The Bank of Japan (BoJ) maintained its rhetoric of loose monetary policy, keeping interest rates at a steady level of -0.10%. This decision is in line with market expectations. The BoJ continues to uphold its Yield Curve Control (YCC), leaving the reference rate at 1.0% for 10-year Japanese government bonds and maintaining the target yield for 10-year bonds at around 0%. This decision confirms the bank's ultra-loose policy, despite speculation about its potential reversal in the coming year.

Key BoJ comments:

- Japanese economy is gradually reviving. Future prospects remain uncertain due to global economic conditions and domestic moderate private consumption growth.

- BoJ notes a slight revival in the Japanese economy, with stable exports and industrial production.

- BoJ expects the CPI to rise above 2% in the entire fiscal year 2024, but also anticipates a subsequent gradual decline.

- The core consumer price index is expected to gradually rise towards, and then the pace of growth will stabilize.

- BoJ is analyzing the wage-price growth cycle and attaches great importance to data and wage growth in companies.

- BoJ emphasizes the importance of monitoring movements in the financial and foreign exchange markets and their impact on the economy and prices.

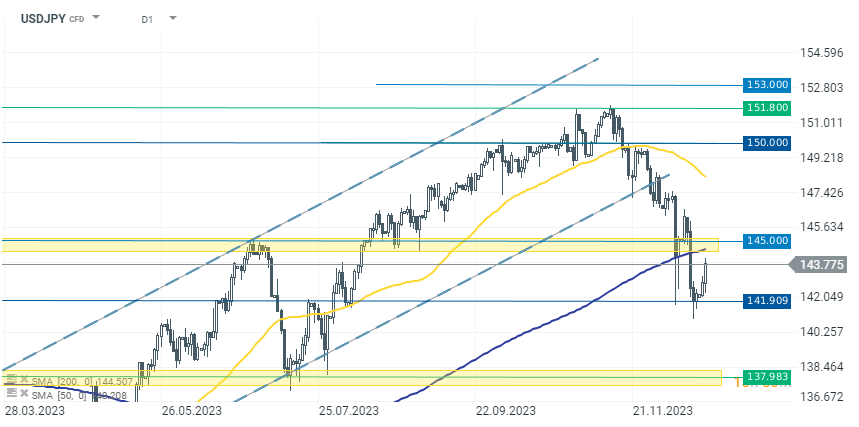

In the forex market, we see a decisive reaction of the Yen to the BoJ's rhetoric. JPY is today one of the weakest currencies among the G10 countries. The USDJPY pair gains about 0.80%, consolidating around 143.800. This marks the third consecutive day of gains for this pair. However, despite the declines, USDJPY remains below the SMA 200 average. After dynamic declines in recent weeks, the exchange rate has stopped around the support level of 141.000-142.000. The first limitation of the current breakout is the level of 145.000, which also marked the local peak in July this year.

Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)