Microsoft denied reports from The Information, which claimed the company had lowered sales growth targets and limits for selected AI products after some sales teams failed to meet their plans. The report cited sources within Azure and indicated that:

- The Carlyle Group reduced spending on Copilot Studio due to data-integration issues;

- Microsoft Foundry failed to meet assumptions tied to customer spending.

Microsoft rejected these allegations, arguing that the report mixes growth expectations with sales quotas, which — as the company emphasizes — have not been reduced. The entire situation comes amid growing market concerns that AI adoption is progressing more slowly than expected, and that only a small portion of projects move beyond the pilot phase. At the same time, tech giants are under increasing pressure to prove that massive AI investments — including Microsoft’s record-breaking 35 billion USD in capital expenditures last quarter — will translate into lasting revenue.

Despite the challenges, Microsoft continues to report solid Azure growth and expects capacity constraints to persist until mid-2026 due to strong demand. The company remains one of the primary beneficiaries of AI infrastructure, although slower implementation and reports of customer-side issues are increasing investor caution and prompting comparisons to earlier tech bubbles.

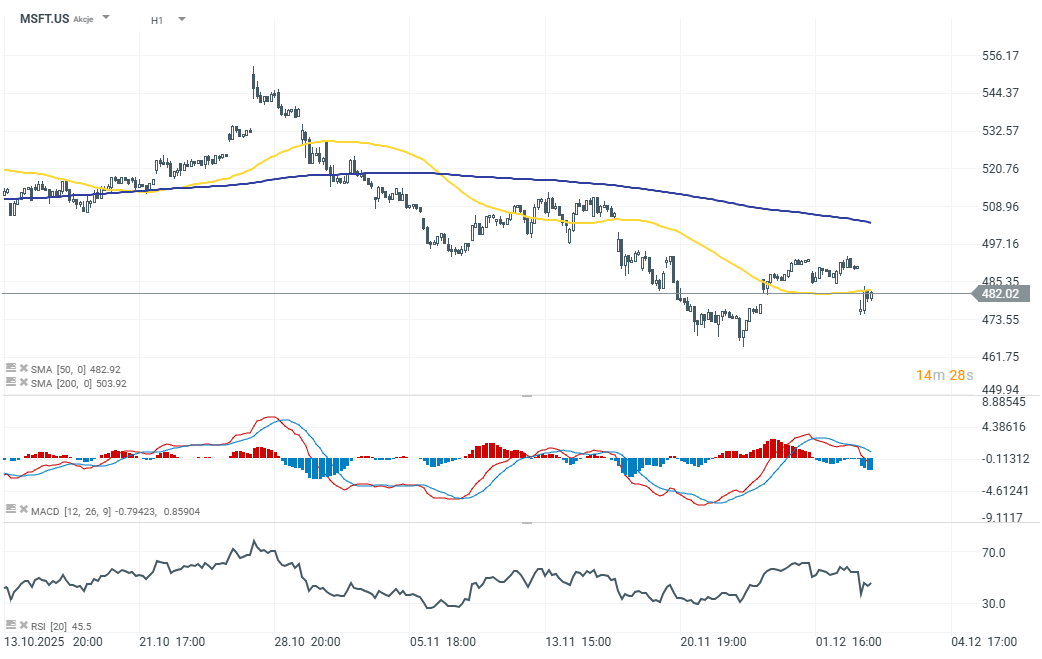

After The Information published its report, Microsoft shares initially fell nearly -3% to around 475 USD. However, they have since partially recovered to about -1.65%, trading near 481 USD.

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records