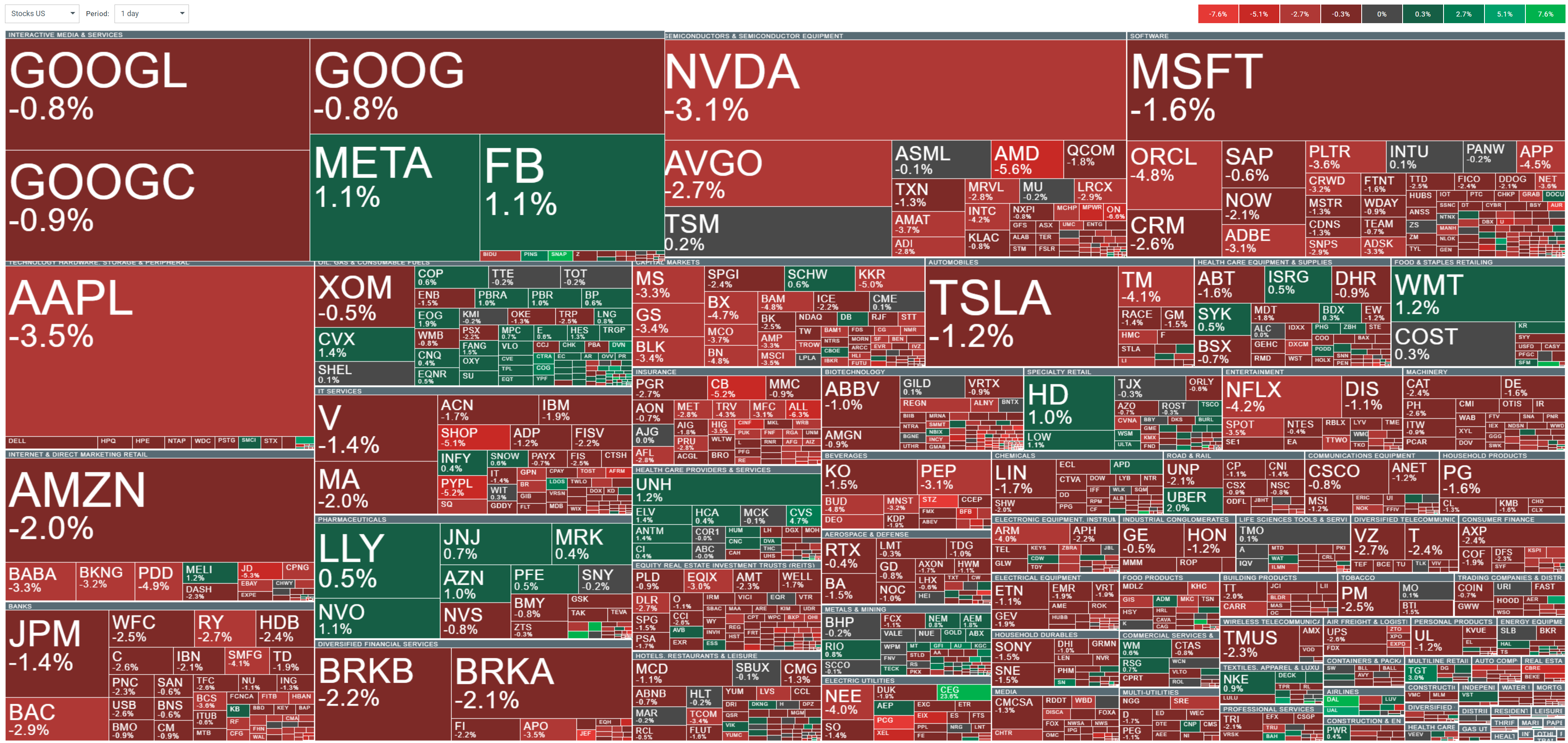

U.S. stocks declined sharply today, with the US 500 (S&P 500) falling 1.6%, as a stronger-than-expected December jobs report forced investors to recalibrate their expectations for Federal Reserve rate cuts in 2024. The market reaction erased the index's early 2025 gains, while Treasury yields jumped with the 30-year briefly touching 5%.

Key Highlights:

-

S&P 500 falls 1.6%, approaching key technical support at 100-day moving average

-

30-year Treasury yields briefly surpass 5% milestone

-

Swap traders reduce 2024 rate cut expectations to 30 basis points

-

Information Technology sector leads declines, down 2.54%

Market Reaction

The robust December jobs report, showing 256,000 new payrolls and unemployment dipping to 4.1%, triggered a broad market selloff. Energy remained the lone bright spot, while all other sectors declined, with Technology and Financials seeing the steepest drops of 2.54% and 2.31% respectively.

Bond Market Turbulence

The Treasury market saw significant volatility as the hot jobs data intensified the global bond selloff. The 30-year yield breached 5% before pulling back, while the 10-year yield continued its upward drift. Bond bulls now pin their hopes on next week's CPI print to break the rout. The swaps market pushed back expectations for the first Fed rate cut from July to October, though analysts note the Fed's focus on alternative inflation measures might still allow for policy easing, just on a delayed timeline.

US Treasury Yield Curve. Source: Bloomberg

Notable Stock Moves

Delta Air Lines (DAL.US) surged 9.8% after forecasting its strongest financial year ever, projecting Q1 revenue growth of 7-9%. Insurance stocks tumbled on California wildfire concerns, with Mercury General plunging 20%. Nvidia (NVDA.US) fell 3% amid opposition to new chip export restrictions, while Walgreens (WBA.US) rose 22% after beating Q1 expectations with $39.46B in sales.

Wall Street's Cautious Outlook

Leading analysts are reassessing their rate cut timelines, with Morgan Stanley's Ellen Zentner noting that even next week's inflation data might not be enough to prompt near-term Fed action. Goldman Sachs Asset Management's Lindsay Rosner emphasized that January rate cuts are now off the table, with attention shifting to March's meeting.

Implied Rate Cuts in US. Source: Bloomberg

US500 (D1 Interval)

The US500 index is nearing a critical support level at the 100-day SMA of 5861, which aligns with the lower Bollinger Band and the 23.6% Fibonacci retracement level. The RSI is trending lower, reflecting weakening momentum, while the MACD is widening to the downside, signaling increasing bearish pressure. A breach of this level could accelerate the downward movement, while a rebound might offer temporary relief to bulls. Source: xStation

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment