Lagarde answered an interesting question about whether the ECB looks at other central banks (Canada or the US). Lagarde points out that she would like to act like the Fed (similar inflation targets), but admits that the economic situation and inflation expectations in the US are at a completely different level than in the US. What can be deduced from this? The ECB will not follow any moves from the Fed or BoC, but will mainly look at the current situation in the euro zone (which is not very good at the moment).

For example, the BoC admitted yesterday that many risk factors have been eliminated, inflation is significantly higher, which contributed to the reduction of the QE program. However, in the euro zone quite the opposite, the ECB must ensure that it will buy faster.

In addition, Lagarde justifies negative deposit rates by pointing out that negative rates do not make money for people putting aside money, but are good for the economy. The ECB views the economy as an aggregate.

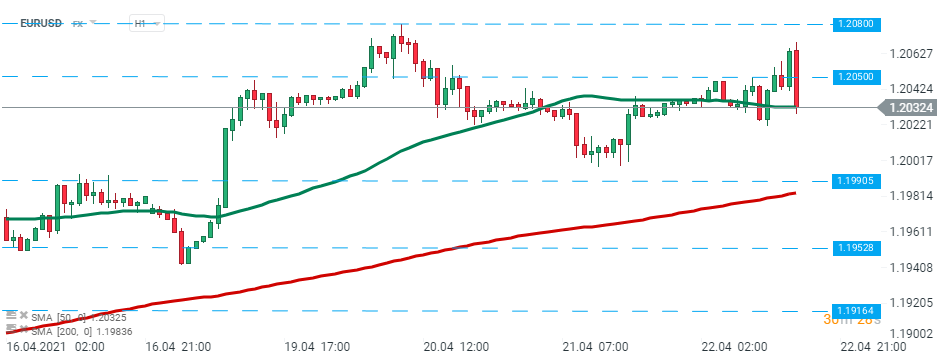

EURUSD pair fell sharply during the Lagarde press conference. Source: xStation5

EURUSD pair fell sharply during the Lagarde press conference. Source: xStation5

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts