NFP report for September, a key macro release of the week, will see daylight in less than an hour (1:30 pm BST). This report is crucial as the Fed hinted that the solid data from the labour market may lead to an official taper announcement "in the coming months". Market expects that solid beat in jobs numbers will cement the decision to announce winding down of asset purchases in November. Market expectations:

-

Non-farm payrolls. Expected: 470k. Previous: 235k

-

Unemployment rate. Expected: 5.1%. Previous: 5.2%

-

Wage growth. Expected: 4.6% YoY. Previous: 4.3% YoY

Mixed moods can be spotted across financial markets ahead of the release. European indices trade mostly flat, US futures pull back slightly and the US dollar is neither leader nor a laggard among G10 currencies. Gold is inching higher. As strong reading would boost odds for Fed to tighten policy, the US dollar may strengthen putting pressure on both gold and equities.

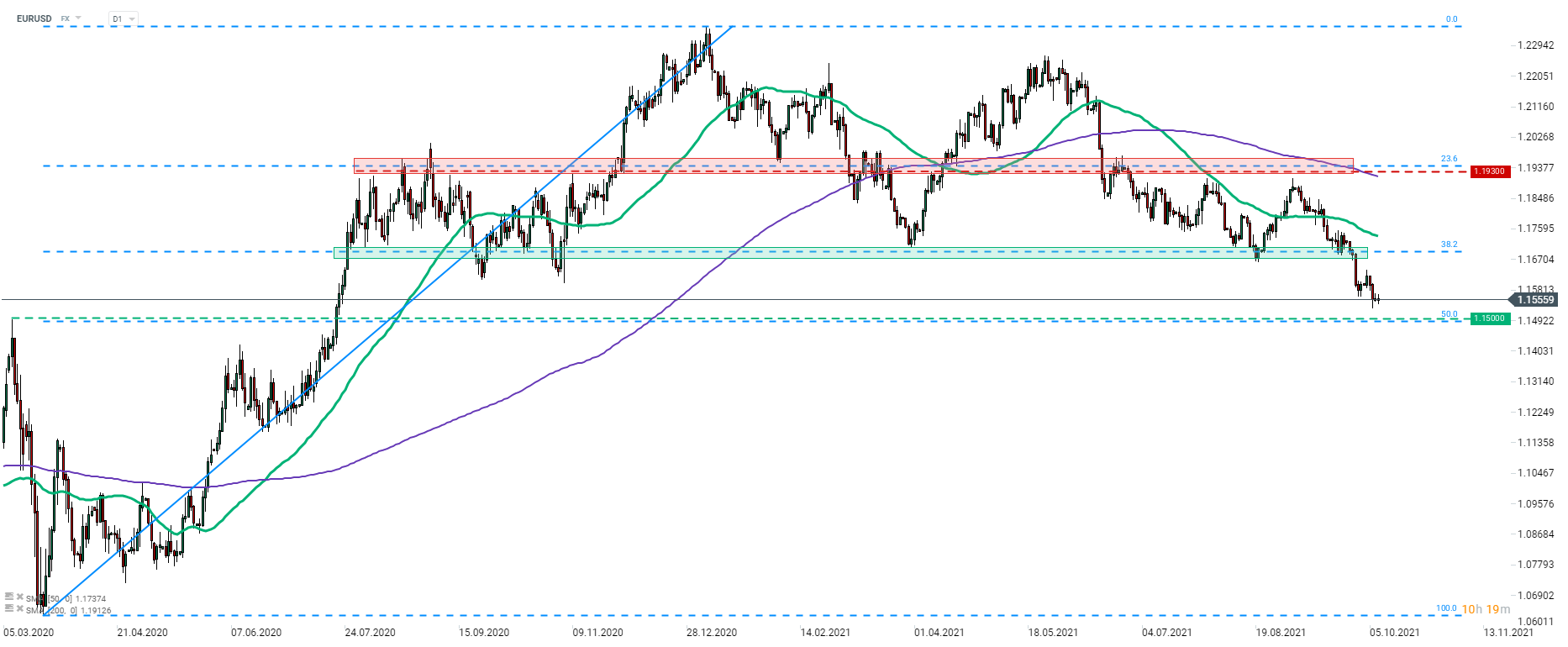

EURUSD plunged to a 14-month low earlier this week and has struggled to recover since. Solid jobs reading may see that pair move lower, towards the 50% retracement of post-pandemic upward move (1.1500 area). Source: xStation5

EURUSD plunged to a 14-month low earlier this week and has struggled to recover since. Solid jobs reading may see that pair move lower, towards the 50% retracement of post-pandemic upward move (1.1500 area). Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report