During the press conference, Christine Lagarde emphasized in particular that the recent rise in yields poses a risk to financial conditions in the eurozone. In her opinion, inflation is being driven mainly by temporary factors. She pointed out once again that rising market rates may cause early tightening of monetary conditions, hence accelerating the pace of purchases in the next quarter. The ECB remains flexible in terms of its asset purchase program. It indicates that in case of constant improvement,the PEPP program does not have to be fully used. Lagarde further stressed that the risks still remain high when it comes to the pandemic, but are slowly balancing. However, the risks in the short term are high and point to negative outlook.

GDP forecasts:

- 2021: 4% previous 3.9%

- 2022: 4.1% previous 4.2%

- 2023: 2.1% unchanged

HICP inflation forecasts from the ECB:

- Prior was + 1.0%

- 2022 + 1.2% vs + 1.1% in December

- 2023 + 1.4% vs + 1.4% in December

- Long-term inflation expectations remain subdued

- When the pandemic effect wears off, the ECB expects increasing pressure on core inflation

- Core inflation should increase this year

For the ECB, the important thing here is that inflation is still expected to be below target for the forecast horizon. This means continuation of the current policy (i.e. zero and negative interest rates). In the last 12 months, the ECB bought an average of EUR 100 billion per month under all programs (APP is around 20 billion per month). In January and February the pace fell to around EUR 80 billion, so one can expect an acceleration, or in fact a return to the average, which may be viewed positively by the stock exchanges, but also theoretically positively by the euro. Why? This may cause pressure on yields. The recent rise in bond yields has caused potential problems in some economies. Therefore, the faster pace of purchases may ultimately be positive for the euro. Nevertheless, we observe the weakness of the euro and rising bond yields. Interestingly, yields in the US react more strongly than in Germany.

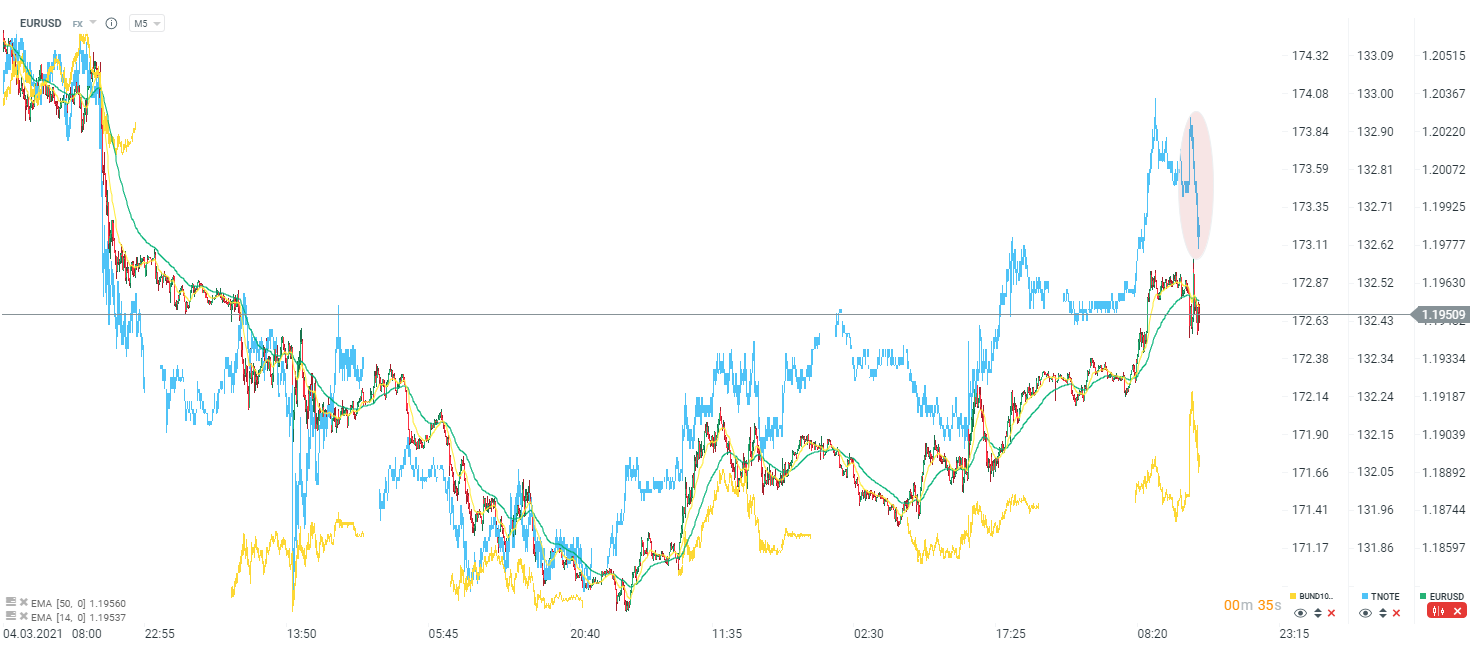

EURUSD is trying to find support around 1.1950. Yields, however, are rising, despite strong pressure from Lagarde regarding the acceleration of the pace of purchases. However, as indicated above, an increase in the pace of purchases may de facto mean a return to the 12-month average. Source: xStation5

During the Q&A session, Lagarde emphasized that an increase in the pace of purchases required a decision by the Council. The pace increase is expected to be significant, but has not been specifically set.

One can see that the ECB is trying in any way to force the yields to retreat. On the other hand, the central bank does not have much tools for that. The pace of purchases may be crucial. As indicated above, the average pace of purchases in the last 12 months was EUR 100 billion, while at the beginning of this year it dropped to EUR 80 billion. The market is likely to be happy with anything above EUR 100bn.

- Lagarde points out that the ECB does not use yield curve control! (the markets may not necessarily like it).

- Approximately 1 trillion Euro is left to be used under the PEPP program.

DAX is trying to recover from the morning sale-off. Source: xStation5

DAX is trying to recover from the morning sale-off. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report