Marriott International (MAR.US) stock rose more than 4.5% during today's session after the hotel chain released details regarding its development process in 2021. At the end of last year Marriott's worldwide system consisted of nearly 8,000 properties and roughly 1.48 million rooms in 139 countries and territories. Company added more than 86,000 rooms on a gross basis, growing the system 3.9%, including room deletions of 2.1%. It also said that by the end of the year it had the largest global development pipeline, with roughly 485,000 rooms. These factors helped drive Marriott's growth in 2021 and are expected to propel the company's growth over the next several years.

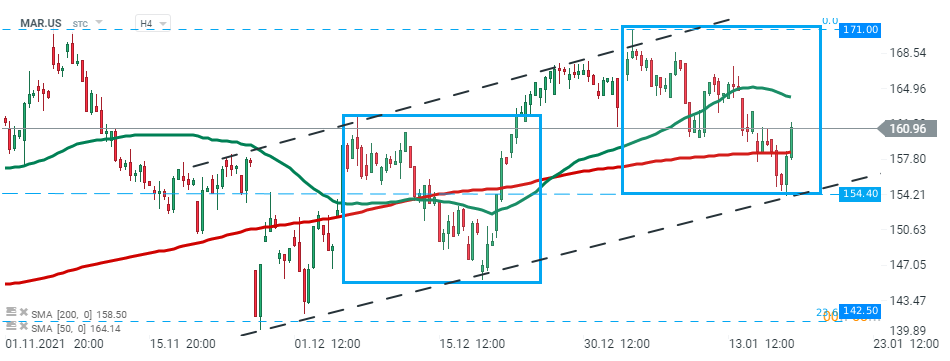

Marriott International (MAR.US) stock has been moving downward since the beginning of January, however buyers managed to halt declines around major support at $154.40 which is marked with lower limit of the 1:1 structure and lower limit of the ascending channel. During today's session price broke above 200 SMA (red line) and if current sentiment prevails upward move may accelerate towards recent highs at $171.00. On the other hand, if sellers manage to regain control and break below the aforementioned support, then support at $142.50 may be at risk. This level coincides with 23.6% Fibonacci retracement of the upward move launched in March 2020. Source: xStation5

Market wrap: European and US stocks try to rebound rebound 📈

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China