PMI indexes in Europe mostly performed weaker than preliminary readings. In countries that reported data for the first time today, the readings were also worse than expected. Those are services PMI readings from European countries:

- Spain: 49.3 (expected 51.5; previous: 52.8)

- Italy: 49.8 (expected: 50.3; previous: 51.5)

- France (fin.): 46 (expected: 46.7; previous: 47.1)

- Germany (fin.): 47.3 (expected: 47.3; previous: 52.3)

- EMU (fin.:): 47.9 (expected: 48.3; previous: 50.9)

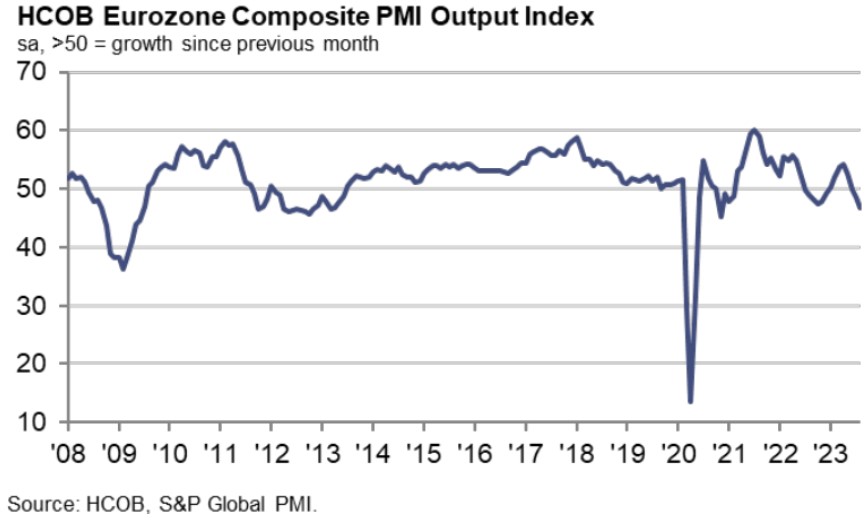

- Eurozone composite drops to 46.7 with 47 points expected.

We have the lowest reading since 2020. HCOB writes in a commentary that the eurozone did not fall into recession in the first half of the year, but the second half of the year comes into big question. The services sector, which had been a stabilizing force for the economy for many months, now appears to be a strong drag, and the industrial sector is likely to decline further. HCOB forecasts -0.1% change in GDP for Q3 in EMU.

The composite index falls to a 33-month low! Source: HCOB, S&P Global

The composite index falls to a 33-month low! Source: HCOB, S&P Global

EURUSD continues its declines and is currently testing the 1.0750 levels. source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)