JPMorgan published Q3 results ahead of the Wall Street session start today. US bank generated revenue of $29.94 billion against expected $28.39 billion. EPS came in at $2.92, much better than expected $2.35. Company also reported much smaller than expected provisions for bad loans - $611 million (exp. $2.38 billion). Results look solid on the face of it but release still triggered downward move on the US futures. Why? JPMorgan decided to extend buyback suspension until the end of the fourth quarter of the year.

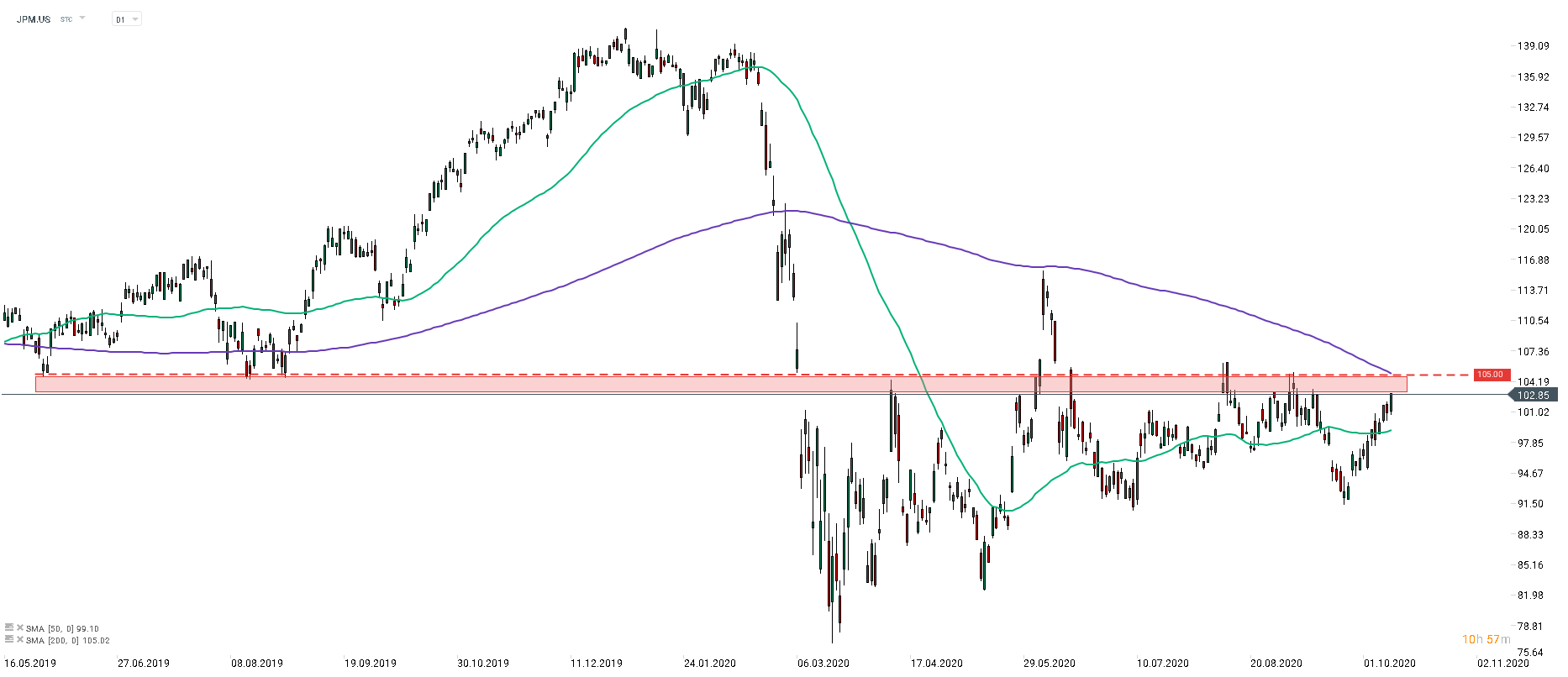

JPMorgan finished yesterday's trading slightly below resistance zone at $105.00, that is also marked with a 200-session moving average (purple line). Decision to extend buyback suspension may weigh on share price during today's trading. Source: xStation5

JPMorgan finished yesterday's trading slightly below resistance zone at $105.00, that is also marked with a 200-session moving average (purple line). Decision to extend buyback suspension may weigh on share price during today's trading. Source: xStation5

US OPEN: Market under pressure from AI

Hollywood on Edge: Another Round in the Battle for Warner Bros.

Norwegian Cruise Line surges 7% amid disclosed Elliott Management 10% stake 📈

BHP Results, the Copper Market, and the KGHM Correction. What You Need to Know