underwriting down 16% y/y.

-

Credit & Balance Sheet

-

Provision for Credit Losses: $4.66 billion (includes Apple Card reserves) vs. Estimate $4.68 billion.

-

Net Charge-Offs: $2.51 billion vs. Estimate $2.56 billion. (BETTER THAN FEARED)

-

Assets Under Management: $4.79 trillion vs. Estimate $4.73 trillion.

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment