European indices and US futures pull back after Austria decided to impose a nationwide lockdown, starting from Monday. Moreover, Austrian authorities announced that vaccinations will become compulsory from February 2022. While Austria is not a key player in the global economy, the move pictures how bad the virus situation has gotten in Europe again. Shortly after the announcement was made, the German health minister said that he cannot rule out a lockdown being imposed in Germany as well. As new Covid-19 cases are spiking across Europe and threaten to overwhelm the healthcare system, pandemic could turn to be an important driver in the markets in the end-2021 and early-2022.

As we have mentioned earlier, indices took a hit on the news with DE30 dropping around 0.5% in the aftermath. An increase in risk aversion can also be spotted when looking at traditional safe haven assets - JPY, CHF and gold moved higher.

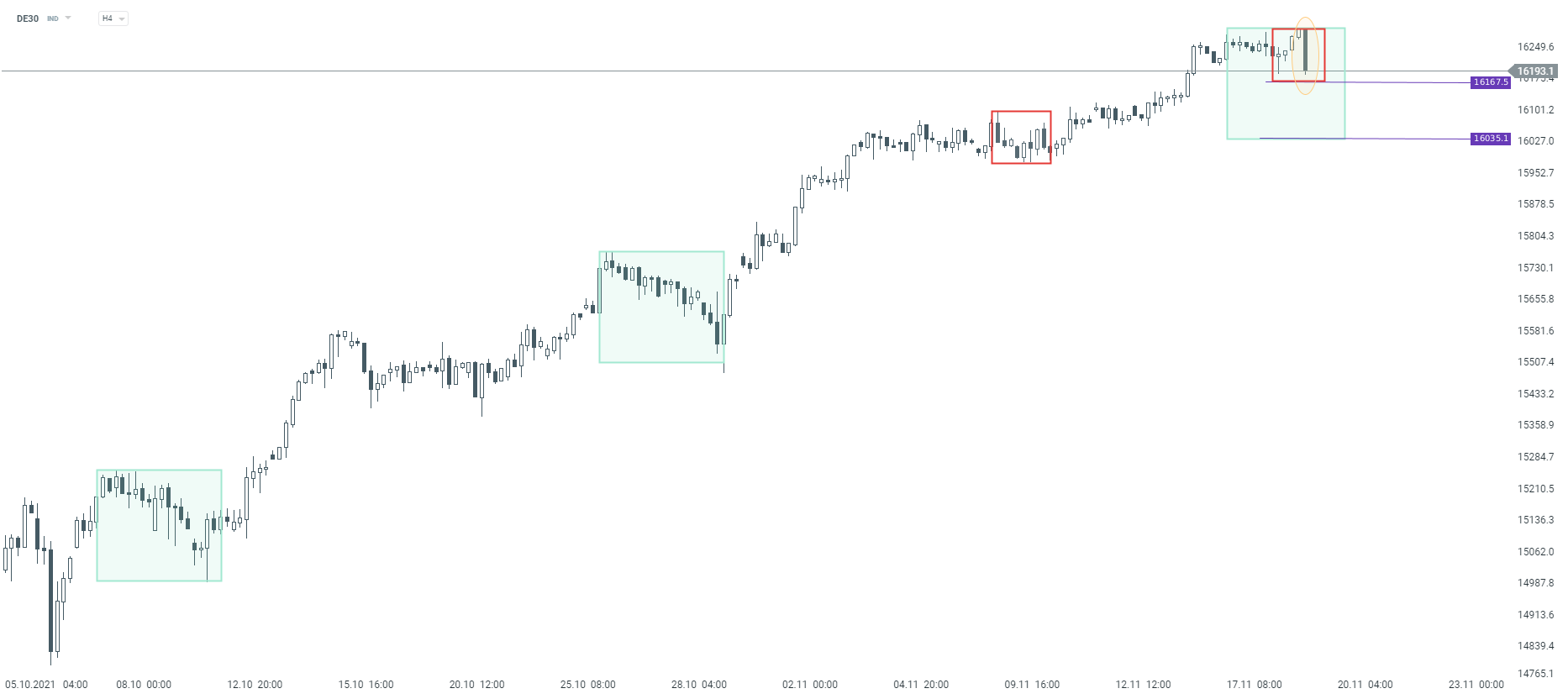

A strong downward move on DE30 and other European indices was launched after Austria announced lockdown and compulsory vaccinations. Near-term support for DE30 can be found in the 16,167.5 pts area, where the lower limit of local market geometry can be found. More important support is the market with the lower limit of the Overbalance structure at 16,035 pts. Source: xStation5

A strong downward move on DE30 and other European indices was launched after Austria announced lockdown and compulsory vaccinations. Near-term support for DE30 can be found in the 16,167.5 pts area, where the lower limit of local market geometry can be found. More important support is the market with the lower limit of the Overbalance structure at 16,035 pts. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%