Summary:

- Chinese Ministry of Commerce insists that a tariff removal is a crucial condition for reaching a trade agreement

- Kudlow adds negotiations are coming down to the final stages

- One month left to reach a deal in order to avoid more duties

Asian markets have risen during the last trading day this week, albeit price gains in China have been quite modest and no consistent. Over the recent days markets have been reacting to any new headlines regarding US-Sino trade negotiations vigorously and it seems that even more information will have to be digested. Markets are fixated on December 15, the date when the US is expected to slap China with additional tariffs on goods worth $156 billion (15%). At the same time, China is expected to boost a tariff rate applied to goods being worth $75 billion. Nonetheless, this scenario may be luckily avoided once both sides are able to hammer out a phase-one trade agreement. Time is elapsing and only one month left to go to avoid unwanted tariffs.

We reckon that additional duties are rather unlikely due to the fact that Donald Trump will not want to escalate the trade spat even more having in mind that it would deteriorate his position in a presidential election next year. Hence, such a deal appears to be a base scenario and financial markets seem to have already priced in it. However, there is no a smooth path to do so and some sticking points remain. For example, China is reportedly hesitant to commit to purchasing a specific amount of US agricultural products. In turn, the Chinese Ministry of Commerce said on Thursday that removing tariffs is an “important condition” for reaching a deal. On the other hand, White House economic adviser Larry Kudlow said several hours later that trade negotiations were coming down to the final stages. All of that suggests that a lot needs to be agreed yet, and markets are likely to be on tenterhooks until the final agreement comes up.

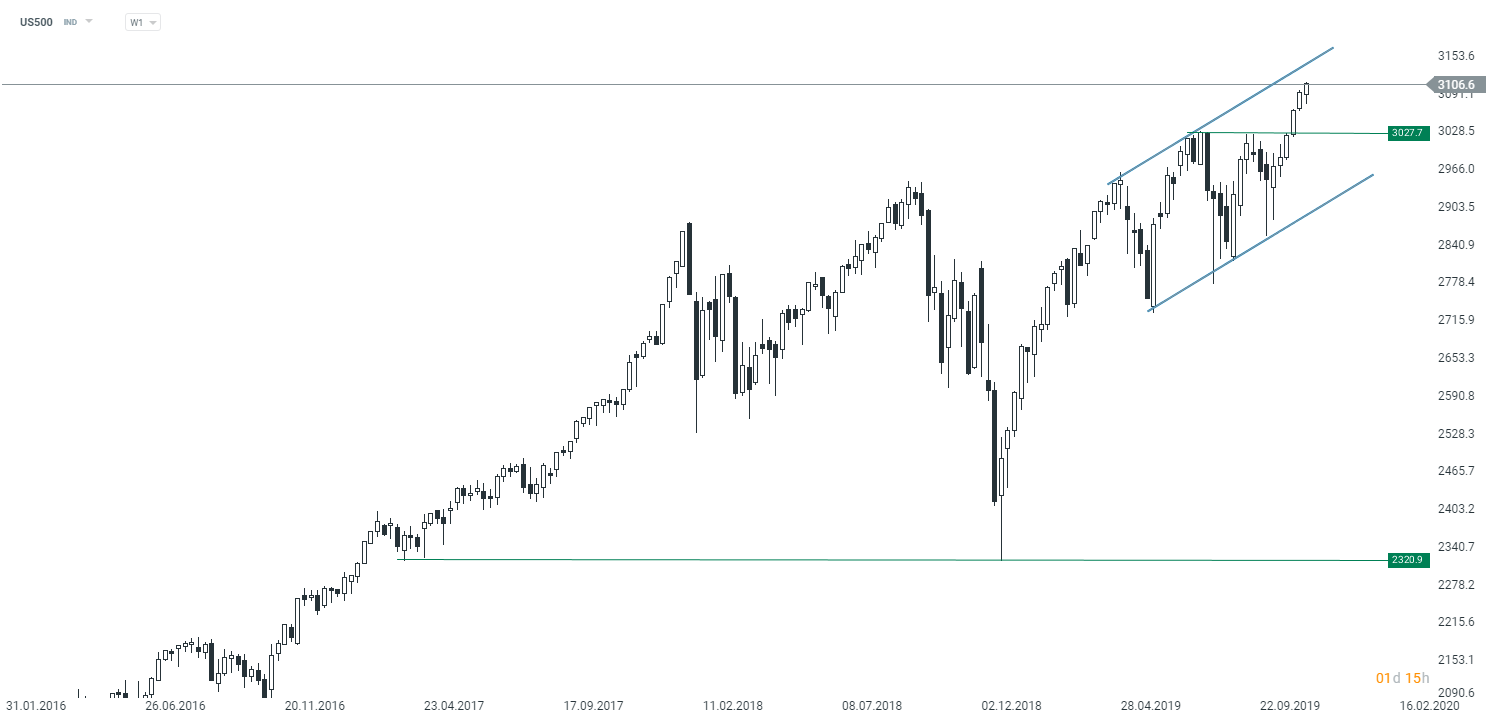

US500 keeps surging another week in a row. Source: xStation5

US500 keeps surging another week in a row. Source: xStation5

Daily Summary - Wall Street is waiting for Nvidia (25.02.2026)

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Chart of the day: US100 gains ahead of the Nvidia earnings 📈

Morning wrap (25.02.2026)